The high-priced ARM IPO

An overview of the company's attractions, challenges, and its high-priced IPO

An introduction to ARM

The company ARM has a lot of attractions, it has a strong market share in providing instruction set architecture (ISA) designs for CPUs and microcontrollers, giving shareholders access to recurring revenue streams stemming from royalties. The company is especially dominant in this field in mobile CPUs, but also has strong positions in internet-of-things (IoT), consumer electronics, and automotive. And they have been growing share in networking and the high-growth cloud computing market. ARM cites the below market shares in their prospectus:

ARM explains why the market for ISA designs has high barriers to entry:

“Every CPU has an ISA which defines the software instructions that can be executed by the CPU, essentially a common language for software developers to use. The ISA sets the foundation for a large library of compatible software which runs on those CPUs. As the Arm CPU is the most popular and pervasive CPU in history, the Arm ISA is also the most popular and pervasive ISA in history. This means that Arm-based chips have a global community of software developers familiar with how to program the CPU. Chip designers utilizing the Arm CPU can add desired functionality (Wi-Fi connectivity, image processing, video processing, etc.) to create an SoC (system on a chip) to meet the needs of any end market.

Our development tools and robust software ecosystem have further solidified our position as the world’s most widely adopted processor architecture and have created a virtuous cycle of adoption, which means that software developers write software for Arm-based devices because it offers the biggest market for their products, and chip designers choose Arm processors because they have the broadest support of software applications. When a major semiconductor company licenses Arm products to deploy in their product roadmap, they are committing to use Arm products in multiple generations of their future chips.”

There’s a lot to digest here, so I’ll provide some additional color. The below diagram illustrates well how the ISA sits between the software and the hardware in a computing system. This is the layer where the compiled 1s and 0s from the lines of coding gets sent to the chip’s micro architecture. If you want your chip to be able to run a wide variety of software, you either take the x86 (Intel and AMD) or ARM ISA. Vice versa, software developers want to make sure that their app is able to run on one or both of the mentioned ISAs in order to enable a wide variety of chip support for their app. Thus, we have a classic networking effect making it hard for a new entrant to come in. However, there is a new chip architecture gunslinger on the scene, more on this one later.

ARM provides notable examples of companies and systems supporting their CPU cores: “This combination of pervasiveness and ease of portability has resulted in our CPU designs having the world’s richest software ecosystem, built in partnership with the leading operating systems providers (including Google Android, Microsoft Windows and all major Linux distributions), software tools and game engine vendors (such as Electronic Arts Inc., Unity Software Inc. and Epic Games, Inc.), and application developers. We also support a flourishing ecosystem of third-party tool vendors for embedded software and a vibrant IoT ecosystem. More than 260 companies reported that they had shipped Arm-based chips in the fiscal year ended March 31, 2023, including the largest technology companies globally (such as Amazon and Alphabet), major semiconductor chip vendors (such as AMD, Intel, NVIDIA, Qualcomm and Samsung), automotive industry incumbents, leading auto suppliers, IoT innovators, and more.”

The below image illustrates how ARM’s blueprints get patterned into an integrated circuit. This is done with ASML’s tools at any of the major fabs, with TSMC being both the largest and the most advanced.

ARM provides a variety of cores depending on the needs of the end application: “Arm’s flexible and modular design IP enables customers to build chips optimized for the power, performance and area (PPA) requirements for a specific use case or end market. A battery-powered device such as a smartphone has a different PPA requirement versus a high-performance cloud server or an IoT sensor. By developing a wide range of CPU and related technologies, Arm can provide a CPU optimized for various use cases to reduce both energy consumption and area (with area being a key driver of the ultimate cost of a chip).”

The below image illustrates the wide variety of chips ARM’s IP can enable. Cortex are the ARM core series that go into the smartphone and Neoverse are the cores for the data center.

Why does a semi designer such as Qualcomm or Nvidia license IP from ARM rather than designing it themselves? Well, the answer is fairly simple, time and money. From ARM’s prospectus: “Each CPU product can be licensed to multiple companies, leading to economies of scale that allow us to charge each licensee only a fraction of what it would cost them to develop internally, while minimizing their risk and time-to-market. With the complexity of CPU design increasing exponentially, over the past decade no company has successfully designed a modern CPU from scratch. We estimate that, Arm’s engineers invested more than 10 million hours in creating the base software and tools for chips containing Arm v8 processors. We also estimate that Arm will be investing more than 30 million hours creating the base software and tools for Armv9 processors, which will enable the next generation of apps and software for Arm-based chips.”

While the development of the ARM v-8 core was started in 2008, as from 2012 ever more processors were developed based on this design. Thus, ARM does significant and lengthy R&D upfront which other semi designers leverage from over the subsequent decade.

Due to increasing chip complexity, design costs of advanced semiconductors are strongly on the rise (chart below). This makes it compelling to source IP for any non-differentiated chip functions, and focus your efforts as a chip designer on the areas where you want to make a difference.

ARM’s business model is straightforward, customers pay upfront licensing fees to access ARM’s IP. And once a chip is successfully developed, ARM collects royalties based on the amount of chips being shipped. The royalty is based on a percentage of the chip’s ASP or alternatively, a fixed fee per unit. Royalties comprise over 60% of ARM’s revenues and are an attractive business, as chips are sold for multiple years and therefore bring recurring revenues. The company has a high weighting towards smartphones and consumer electronics, with over 50% of royalties flowing from these end-markets.

Licensing on the other hand can be a lumpy business, as you only have to buy it once for a particular design. To address this cyclicality, ARM is moving its customers to a subscription bundle where you can access their portfolio of designs for an annual fee. Obviously this a highly attractive business model bringing continuously recurring revenues. However, it also locks the customer in. As once you’ve subscribed to the bundle, you’ll likely use as much ARM IP as you can.

There two types of bundles available, one which includes the latest designs, and one which focuses purely on older ones (lagging nodes) but where individual designs can still be added for an additional fee. The latter model is mainly targeted at startups and smaller companies, whereas the former is focused on large companies such as Qualcomm or Google as examples.

The company provides the following client numbers for companies that have subscribed to one of these two bundles. Currently, 214 have taken the Flexible bundle, and 20 have subscribed to the Total package.

The evolution of computing power

ARM was originally started as a joint-venture between UK based Acorn Computers and Apple. Its small, low power, and widely available designs made them the logical choice to form the basis for mobile chips. As phones became more powerful, increasing the need for more advanced chip circuitry, ARM shareholders started enjoying a revenue bonanza during the smartphone age. Subsequently its designs were introduced in ever more devices and chips, including lower value ones such as microcontrollers and embedded chips.

The illustration below highlights well how as computing power is continuously becoming more widespread around the globe, demand for semiconductors keeps moving upward. From Applied Materials:

In the beginning, computing power was contained as it only resided in a limited number of central locations. This was the mainframe era with only one computer per large institution or corporation. Employees would connect via a terminal to this central machine. As chip technology improved, computing power was able to disperse with the rise of desktop computers and later on pocket computers during the next decades, i.e. smartphones.

Part of the computing power has moved back however into central locations, particularly for compute intensive workloads with the cloud data centers. Now we’re moving into the fourth era of computing, with the advent of AI. AI will demand not only huge amounts of computing power in central locations to train the models, but also at the edge to run these previously trained models (inference). Some inferencing workloads are being run on CPUs and so ARM could benefit from this.

However, I remain of the view that AI won’t be much of a driver for ARM. You could actually make the counter argument, with more CPU power being replaced with GPUs and other accelerators to run AI workloads. This risk is also flagged in the prospectus: “New technologies, such as AI and ML, may use algorithms that are not suitable for a general purpose CPU, such as our processors. Consequently, our processors may become less important in a chip based on our products, thus eroding its value to the customer and resulting in lower revenue for us.”

CPU power will remain an important part of smartphones and data centers, e.g. to run gaming, social media, video and other non-AI workloads. But if AI applications become more prevalent, it could result in some amount of computing power being diverted to introduce more space for AI accelerators.

The other part of the fourth wave is IoT (internet of things), and this is especially the area which ARM has been talking up: “There are billions of tiny low-cost devices—from sensors to electric motor controllers—that are now functionally computers as well. Each of these computers needs at least one CPU, and in many cases more than one. This trend has driven the dramatic growth of Arm-based chips over the past several years.”

This is correct, ARM designs are a volume play on IoT chips. However, the main flaw in this end-market is these are mainly lagging tech, lower value chips with regular price decreases.

So ARM isn’t really a play on advanced semis. The chart below provided by ARM illustrates this well, with only a small segment of royalty revenues stemming from chips launched over the last four years.

That being said, the overall royalties CAGR is still attractive at around 12% over the 2018-2020 period. Overall ARM revenues however grew at only a 7% CAGR, indicating that the licensing business has been fairly stagnant.

Masa bought the wrong company

Masayoshi Son (‘Masa’ for short), the flamboyant founder of Softbank, had the right vision that AI would become a dominant force over the coming decades. However, he bought the wrong company. In July of 2016, he decided to buy ARM at a valuation of $32 billion. If he manages to list the company at a valuation of $55 billion, overall that wouldn’t be a bad deal. However, Nvidia’s market cap at the time was around $25 billion and is now valued at $1.2 trillion.

Masa’s vision was that AI would leverage the data collection from a wide variety of chips and sensors all over the world, the so called internet-of-things (IoT). Therefore he decided to go for ARM as all these chips would use the company’s IP. In one interview he famously stated that your shoes would become smarter than you. With this he meant that in the future your shoes could contain an ARM chip which thanks to AI would be cleverer than you. However, at this stage it already had become clear that a lot of AI training, especially the advanced projects, were happening on Nvidia GPUs and that this one would become the clear play on AI. ARM on the other hand was more of a play on IoT, which due to the low value of many of the chips used in this ecosystem, had much less of an attractive CAGR.

Growth driver #1: Data center CPUs

From ARM’s prospectus: “Leading OEMs are increasingly looking to build custom chips in-house that deliver greater performance and greater efficiency at an equal or better price for a particular use case. The success of Arm-based products such as Amazon’s Graviton, deployed across Amazon data centers globally, have demonstrated the opportunity to create a sustainable competitive advantage through this approach. For example, Amazon claims that Graviton delivers up to 40% better price performance over comparable x86-based systems. As a result, we expect our market share of cloud compute to grow significantly faster than the overall cloud compute market.”

I have written before how the data center CPU market is fragmenting with Intel being a large share donor. Not only AMD, but also ARM based processors from Amazon AWS, Ampere, and others such as Alibaba are gaining market share. ARM estimates that they currently have taken a 10% of the data center market, up from 7% in 2020. The hyperscalers from their part are mentioning 30 to 50% improvements on a total cost of ownership (TCO) basis of ARM based processors compared to x86 ones (Intel and AMD). This is likely stemming from ARM cores’ lower power consumption.

Growth driver #2: Content growth

From ARM’s prospectus: “To address increasingly complex workloads, a key approach has been to increase the speed of a CPU and expand the number of processor cores per chip. For example, core count increased by approximately tenfold between 2010 and 2022 for many smartphone application processors and by more than 30 times over the same period for certain data center server chips.

For servers and high-end networking equipment, we are enabling market-leading core counts, such as in Ampere’s Altra Max and Alibaba’s Yitian 710 server processors, which both have 128 Arm CPU cores. These innovations enable us to license more advanced Arm products.”

This is correct. As Moore’s law has been slowing, which can best be observed in the flattening of the slope of the blue dots on the chart below (single-thread performance), the response from the semi manufacturers has been to increase core counts (black dots). This results in the slope of the orange dots (transistor counts) remaining on its upward trajectory.

Modern programming languages make it effortless to spin up new threads so that software developers can easily communicate to the hardware which lines of code can be run in parallel on separate cores. Especially in the cloud data centers this is useful as servers are shared by a large number of users and processes, making chips with a plethora of cores clearly advantageous as the hypervisor can easily direct a particular process to a particular core. One core can further be divided into multiple virtual cores to further split up the workflow.

ARM details a number of other end-markets which they see as fertile grounds for content growth:

“We expect the value of the market for mobile applications processors to continue to grow, particularly in light of several smartphone usage trends that are increasing the need for high-performance processing capabilities, including the shift to 5G, growth in mobile gaming, and emergence of AI and ML workloads.

The automotive TAM is expected to increase as advanced driver assistance systems (ADAS), electrification, in-vehicle infotainment (IVI), and eventually autonomous driving, accelerate requirements for higher compute performance in newly manufactured vehicles. Today, our market share in the automotive market is highest in more technologically advanced functional areas such as IVI and ADAS. As automotive electronics continue to transition from hardware-defined to software-defined architecture and compute, a trend that mirrors evolution of the smartphone, we believe we are well-positioned to outpace the growth of the overall automotive market.”

ARM cites the below end-market CAGRs in their prospectus. Cloud computing and automotive are clearly the most attractive markets, with also IoT expected to grow at a high single-digit rate.

ARM-based cores are known for their lower power consumption compared to x86 ones (Intel), which was the dominant factor in them taking control of the smartphone CPU market. The company also alludes in their prospectus that this will remain an important factor going forward, including in the automotive and datacenter markets, which should put them in a good position to take further market share. However, the new gunslinger on the block, RISC-V, is also known for their power-efficient cores, which will be discussed further down.

ARM details their argument: “Individual servers are limited by their ability to dissipate heat energy, while whole data centers are limited by how much electricity is available to them. Mobile devices are limited by the energy stored in their batteries, while their instantaneous power is limited by thermal constraints. Furthermore, the transition to electric vehicles is increasing pressure on automakers to consider the power consumption and thermal management of vehicle electronics. In addition, enterprises are increasingly mindful of environmental sustainability, which is driving a need for more efficient alternatives to offset the continued growth in data centers and other compute deployments. According to McKinsey, the energy usage from data centers is expected to increase two times by the end of 2030 relative to 2022 levels. Collectively, these considerations result in the need for innovation in chip design to address market demands for an optimal balance of performance, efficiency, size, and cost across end markets.”

Growth driver #3: A new pricing model?

No mention of a new pricing model being introduced was made in the prospectus. However, it has been speculated over the last year that ARM is planning to stop charging royalties based on a chip’s value and instead move to a business model where the smartphone makers themselves would be billed based on the value of the device. As the the device can easily be worth 5 to 10 times the value of the CPU, this would a huge step up in royalty collections for ARM.

If a higher-end smartphone CPU is costing around $100, ARM might only collect $2 in royalties for this shipment. However, if the smartphone that chip goes into costs around $700, this could translate into 10 to 15 dollars in revenues depending on the negotiated royalty rate.

Qualcomm is actually running a similar business model as the one ARM is being speculated trying to implement here. However, D2D Newsletter explains why investors shouldn’t get overly bullish:

“Surely, it cannot be that hard, after all Qualcomm runs exactly this model charging OEMs a royalty for the Qualcomm IP in their hardware. True, but Qualcomm was only able to achieve that through a few decades of bare-knuckles legal brawling including a half dozen billion dollar plus lawsuits, a half dozen antitrust investigations around the world and 20+ years of intense, sharp-elbowed ‘negotiations’ in the wireless standards bodies. Does Arm really want to go through all of that?”

The side-effect of being too aggressive on pricing will likely be however that the semiconductor industry will further step up its investments in RISC-V, ARM’s open-source competitor which has been seeing strong growth. ARM being overly demanding in the handing out of licenses to startups and academics is what gave rise to the birth of RISC-V in the first place. More on this topic further down.

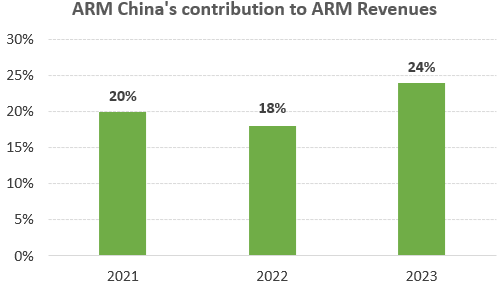

Problem #1: ARM China

ARM China has become a rather complicated affair. The joint venture was founded in 2018 to address Beijing’s concerns regarding its tech supply chain with Softbank, ARM’s owner, holding a 49% stake and Chinese investors controlling the other 51% of the company. Allen Wu, an employee in ARM’s Chinese division, was chosen to head the company and he managed to maneuver himself into the role of Chairman as well with a 15% stake in the company. This already seems quite sloppy from Softbank’s side, allowing one individual to have so much sway over this JV.

In 2019, it became clear that Wu had invested in a Hong Kong private equity fund which in turn had returned the favor and invested in ARM China’s affiliates. After a six month investigation, the board decided to fire Wu. Wu decided to ignore this vote and started running ARM China as his fiefdom. For example, red envelopes with cash being handed out by the company on Chinese new year mentioned his name, not the name of the company as is the usual tradition. According to one news report, Wu also decided to keep supplying Huawei with ARM high-end IP, in defiance of US sanctions.

The Chinese regulator from their part decided to sit on the fence, after which Softbank then threatened that ARM would not license additional IP to the JV. Which would effectively cut the unit off from the latest tech to sell into the Chinese market. The Chinese definitely want to be able to access the latest IP, so in April of this year, the Shenzhen regulator chose to support SoftBank’s claims and allowed the company to update Arm China's business registrations. The regulator and SoftBank decided to appoint Liu Renchen and Eric Chen as co-CEOs, with Liu as the legal representative.

The Financial Times reported at the time how Liu was chosen as a compromise candidate between the Chinese government and Softbank: “Replacing Wu as co-CEO and in the critical role of legal representative is Liu, a government adviser and businessman who has married his career with the interests of the state. For more than a decade, he has worked to facilitate technology transfer to China, with a stint in San Francisco recruiting tech talent and projects to Shenzhen, according to state media. He currently leads a state-backed venture called Shenzhen Qingyan Technology Transfer Co.”

However, Softbank wasn’t rid of Wu yet. Coordinating with the company’s IT team, the new management were cut off from communicating with the staff. Wu rallied employees to back him as CEO. Finally, on May 5, the IT team followed orders to remove Wu from the company’s mailing and communication systems.

So Allen Wu is gone and now the problems are solved? Not really. There are several potential problems. Firstly, the business operates completely independent from ARM. Secondly, the company gives a gloomy outlook on this unit, also due to the export restrictions of high-end technology which Washington has been enforcing on the semiconductor industry. And thirdly, Allen Wu is still fighting back in the courts to regain control of the company.

I’ll run through these below:

Simply put, ARM China is the only authorized seller of ARM's IP in China. While most of its revenues are generated by ARM's designs, the company also sells its own IP. The unit is prohibited however from developing its own microprocessor cores and thus competing with ARM’s key business. Chinese investors’ hope was that the ARM China business could gradually increase its own IP content over time, and thereby contribute to the country’s goal of achieving national self-reliance in semiconductors.

ARM’s Chinese offspring now operates completely independent from the mother company. In 2022, ARM’s equity interest was transferred into a subsidiary of SoftBank, Acetone, where ARM holds a 10% non-voting interest in and which in turn has a 48% stake in ARM China. So overall, ARM has a 4.8% indirect stake into the Chinese JV.

Under the terms of the agreement, ARM is entitled to around 90% of ARM China’s revenues on the sale of ARM IP into the country. This makes it ARM’s largest client:

The accounting is straightforward, from the prospectus:

“Where our revenue is earned as a percentage of the license fee received by Arm China, we categorize such revenue as our license revenue. Our share of Arm China’s royalties is categorized as Royalties in our financial statements.”

The company however doesn’t give a bullish outlook on this business: “For the fiscal year 2023, although our total revenues derived from the PRC increased as compared to the prior year, the growth in our royalty revenues slowed for the same period primarily as a result of economic issues in the PRC and factors related to export control and national security matters. Furthermore, in light of these issues, we expect to continue to see declining royalty revenues derived from the PRC and we could see a decline in licensing revenues.”

Finally, also Allen Wu hasn’t left the stage yet, he’s still fighting back in the courts. And although to date at the trial court level, all cases have been ruled in favor of ARM China, there is still a risk, albeit it seems very small at this stage, that Allen Wu could regain the CEO position on appeal.

Problem #2: RISC-V competition

RISC-V is an open source competitor to the ARM ISA. The project was started in 2010 in what was meant to be a three month research study. The founding academics were struggling to obtain ARM licenses at the time, both due to the lengthy negotiation process as well as the high price tag. They decided to develop their own ISA, free to use and modify by anyone, with a low power design in mind. RISC-V can be much more easily modified compared to ARM, including by adding or removing instructions. Customers are allowed to patent their designs based on this ISA.

Some of the biggest frameworks in tech were started as what was meant to be short projects. Guido van Rossum famously started Python as a short Christmas holiday project in the early nineties to speed up the development of all his C-based projects. Similarly Javascript was developed in a few weeks at Netscape to enable the running of a scripting language in the browser alongside HTML. These two are the biggest programming languages in the world today.

There are two options for a semi designer to work with the RISC-V architecture. One, build an in-house team to integrate the design. Or two, license a core from a provider such as SiFive in the US, Codasip in Europe, or Andes in Taiwan.

At the end of 2022, the overall RISC-V world had already shipped more than ten billion RISC-V cores (since its founding). Qualcomm is shipping control and security cores, Western Digital is shipping a billion cores per year, used in their SSD and HDD products. And new players Andes and Codasip have each shipped over 2 billion cores since their founding. Codasip has also started work on a high-end RISC-V based core due to strong customer demand.

For comparison, around 30 billion ARM-based chips were sold last year. So if RISC-V based volumes are currently around 2 to 3 billion per annum, the open-source ecosystem could already be at around 8% the size of ARM’s by volumes. Although RISC-V will have a much higher proportion of lower value chips, i.e. in the embedded and IoT segments, so its market share in terms of dollar values will be much smaller.

The momentum for the RISC-V ecosystem is only continuing. Last year, Intel invested part of a $1 billion innovation fund into RISC-V, while announcing that its foundries would support all three of the ARM, Intel, and RISC-V architectures. The company is also introducing the new architecture in some of its FPGAs. Jim Keller’s Tenstorrent startup is working based of RISC-V designs, a company which is developing a new type of AI accelerator. And Apple has started implementing RISC-V embedded cores for wifi, bluetooth and touchpad control. Startup Ventana has designed a RISC-V core for high-end data center applications. From SemiAnalysis:

“Cutting right to the chase, Ventana’s Veyron VT1 per core performance is comparable to the Neoverse V series from Arm (V1 in Amazon Graviton 3 and V2 in Nvidia Grace) but at higher clocks. Furthermore, it scales up to 128 cores within a 300W power budget. This is comparable performance to what AMD’s Genoa can do. Ventana can also achieve twice the core counts of Amazon’s Graviton 3, albeit with higher power.”

Earlier this year, Google announced that their smartphone Android operating system would add support for RISC-V CPUs, although this would take a few years to accomplish. And last month, five chip giants - NXP, Infineon, Qualcomm, Bosch, and Nordic Semi - jointly established a RISC-V company to provide reference architectures. The large Japanese semi house Renesas has partnered with SiFive to implement the architecture in its products.

Also China is showing great interest in the ISA, the main factor being the risk of further export restrictions on ARM IP. RISC-V is meant to be the Switzerland of the chip world and therefore also relocated its offices to Switzerland. Which should shield the project from Washington’s controls. As the open-source ISA was also initially funded by DARPA (the Defense Advanced Research Projects Agency), there could be some hostile sentiment starting to brew towards the ecosystem within the ranks of the US government. Chinese premier members of the RISC-V alliance include Alibaba, Tencent, Huawei, and ZTE. US premier members include Google, Qualcomm, Intel, SiFive, and Ventana.

Both Bytedance and Alibaba are working on high-performance RISC-V based CPUs, to be used in data center and AI workloads. A senior engineer at Alibaba’s chip unit mentioned to the Financial Times: “Our goal is to develop RISC-V chips to replace the existing ARM ones in our most advanced products.” Alibaba has already been releasing RISC-V cores for the mid-end data center market. The company also released last March a RISC-V chip for secure payments. A variety of Chinese startups together with VeriSilicon, a Shanghai based semiconductor IP firm valued at $4.5 billion, announced that they will share patents from RISC-V based designs.

In conclusion, there is substantial momentum and effort behind this new architecture. Although a lot of it is work in progress still and it will likely take another number of years for RISC-V based cores to become fully competitive with ARM.

Speaking to the FT, Rene Haas, ARM’s CEO, mentioned that RISC-V is a very real threat. However, he also discussed that ARM has a significant advantage due to its software tooling which is provided alongside its designs. Which with a community of 50 million developers around the world makes it difficult to move things away from ARM.

The Chip Letter wrote a great overview of the recent history of RISC-V, I’ve inserted some insightful paragraphs below but you can read the full story on this Substack.

“Asanović, together with his graduate students Yunsup Lee and Andrew Waterman who had been working together on RAMP Gold, needed a processor core for use in what was intended to be a ‘three month’ research project. Their first thoughts were to use the Arm ISA for the new processor. Asanović, Waterman and Lee soon realised, though, that using Arm would mean buying a licence. Even worse, they would probably not be able to modify the core as they wanted and would then struggle to distribute their designs to researchers at other universities to study and build on. With no obvious alternatives available, in May 2010 they started work on the development of their own ISA.

Companies with successful ISAs like ARM, IBM, and Intel have patents on quirks of their ISAs, which prevent others from using them without licenses. Negotiations take 6-24 months and they can cost $1M-$10M, which rules out academia and others with small volumes. An ARM license doesn’t even let you design an ARM core; you just get to use their designs. Only ≈15 big companies have licenses that allow new ARM cores. Users of the RISC-V standards are free to be able to make their designs open or closed depending on their preference and purposes.

The Berkeley team found a receptive audience for their message. They have recalled that they found that attendees were frustrated, less with the cost of licensing Arm cores, but with how long it took to get started using commercial cores.”

Qualcomm litigation

This is a topic which I haven’t studied that much. However, if you’re looking to invest in ARM, it’s worth looking into as Qualcomm is one of their key customers contributing to around 11% of revenues. The case centers around the fees Qualcomm will have to pay for the ARM-based designs from their Nuvia acquisition. My interpretation of the likely situation here is that the pricing which Nuvia initially negotiated is likely higher than Qualcomm’s, who is a large semi designer and ARM customer. And so I guess that the latter wanted to apply its lower rates to Nuvia’s products whereas ARM is probably arguing that Qualcomm should pay the negotiated rates. Or at least, this is how I can make sense of the possible motivations of both players.

ARM discussed this topic in the prospectus:

“This case is currently in the discovery phase, with trial set for September 2024, and will likely require significant legal expenditures going forward. It may also require substantial time and attention from our executives or employees, which could distract them from operating our business. In addition, our involvement in such litigation could cause us to incur significant reputational damage in the industry, in our relationship with Qualcomm or in our relationship with other third-party partners.”

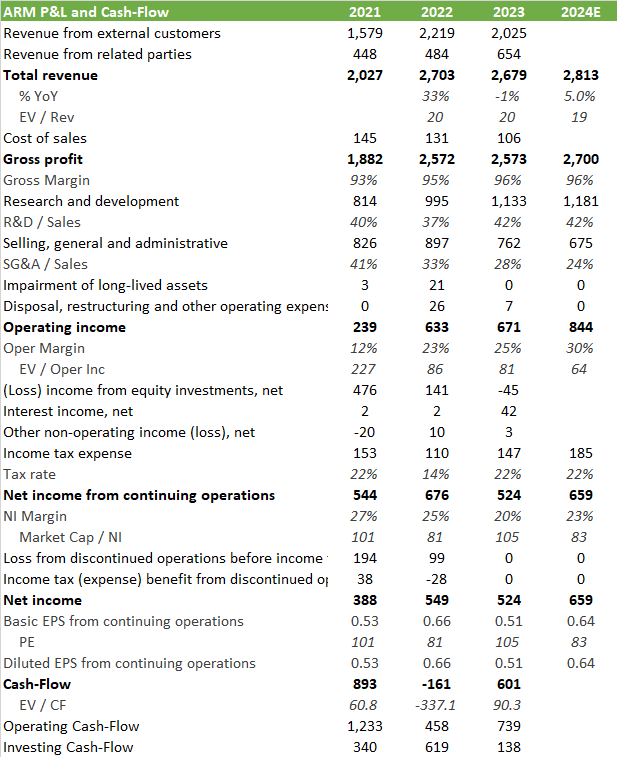

Valuation

Softbank acquired ARM to step up its investments, which can be difficult for a public company, and drive growth in new areas such as IoT. However, my reading of their financials is that they succeeded in the former, but not so much in the latter. ARM managed to grow revenues at a 7% CAGR over the 2017-2023 period, whereas over the 2010-2017 period, they were growing at a 15% CAGR, mainly driven by the smartphone revolution:

The latest reported valuation is 50 to 55 billion USD, leaning towards the upper end of the range. Working from the number of shares reported in the prospectus of just over one billion, I get to a estimated opening share price of around $54:

The company also has a net cash position of $722 million, leading to an enterprise value of around $54 billion:

Assuming 5% top line growth next year and modelling in some further cost cuts in SG&A, the shares would still be trading on 64x 2024 Operating Income and 83x EPS.

Some notable items:

Gross margins are incredibly high, as the only cost of sales is providing technical support and training to customers. Some R&D can also get categorized under cost of sales if IP is being customized for a particular customer.

As there is a shortage of semi engineering talent, the company is guiding for costs in this area to increase, driven by higher salaries and other forms of compensation. Therefore, there is further potential risk (upside) in the R&D to Sales ratio.

Costs are to a large extent denominated in British pounds as well as other currencies, whereas revenues are in dollars. So a strong dollar will typically lift profitability and margins, and a weak dollar should be a headwind although the company has some hedges in place.

The drop in 2022 operating cash-flow is explained in the prospectus, which can obviously be very lumpy:

“Net cash provided by operating activities decreased to $458 million for the year, primarily due to changes in working capital resulting from a one-time $750 million non-cancellable and non-refundable prepayment from a large technology customer, which was received in the fiscal year 2021.”

Quality tech companies trade at around 15 to 35x EBIT, although most of these are generating better top line growth rates than ARM:

Putting the 2024 operating income on a 20x multiple, I arrive at a market cap of around $18 billion and a share price of $18, giving 67% downside from the estimated opening share price of around $54.

Conclusion

ARM is operating in a highly consolidated industry, with x86 and RISC-V being its only real competitors. Therefore I do believe the company deserves a fairly generous multiple of around 20x. I also estimate that ARM can continue to take substantial market share from x86 in the data center which should give the company attractive revenue growth stemming from this area. However, the desire from China to invest in the RISC-V ecosystem is strong, and with ARM China being the company’s largest customer at 24% of revenues, this business could come under pressure in the medium term.

So we have a mixed picture for this company. Overall it is a good quality business with some avenues for growth, but it is also facing a number of potential challenges. My main concern is that the valuation looks very high. Maybe the company can weave a compelling story to institutional investors during the roadshow, such as a new pricing model. Although as discussed, implementing this won’t be easy for ARM and would bring with it the risk of an ongoing shift in the semiconductor industry to the RISC-V architecture. In my opinion, the risk-reward is clearly to the downside on this one and I wouldn’t be surprised to see the shares trade 50% lower in twelve months time from the currently reported valuation.

If you enjoy research like this, hit the like button and subscribe. Also, please share a link to this post on social media or with colleagues with a positive comment, it will help the publication to grow.

I’m also regularly discussing technology investments on my Twitter.

Disclaimer - This article is not advice to buy or sell the mentioned securities, it is purely for informational purposes. While I’ve aimed to use accurate and reliable information in writing this, it cannot be guaranteed that all information used is of such nature. The views expressed in this article may change over time without giving notice. The mentioned securities’ future performances remain uncertain, with both upside as well as downside scenarios possible.

Always excellent research and writing!

Thanks, it shows how complicated it is to invest in pure tech. I prefer tech-service companies as the moat is more about human interactions