Tokyo Electron: a strong semicap player nearing the bottom of the cycle with an attractive long term outlook

Industry overview & thoughts on the company following recent results

Tokyo Electron is a leading player in the manufacturing of semiconductor fabrication equipment, otherwise known as the semicap industry. What attracted me to have another look at the company are several factors:

One, this is an oligopolistic market where the companies generally have good pricing power. Its two key competitors are basically Applied Materials and Lam Research. Two, this is a cyclical industry with semiconductors having been in a downtrend over the last twelve months. Hopefully we should now be getting near the bottom, although the macro environment remains a wildcard for the moment. Three, each geopolitical power wants to have its own onshore semiconductor supply chain, from the US, to the EU, to Japan, to China. This means a lot more demand for semi equipment in the near future. Four, chip manufacturing processes keep growing in complexity, which means again more demand for tools. And lastly, five, can we write a tech note without saying the word AI? Apparently not. But the strong demand for both AI training and the application of these models in the real world will be a growth driver for leading edge semiconductors, which happen to be the most tool intensive. And hence a boon for Tokyo Electron.

Do me a favor and hit the subscribe button. Subscriptions let me know you are interested in stock and industry research like this, which is a good motivation to publish more of the analysis I’m carrying out. Special thanks to the 300 subscribers so far!

Tokyo Electron’s business can best be thought of in the following way. The company dominates in coating equipment with a market share in the industry of around 90%, a level similar to ASML in lithography. And the company has strong positions in etch, deposition, cleaning and probing tools with global market shares ranging from 25 to around 40 percent.

A brief overview of semiconductor manufacturing

Baking chips, as semiconductor manufacturing is also called, is basically a long assembly line where silicon wafers undergo a series of processes undertaken by a variety of tools. Over time, this entire set-up has grown tremendously in complexity, with ever more complex, higher priced tools but also with wafers having to undergo an ever increasing amount of steps in order to achieve to desired chip miniaturization. This has been a big boon for the semicap industry.

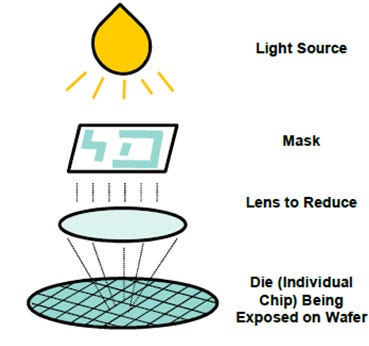

I’ll briefly explain the semiconductor manufacturing process. The first step is depositing thin layers of silicon oxide and silicon nitride onto a wafer, called the deposition phase. Subsequently, the wafer is spun at high-speeds to coat it with a light-sensitive chemical called the photoresist. As already mentioned, Tokyo Electron is dominant in this phase with its coating tools. The third step makes use of ASML’s lithography tools, where light is projected onto the wafer in a very precise manner, creating the needed patterns for the chips’ circuitry. Subsequently, the wafer is baked making these patterns permanent. Then comes the etching phase, where materials such as gases are used to etch away the spaces created by the lithography tools, leaving a 3D version of the patterned circuitry. There are more steps, such as the transistor gate formation and interconnecting them, but this should give of a feel for what’s going on inside a fab.

These steps can get repeated lots of times to create all the needed chip patterns. This basically results in the wafer being divided into lots of separate dies, each of which will later get packaged to be used as a chip. Or at least if the testing phase shows the die to be working as intended.

An illustration of the key lithography step:

A wafer’s yield basically means how many dies on the wafer were successfully manufactured as a percentage of the total. The fab’s yield is then the average of all wafer yields which it ran in a given month. An illustration of a wafer and its achieved yield:

Semicap intensity has been rising

The below chart illustrates how each new chip technology becomes more tool intensive. This is back from some analysis I did on ASML in 2016, showing that as the nanometer transistor sizes decrease, an ever larger amount of immersion and EUV lithography tools are needed. The same logic can be applied to coating, deposition, and etching tools.

This means more needed capex for each fab to advance to a new technology, which means in simple terms more dollars for the semicap industry.

The above are illustrations for the logic industry (CPU and GPU), but the same dynamics are at play in DRAM (i.e. working memory). Also in NAND (storage memory) a similar analysis can be made, although the evolution of new technology here is more etch intensive, rather than litho intensive.

Many investors and even semiconductor analysts think companies like ASML are purely plays on semiconductor growth. This is wrong. Understanding how technology evolves and which types of tools will be needed at each new step are actually the key to successful semicap investing.

Thoughts on Tokyo Electron’s future and its recent results

Tokyo Electron still had a strong last twelve months, driven especially by the September quarter and the March quarter (chart below). The company is guiding the market that revenues should bottom in the June quarter of this year, after which we should gradually start to see growth pick up again: “Our outlook that the wafer fabrication equipment market will strongly grow in 2024 and beyond remains unchanged. Various applications and technologies will drive the strong growth: growing investment in data centers, a recovery of smartphone demand, a PC replacement cycle triggered by new operating systems, the spread of electric vehicles, autonomous driving and the adoption of generative AI such as ChatGPT.”

The company did revise their outlook down for the overall semicap market in 2023 with around 7%, from $75 billion to $70 billion. The main reason cited seemed to be a stronger than expected downturn in memory.

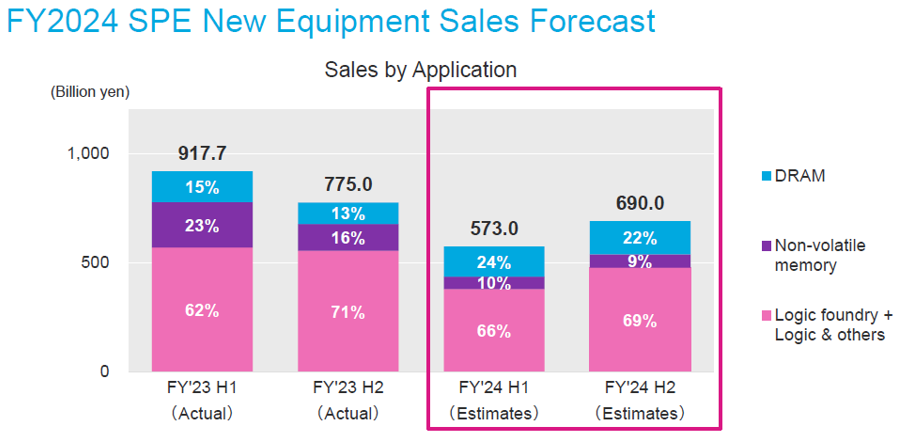

Over the last year, semicap demand from the logic industry has still been strong (e.g. TSMC and Intel), whereas especially DRAM memory has been weak (e.g. Micron and Samsung). Also storage memory (NAND) has seen weak tool demand, especially over the last two quarters.

The company expects these trends to flip around somewhat in the coming twelve months, with demand from the logic industry being weaker, and DRAM picking up. Generally the semicap players have reasonably good visibility on demand as they operate in a supply chain where close collaboration with the manufacturers is extremely important to drive innovation.

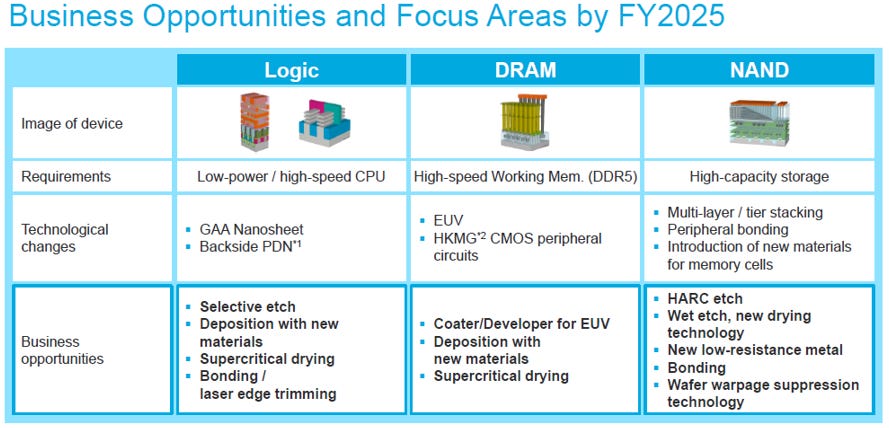

The below slide might be somewhat technical, but it basically highlights what Tokyo Electron sees as the technology roadmap for their customers’ most advanced foundries, resulting in what this means in terms of additional needed tooling. This is the most interesting growth driver for the company. As the logic industry is racing towards ever lower power and higher speed processors, the next generation of transistor architecture will move to gate all around (GAA) nanosheet types. Belgium based IMEC, a few hours drive from where ASML is located, is the leading research house in this field of transistor scaling. They also explain that backside PDN, meaning a change in the power delivery to the chip’s backside, has shown clear performance advantages. To implement this in manufacturing, more etch and deposition tools will be needed. This basically means $$ for Tokyo Electron. Similarly DRAM is moving towards DDR5, an architecture allowing for higher working memory speeds. In order to achieve this, chipmakers will introduce ASML’s EUV tools in the manufacturing process, resulting in more needed coating and deposition tools. Finally, NAND i.e. storage memory, is not scaling anymore, meaning making ever smaller cell architectures. Rather, the memory cells here are being stacked vertically on top of each other with the industry currently working towards a structure of 300 layers. This process is especially etch intensive. All good news for Tokyo Electron.

Tokyo Electron has also built up an attractive non-cyclical services business called field solutions. This is basically the servicing of their equipment in the fabs to keep uptimes high, as well as the selling spare parts, which is a high-margin business. Last year this business contributed 28% to revenues, so it provides somewhat of an airbag for investors during a downturn. This business will continue to grow as the more tools the company has out in the field, the more servicing and spare parts will be needed.

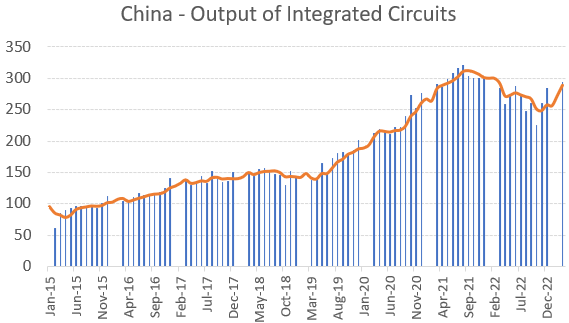

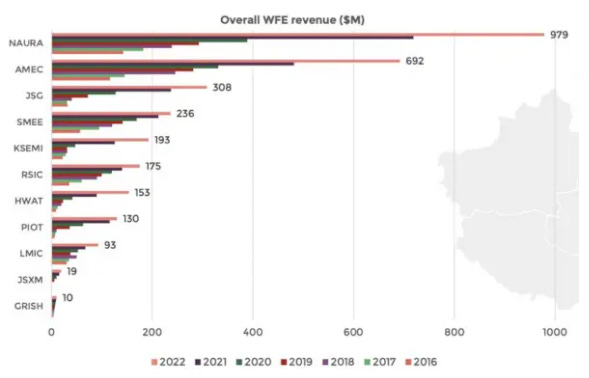

A risk could be the Chinese business, which was 24% of revenues last year. And down somewhat as a proportion of overall revenues due to the US-Chinese chip war with the Biden administration restricting the shipment of advanced chip tools to China. Initially I thought there could be more risk here in the coming years, however, the company is seeing strong demand from lagging node players here (meaning older tech in simple terms). As such they guided Chinese revenues to be up in the coming year. This is something I’ve seen confirmed in various news and industry reports, as well as from data from the Chinese Bureau of Statistics:

Longer term, emerging Chinese players could become new competitors for the semicap industry. However, a few things to note here. One, these are still small players, the largest Naura, is around 6% the size of Tokyo Electron in terms of revenues. Two, their tools are currently mostly used for lagging chip tech (older nodes). That being noted, there is a lot of engineering talent in China and I suspect that over time these could become competitors. However, due to the geopolitical tension between the large two power blocks, I doubt whether the semi manufacturers from both the US and its allies would actually buy these tools, even if they become competitive. As this moment, my guess is not, as there is a pretty strong drive to move sourcing away from China where possible, especially for tech components.

Tokyo Electron’s shares have been on a tear recently:

Actually, Japanese stocks in general have been rallying. This was something I actually flagged beforehand as an investment idea on my Twitter. As I was reading the Nikkei I came across this: ‘The Tokyo Stock Exchange sent a letter to 3,300 companies listed on its prime and standard sections, calling for a stronger focus on share price and capital efficiency. For 1,800 companies whose share price is below book value, the TSE demanded a concrete action plan. Big names like Toyota, Mitsubishi, and SoftBank fall into this category, along with DNP. Matsumoto said corporate managers today have become more receptive to this kind of pressure because they have less attachment to traditional Japanese-style management.’

It was a great article discussing how Japanese corporate culture is shifting towards hoarding less cash, and instead returning more of it to shareholders. Sparking a rally in the Japanese stock market.

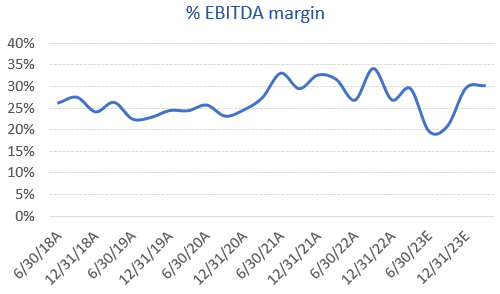

Back to Tokyo Electron. The sell side expects margins to bottom in the June quarter, with a strong pick-up thereafter. Tokyo Electron mentioned to be increasing R&D spend with around 5% for the coming year. As revenues are expected to be down, this will impact margins more than usual. However, longer term this should be money well spent.

The coming fiscal year will be a peak capex year as the company is ramping up new facilities, mainly for R&D purposes but also for production. The sell side is expecting capex to normalize afterwards, giving a healthy free cash flow yield of around 4% at current valuation levels.

These are the expansions in facilities which the capex will be financing:

Valuation doesn’t look overly expensive for an oligopoly player exposed to attractive growth at around 18x coming twelve months EBITDA, which should be the bottom of the cycle, and 14x for the year thereafter. The company should also be paying out a dividend yield of around 2% per annum which should grow over time. Combined with share buybacks as cash-flow allows. The current share buyback plan for the remainder of this calendar year is around 2% of the current outstanding shares. So overall this company provides an attractive capital return for investors.

Comparing to peers, Tokyo Electron is currently the number four player in the industry, just behind Lam Research, with the top two being ASML and Applied Materials. Both ASML and Applied Materials are names I’ve historically been invested in and I’ll probably review both over the coming months, so make sure to hit subscribe if you’d like to know more about these companies.

If you enjoy research like this, hit the like button (at the bottom or top) and subscribe. Also, share a link to the research on social media with a positive comment, it will help the publication to grow.

All my research can be found here.

If you like to do some further tech investment related reading, I’ve compiled a suggested reading list below.

Further reading

Fabricated Knowledge dives into semiconductors on a weekly basis

Convequity is an expert on SaaS stocks and in particular cybersecurity

Clouded Judgement is ditto a great substack to follow SaaS trends

Nick’s Vital Few discusses on a weekly basis interesting topics in the world of investing and tech

GoldenLake’s Deep Dives writes insightful research in the tech space

Disclaimer - This article doesn’t constitute investment advice. While I’ve aimed to use accurate and reliable information in writing this, it cannot be guaranteed that all information used is of such nature. The shares’ future performance remains uncertain. The views expressed in this article may change over time without giving notice. Please speak to a financial adviser who can take into account your personal risk profile before making any investment.

Thanks for the shout out, Tech Fund!! I have a post going out on Tuesday with a semiconductor segment that mentions Tokyo Electron. Tokyo Electron is a company that doesn't get enough coverage. I am going to link to your post here! Well done and Cheers 🍻

I have done a deep dive in to the VAT group, Have you done some work on this name? It's also an interesting pick and shovel player in semi production, providing vacuum valves for the likes of Lam Research, AMAT and Tokyo Electron. Would be interesting to hear your view :). Thanks for the write up.