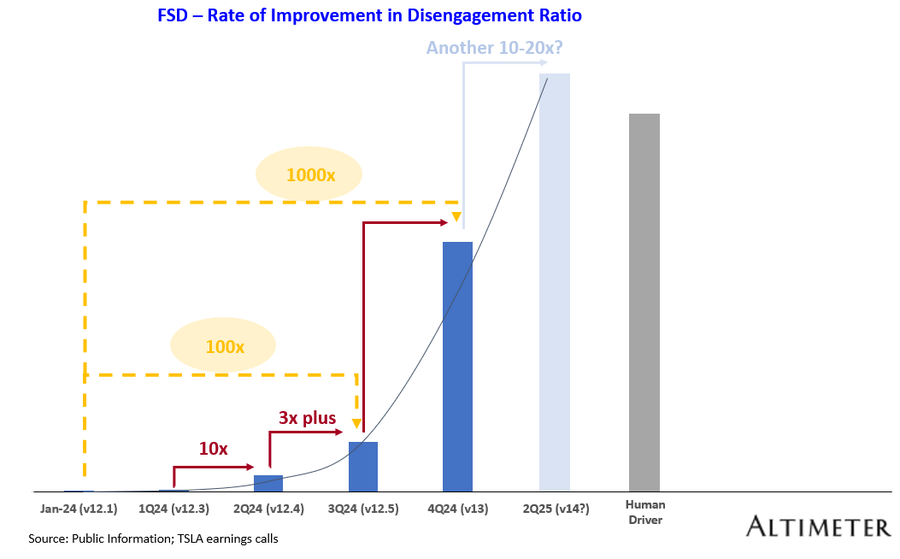

“For the miles between critical interventions, we already made a 100x improvement with FSD 12.5 from the start of this year and then with the v13 release, we expect to be 1,000x from January of this year. This came in because of technology improvements, going end-to-end, having a higher frame rate and partly also helped by Hardware 4's better capabilities. We hope that we can continue to scale the neural network, the data, the training compute et cetera.” — Ashok, Tesla’s VP of Autopilot

“For version 13 of FSD, we expect to see roughly a further five or six-fold improvement in miles between interventions compared to 12.5. Looking at the year as a whole, the improvement in miles between interventions will be at least 3 orders of magnitude. So that's a very dramatic improvement in the course of the year and we expect that trend to continue next year. The current internal expectation for FSD having more miles between interventions than a human is for the second quarter of next year. It may end up being in the third quarter, but it seems extremely likely to be next year, and then to continue with rapid improvements thereafter. We also published our Q3 vehicle safety report, which shows one crash for every seven million miles of autopilot. That compares to the US average of one crash for roughly every 700,000 miles so FSD is currently showing a 10x safety improvement relative to the US average.” — Elon Musk

Both anecdotally and on Tesla’s own data, the company has been making huge improvements in their full-self-driving (FSD) autopilot, with a Tesla vehicle now being able to drive long distances and navigate complex situations without driver interventions. Altimeter made a nice chart summarizing the above stats and if we can get another one to two orders-of-magnitude improvement next year, i.e. 10 to 100x, FSD would surpass the capabilities of human drivers:

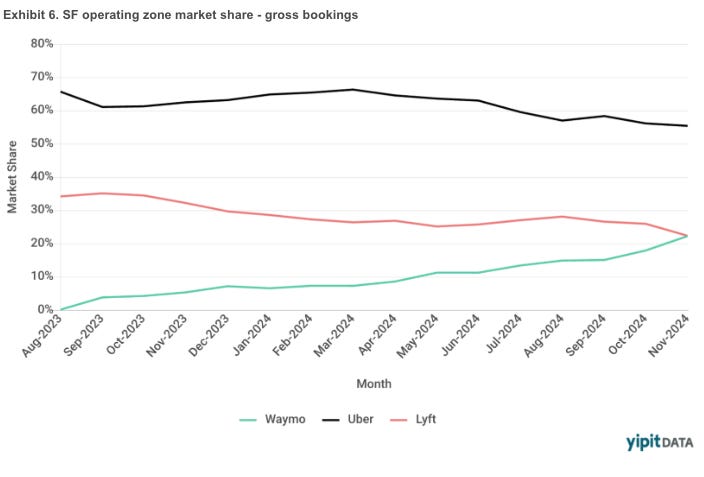

According to YipitData, also Waymo is now getting more gross bookings than Lyft in the San Francisco area where it operates:

Tech investors have enjoyed many secular tailwinds over the last few decades, resulting in tremendous performances for companies that are able to dominate these spaces. If you’re a monopoly or oligopoly player in a vast new market, you’ll do very well. A few examples of these new markets which emerged include search, social media, the public cloud, SaaS, AI accelerators and leading edge foundries. However, looking ahead, the future robotaxi market could easily dwarf all these previous vast new markets. Even capturing a small share of the number of miles being driven on a daily basis would propel the winners to become the largest market caps in the world.

Two of the best positioned names in automated driving are Tesla and Waymo (Google). In this article we’ll dive into the underlying tech by speaking with a current engineer at Tesla who was previously at Waymo. We’ll also review the outlook for both companies, calculate the financial opportunity from this new market and discuss the current financials and valuation for both names. Obviously Tesla shares have been on a tear over the last six months and we’ll discuss whether the valuation still makes sense here, or whether it’s time to start locking in profits..