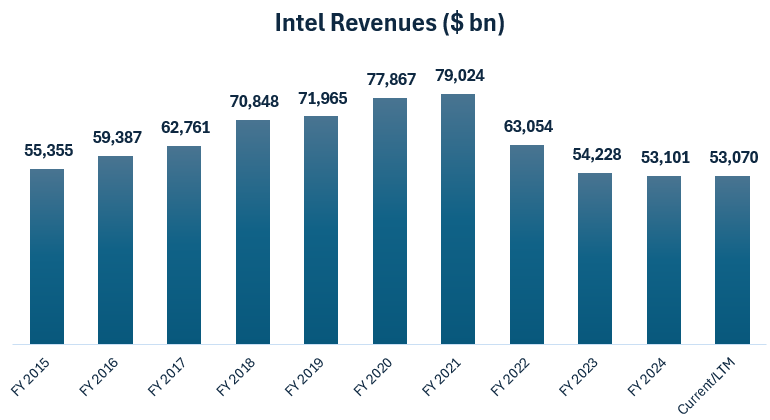

Intel remains in a difficult position, despite the current boom in advanced semis and with revenues exploding at many of the leading semi names such as Nvidia and TSMC, the historical semi champion’s revenues have been going south over the past few years:

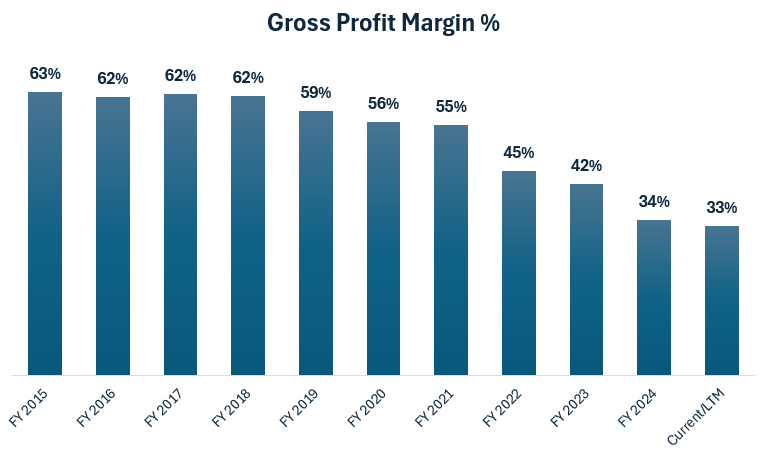

The seeds of this disaster were already sown almost 10 years ago, when Intel failed to transition to 10nm and lost its manufacturing lead to TSMC. Intel seemed to be on 14nm forever, with its 10nm node being delayed with more than 3 years. To make matters worse, Intel only managed to insert EUV into high-volume manufacturing in ‘21 with its ‘Intel 7’ node. During these delays, TSMC moved swiftly in a regular two year cadence to N10, N7, N5, and then N3. This allowed Intel’s competitors, most notably AMD which had been heavily betting on TSMC, to take market share due to superior products. The above revenue chart doesn’t capture just how bad things are going for Intel. Gross profit margins are a better reflection of how pricing has been evolving for Intel’s products:

Collapsing profit margins led to collapsing operating cash-flow, and as the company had to step up capex to become competitive in manufacturing again, this led to a heavy cash-burn. Over the last twelve months alone, Intel burned another $11 billion of cash. It’s beyond comprehension that this company was still paying out a dividend up until Q3 of last year, and obviously all dividend payments should have been halted already in ‘22. By this time it had become also clear financially just how difficult the company’s current position is:

Intel isn’t going bust anytime soon, the company has still $21 billion in cash with another $3.5 billion coming in from the sale of Altera, $1 billion from reducing its stake in Mobileye, another $2 billion from Softbank, and $5.7 billion from the US government. So, in total we have another cash-inflow for the company of $12.2 billion in the coming months. In addition, the company still has a stake in Mobileye currently valued at $8.8 billion, and there is the possibility to sell various other assets. So Intel still has a lot of runway, however, it is also clear that the company’s financial performance has to start turning around in the coming years. This is no easy feat in leading edge semis.

Due to the heavy cash burn, Intel is making it clear that they want to add external customers first to make the investments in their coming 14A node. This is the company’s CFO at the recent Deutsche conference:

“Lip-Bu wants to execute on 18A and he wants to execute on 14A, but he wants to maintain financial discipline while he's doing that. And so what we're trying to communicate is the philosophy around why we're getting into the Foundry business. There's opportunity there. But the volumes required at these new nodes in terms of the spending level, it's hard to get an ROI unless you've got more volume than we have. We were able to do it with 18A. I think it will turn out to be a good node for us from an ROI perspective without Foundry customers, although I do think that we have an opportunity in the second wave to get Foundry customers into 18A. But 14A is different. So we do need outside customers to drive volume and make sure that we get the right ROI. We're not going to put capital in place until we have firm commitments from customers that they're going to use 14A. Now Lip-Bu, every day, he kicks the tires on 14A. He becomes more and more confident around our ability to be successful there. The fact that 18A is now making steady improvement on the yield, it's also giving us a high degree of confidence that 14A will be successful.”

We do think that starting a foundry business is the right move for Intel. The company has good manufacturing tech, while there is a desire from customers to diversify their supply chains. For example, Nvidia allocated their gaming GPUs to Samsung’s foundry not too long ago while Tesla will be sourcing its next-gen AI6 chip from Samsung. At the same time, on-shore semi manufacturing capacity is seen as a national priority in Washington. The latter could help Intel secure certain volumes for its 18A and 14A nodes.

President Trump is known to regularly get involved at the more micro level to help out US businesses. For example, just a few months ago, Trump got involved in the acquisition of US Steel by Nippon Steel, securing all sorts of guarantees to increase US steel manufacturing capacity and a golden share with veto power in about a dozen key areas. Recently, Trump met with Intel’s new CEO, Lip-Bu Tan, and mentioned afterwards that he “really liked him”. This meeting came after the attacks launched by Senator Tom Cotton, which portrayed Lip-Bu as being tied to the Chinese communist party. However, after the meeting, Trump mentioned that he thought that Lip-Bu was unfairly a victim here.

It’s not hard to put all the above observations together. Firstly, Intel needs volumes in order to invest in its next leading edge node. Secondly, Washington wants more semiconductor manufacturing capacity, which it sees as crucial for national security. And, finally, Trump is known to get involved into business deals to help out US companies, especially when it comes to US-based manufacturing capacity, and Intel’s new CEO has successfully built a new key relationship here. So, we do think it is well possible that at some stage, there will be some horse trading going on behind the scenes, where the leading US semi designers will be asked whether they can allocate some of their (smaller) products to help out Intel and the country in general. Deutsche Bank made a similar conclusion after their meeting with Intel’s CFO:

“Despite the initial dilution, the company views this as a strategic win to bolster their near-term cash balance while eliminating the uncertainty (and time duration) of receiving cash grants from the US CHIPS Act. Further, this investment aligns their incentives with those of the US government (i.e. a strong US-based foundry and we believe decreased odds of any foundry based spinoff). While largely indirect, we also believe the involvement of the US government may help attract US fabless companies to utilizing the Intel foundry business.

Regarding the necessity of garnering external customers for 14A to generate an acceptable ROI, Intel’s CFO indicated that this should not be read as a sign of uncertainty nor lack of commitment to the foundry business, but rather a statement of Intel’s financial discipline. We believe the statement was also meant to encourage greater collaboration with potential foundry customers that may desire to increase their US-based wafer sourcing and avoid future foundry sole-sourcing. Overall, the company remains confident in its ability to generate a solid ROI in 18A over the next several years and expects customer designs for 14A to fall within the CY26/27 range before ramping in earnest in the CY28/29 time frame.”

In the meanwhile, Intel is also taking other measures to improve profitability such as increasing its levels of tool reuse and increased pricing at the next nodes. This is the CFO at the Deutsche conference:

“Naga and Lip-Bu have been pushing on reuse too, and I don't think we did a particularly good job on reuse. So they're really forcing the organization to not dispose of equipment and sell it at pennies on the dollar, but reuse it in the process. I think on the Foundry side, we're in pretty good shape. 18A and 14A have very good cost structures relative to older nodes. The pricing is better. So they should be on a steady path to improving both gross and operating margins as we go into '26 and beyond.”

A foundry business would be lucrative for Intel shareholders. If the company would be able to capture a 12.5% market share over time in a future foundry TAM of $250 billion, this new venture alone could generate over $2 of EPS:

Valuing the above on a 25-30x PE would already result in a future share price of around $60 for the Foundry business. This is really the only credible bull case we can see in Intel at this stage, and needless to say, this remains a speculative story. Yields on its coming 18A and 14A nodes will have to be sufficiently high in order to attract volumes. We do believe that Washington will be pushing to help, but if Jensen explains that the yields are too low, Intel will obviously be in a very tough spot. Under that scenario, it would make much more sense for the US government to give further incentives to TSMC to build out their massive fab hub in Arizona. Overall, Intel remains a speculative and difficult turnaround story. At this stage, we’re more inclined to stay on the sidelines for now. Greater clarity in a roadmap to successfully build out a foundry business is a key factor that could bring us onboard as investors in this name.

Fortunately, for premium subscribers, we will analyze 7 investment ideas next. These will range from hardcore semi engineering firms to AI names and fintech. We’ll cover US, international, and emerging markets stocks.