Spotify’s Tik Tok & Cash Machine and Texas Instruments' Strategy to gain Market Share

Outlook for both companies post Q1

Spotify’s Tik Tok and Cash Machine

Spotify is the largest player in music streaming with a market share of over 30%. In addition, the app is becoming an extremely comprehensive audio and video content platform with a clear path to increasingly monetize this. One feature that stood for me is the addition of a Tik Tok-like reels to discover new content, which can both be produced by artists or by users. For example, a user could create a remix of a song with Spotify’s AI. CEO Daniel Ek on this new feed:

“We are focused on winning discovery, and we're going to add as many ways that we can to improve the discovery of Spotify. So you saw us in the quarter add music videos and you're going to see music clips in a bigger way. Those, in a similar way, are like a reels product that Tik Tok did a few years ago. I think the whole industry, TikTok and other companies, have obviously improved the user experience. We are all learning about these trends and best practices and trying to improve our products. We learn what consumers like and we try to improve upon it, and make the best possible user experience. So short-form music content is a big focus of ours.

And two other things that you're going to see, more AI products on the music side as well and an even more global music ecosystem. You're also going to see music clips show up in a bigger way where artists are using short-form storytelling to tell the story around their album or tell fans about a new album drop that they should be presaving. And I think long term, the way to think about that from a financial impact point of view is really, the more we can improve engagement and the more value we're creating, the more ability we will have eventually to capture some of that value through price increases or more inventory that then drives advertising.”

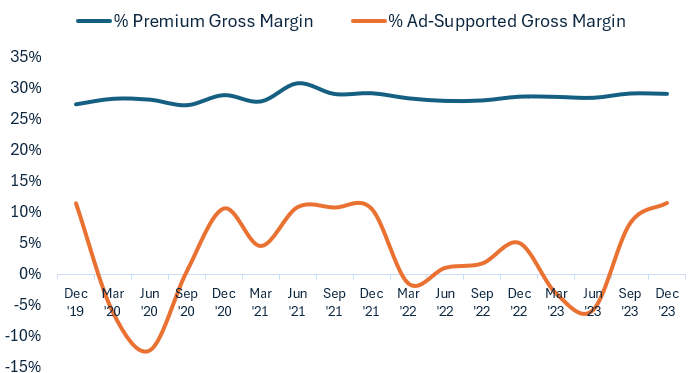

Advertising is nothing to write home about for Spotify, or at least for the moment, as the company’s gross margins here have been hovering around the lower single digits:

All gross profits, or around 95% to be more precise, are generated from premium subscribers and the company has a good track record of increasing monetization here. This is illustrated in the chart below where premium revenues have been growing faster than the number of premium subscribers in most quarters:

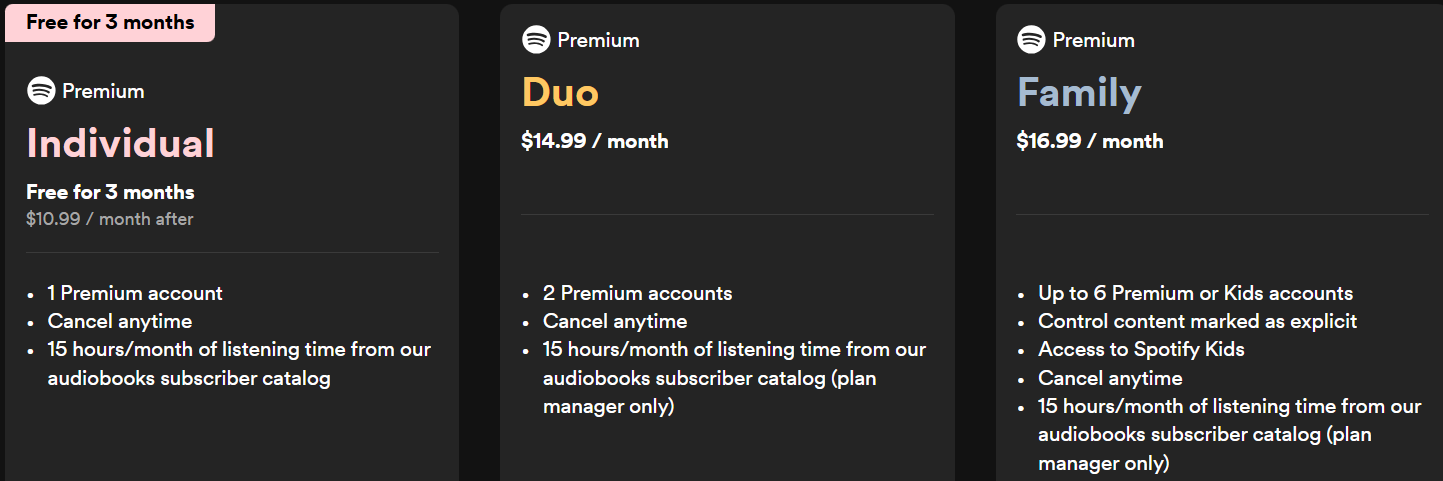

For example, there is speculation that Spotify’s audiobooks plan will increase with 20% from $9.99 to $11.99 and that the premium tier will start excluding audiobooks going forward. The premium plan currently includes 15 hours of audiobooks per month out of a total catalog of 250,000 titles:

This Daniel Ek on the company’s strategy to turn Spotify into a comprehensive platform and drive price increases:

“Over the course of the last 2 years, we've added a tremendous amount of value. We've added of course, more podcasts than ever before. We have millions of podcasts now and we have a library of over 100 million music tracks. We've added Audiobooks in many markets and more than 25% of our user base are now using that. In the first 14 days of new users using Audiobooks, we see over 2.5 hours of incremental usage, so we're seeing some great results. And of course, we've added video on the music side but also on the podcasting side, and features like AI DJ.

We're focused on capturing some of that value we've been adding by increasing the price. In many territories, we have been doing even more price increases than in the US. Sometimes that's due to local dynamics, sometimes that's also due to inflation and other things that are contributing. So it's really a mix of many different things that we're considering as we're raising prices. But the main one I want to focus on, it's really the value-to-price ratio and keeping that very healthy, where we're obviously offering a lot more value to consumers than what we're capturing through the price increases.

The Spotify machine isn't just a one-trick pony anymore, but it is actually multiple verticals working together to provide a consistent great story around just more choice for consumers that drives more engagement. You may come for the music and stay for the audiobooks. Some consumers may come for the podcasts and stay for the audiobooks.

We went from a single pricing plan, $9.99 back in the day, to then Family plans, Duo and having day and week pricing in certain markets. And now you're seeing an audiobooks-only tier, and you're going to see eventually a music-only tier too. You will see a lot more tiers that allows for more flexibilities to consumers, to opt into the type of deal that they believe offers the greatest value for them in terms of how they're using Spotify.”

The Duo product is a great feature as more price conscious consumers will try to find a friend to purchase a subscription together. This is basically the business model that PinDuoDuo popularized in China and which allowed them to take large swaths of market share from Alibaba.

Besides benefitting from the monthly subscriptions, creators can also sell work separately directly over Spotify. For example in education, creators have been selling courses over the platform. Take rates are usually attractive for the platform, and typically range around 20 to 30 percent.

Spotify has been growing premium subscribers at attractive double-digit rates, but ad-supported subscribers have been growing at even faster 20 to 30% rates:

So it’s now key for the company to turn more of the latter into paying subscribers, and it seems that the company is using the right strategy here, by adding innovations to discover and engage with content, as well as by expanding monetization options. This strategy is clearly working, user growth has been attractive, and gross margins are heading in the right direction as well:

2022 was really a year of investment for Spotify in terms of content expansion, so this temporarily depressed the margins.

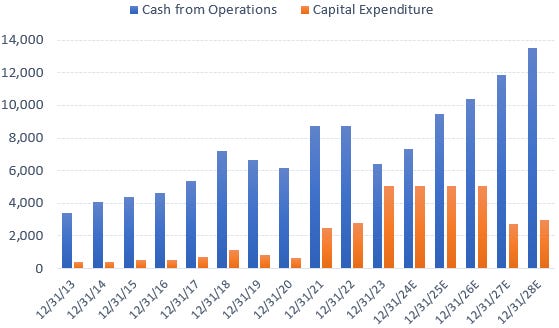

Looking at valuation, these types of quality, higher growth stocks rarely come cheap, and I would say that the PE valuation is probably looking a bit stretched here at 51x next-twelve-months’ EPS. However, the company has become a cash machine and is expected to generate a yield of 3% on the EV this year, so obviously Spotify is becoming an attractive cash generation story, certainly for a company that can continue to enjoy double-digit top line growth rates and margin expansion:

Texas Instruments' Strategy to gain Market Share

Geopolitically safe supply chains remain a key theme in semiconductors, and Texas Instruments (TI) with its fabs in Texas and Utah should be a key beneficiary of this, from the last call:

"I would say that many customers, and especially those in automotive, many found that they have a pretty significant dependence on wafers coming out of both China and Taiwan. And what they described to us is that geopolitically dependable capacity is what they're seeking. And so I think we're in a position to be able to support customers and that growth that will come from that."

Not only is TI one of the best quality players in analog semis, but it is also among those with the largest scale, allowing for manufacturing on 300mm wafers and giving the company a 20% cost advantage on the overall chip:

So I still like the set-up here, and the company should be well positioned for market share gains in the future. There is risk of some share losses with customers headquartered in China, but these are less than 20% of revenues. And as product lifecycles in industrial and automotive semis are long — once you get designed in you’re typically in the product for 6 to 12 years — it’s not like you’re going to see dramatic market share shifts overnight. In the meanwhile, the company mentioned that their market shares in China have been stable and that the market continues to grow:

"We've got very competent local competitors there as well as there's subsidized capacity going in place. And when you compare that to 5 or 10 years ago, is it harder to compete there? It certainly is. But again, I would not describe that as a competitive landscape that's changing overnight and we've talked about that for some years. So China is an important market for us and it continues to be a growing market."

TI has been struggling with a downwards semi cycle in its end-markets, mainly as clients and distributors built up large inventories during the covid semi boom, from which they’ve been sourcing more recently to ship product. However, it seems like we’re now starting to see the first signs that a number of end markets are moving into a new upcycle:

"As we looked at it inside of industrial, there obviously were some customers that are nearing the end of that inventory depletion cycle. We've got some of the later-cycle sectors that are continuing to decline and declining at double-digit rates, but there are some that are beginning to slow in the declines and even a couple that grew sequentially."

Basically when channel inventories normalize or start to get depleted, customers have to start buying more again from the semi manufacturers and this is the moment when the semi cycle turns. There has been some concern on Twitter about TI’s large current inventory levels, but remember that the company suffered share losses during the previous upcycle as they didn’t have sufficient fab capacity and inventories. So given the strong long term demand outlook that the company is seeing, I do think it’s the right strategy to build up a strategic buffer of merchant silicon which can go into a plethora of products, i.e. the die bank. Also remember that TI has been building out an Amazon for analog semis, ti.com, from where you can easily source TI semis. As a reminder, TI is currently constructing two new fabs at a site in Sherman, Texas, a site where in total four new fabs can be constructed.

As a result, capex will remain elevated for the coming three years, although the company has managed to stay FCF positive even in this downturn:

In the recent results we got some more details on the current semi cycle. The company saw increased bookings every month during Q1 and is forecasting sequential revenue growth during Q2, both of which were described as normal seasonal patterns. The market took these signs of both normality returning combined with a recovery starting in a number of end markets well and shares rallied more than 10%.

Overall, TI should remain an interesting story for long term investors. This is a company which should be able to grow through the cycle at high single digits and potentially low double digits, and the company remains one of the best quality names in analog semis with a 300mm manufacturing advantage. As capex normalizes, TI should turn into a cash machine for shareholders and the company is committed to return this cash to shareholders in the form of both dividends and buybacks.

If you enjoy research like this, hit the like and restack buttons, and subscribe if you haven’t done so yet. Also, please share a link to this post on social media or with others who might be interested, it will help the newsletter to grow, which is a good incentive to publish more.

I’m also regularly discussing tech stocks on my Twitter.

Disclaimer - This article is not a recommendation to buy or sell the mentioned securities, it is purely for informational purposes. While I’ve aimed to use accurate and reliable information in writing this, it can not be guaranteed that all information used is of this nature. Before making any investment, it is recommended to do your own due diligence.