OneStream is a leader in the enterprise finance cloud. The shares had a rough month selling off by 23%, mainly due to concerns around Q3 headwinds with lower government spending. However, the core of the business continues to do very well and beat consensus across all key metrics—revenue grew at +26% yoy last quarter, billings at +20%, and the company is seeing strong growth for its new AI analytics products (+60%). At the same time, the company actually took guidance up for the year, this is the CFO:

“We have the largest pipeline we have ever had at this point of the year and feel very good about our product portfolio and innovation momentum. Our leading indicators remain positive. As such, we are increasing our full year 2025 revenue guidance to be between $586 million to $590 million. Now let's turn to Q3. We are positive about the long-term outlook for the U.S. federal and the public sector business. Near term, the uncertainty in the spending and restructuring environment in the public sector is likely to impact our Q3 revenue growth as this is the largest quarter for the U.S. federal government business. In addition, we continue to see opportunities to convert on-premise government contracts to SaaS, which we have contemplated in our guidance.”

This is CEO discussing the long term opportunity:

“These engines of our business continue to feed off three main drivers at the heart of our industry. Number 1, finance is in the initial phase of its digital transformation. Having utilized outdated legacy financial systems for decades, CFOs are recognizing the crucial need for a platform to provide a single view into financial and operational data across the enterprise to effectively steer the business. Number 2, the role of the CFO is evolving and expanding. CFOs are transitioning from focusing on reporting to providing more strategic insight and operational planning to help drive business execution. And number 3, the use of advanced tooling is enabling finance teams to drive business performance, not only measure it. We are seeing a shift in customers looking for applied solutions that are purpose-built for finance. Proven AI solutions have the potential to give finance teams greater predictability and visibility into their business with more speed and agility.”

The risk-reward in the shares is starting to look attractive here with this short term government headwind. Long term, the company should be looking at high growth rates while valuation is currently at 7.5x consensus ‘26 revenues. The analyst at William Blair makes a similar conclusion:

“OneStream reported solid second-quarter results that beat consensus across all key metrics. While OneStream expects growth to face some pressure during the third quarter given potential headwinds to its public sector business, the company believes that billings will quickly return to 20%-plus growth in the fourth quarter given the strong pipeline trends it is seeing. Management noted that the company’s pipeline is the largest it has ever been exiting the second quarter. In the near term, OneStream believes that recent DOGE uncertainty could impact demand in the company’s public sector business. In order to account for these headwinds, management took a prudent approach to guidance around the third quarter given it is the largest federal spending quarter. While billings are expected to face some headwinds, management expects a reversion to billings growth of at least 20% in the fourth quarter given strong pipeline trends in its commercial business. Management also highlighted that the public sector represents a significant long-term opportunity for the company, especially since OneStream is the only cloud-based FedRAMP certified CPM provider. OneStream trades at 7.7 times our calendar 2026 revenue estimate versus peers at 11 times. We believe OneStream’s leadership position in a large market that is early in its digitization cycle should help the company deliver durable growth and expanding margins over the next few years.”

So this sell off should provide a nice entry point both for shorter term as well as long term investors:

After a poor start of the year, AMD’s shares have been on a roll since early April where macro fears around the new tariff announcement took the whole market down. However, since then, the US has successfully concluded trade agreements with its major trading partners including the EU, UK, Japan, South-Korea, Indonesia etc., with even a trade deal with China now in the making.

This is Deutsche on AMD’s quarter:

“AMD delivered a solid top-line beat in its 2Q25 report ($7.7b, +4% above DBe) and provided an optimistic 3Q25 guide ($8.7b, +2% above DBe). While aggregate revenues being above DBe is a positive, the drivers were more mixed with Gaming driving upside in 2Q (lower quality semi-custom) and Instinct (DC GPUs) driving the upside in 3Q (higher quality). On the all-important Instinct business, AMD appears to be ramping its MI355 product slightly ahead of plan, yielding DBe +75% q/q in 3Q despite no China-focused MI308 shipments being included. We expect this Instinct goodness to persist through 2H25 and into 2026, incrementally raising our ests accordingly (DBe $6.5b/$11b in 2025/26). Beyond revenue, GMs remain impressively steady despite mix gyrations, with opex continuing to increase as AMD accelerates investments into the AI opportunity. Overall, we remain impressed with AMD’s execution across its array of product lines, expecting solid growth to continue in CPUs and likely accelerate in DC GPUs. However, even with these growth drivers reflected in our model (CY25E EPS ~unchanged, CY26E ~ +10%), we see EPS power in the ~$6-7 range as largely being reflected in a current valuation (~25-30x P/E). Consequently, we maintain our Hold rating, but raise our P/T to $150 (~26x CY26E).”

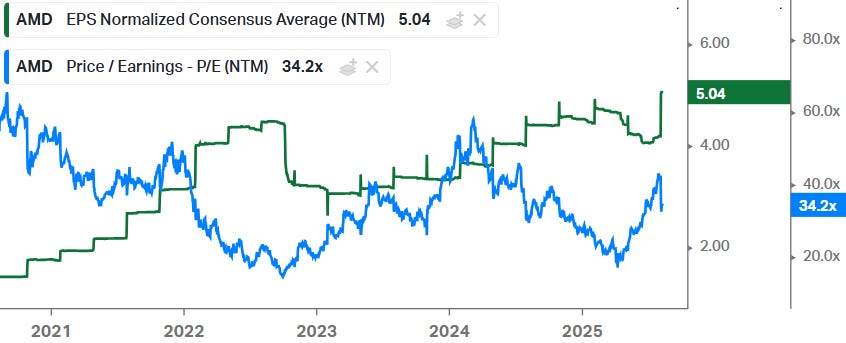

We think the above conclusion from Deutsche is too negative. The penetration of AI automation in the wider economy is still very low, so we could be looking at high growth rates for AI semis for the foreseeable future. At the start of the LLM revolution, AMD was massively behind Nvidia especially in its software stack. However, since then, its ROCm computing platform has become much more capable and AMD is becoming a viable option, especially in inference. So we think that long term, AMD should be able to take its share of the data center GPU market, while the shares are not particularly aggressively priced at 34x:

Next, for premium subscribers, we will discuss the massive sell off in The Trade Desk’s shares (-40%) and whether this represents a buying opportunity. Subsequently, we will discuss a smaller semi name for which a large opportunity in the AI data center is now emerging.