Silicon Labs vs Nordic Semi, the battle for the IoT semiconductor market

An overview of the space

IoT, the world of connected devices, remains an interesting area for investment exposure. One, this is a market which has been growing at double digit rates over the last decade and is forecasted to continue to do so. Two, there are a number of larger semi players in this field and customers use their provided software tools to integrate and customize IoT SoCs (System on a Chip) into their products. So not only do these SoC designs regularly have to be updated for the latest wireless tech, but customers are also trained on the software, strengthening the moat for these players. Three, provided SoCs are becoming more complex, advanced and integrated, lifting ASPs over time. Finally, we should be nearing the bottom of the semi cycle now in this market, so investors have the prospect of a strong growth recovery once the cycle turns.

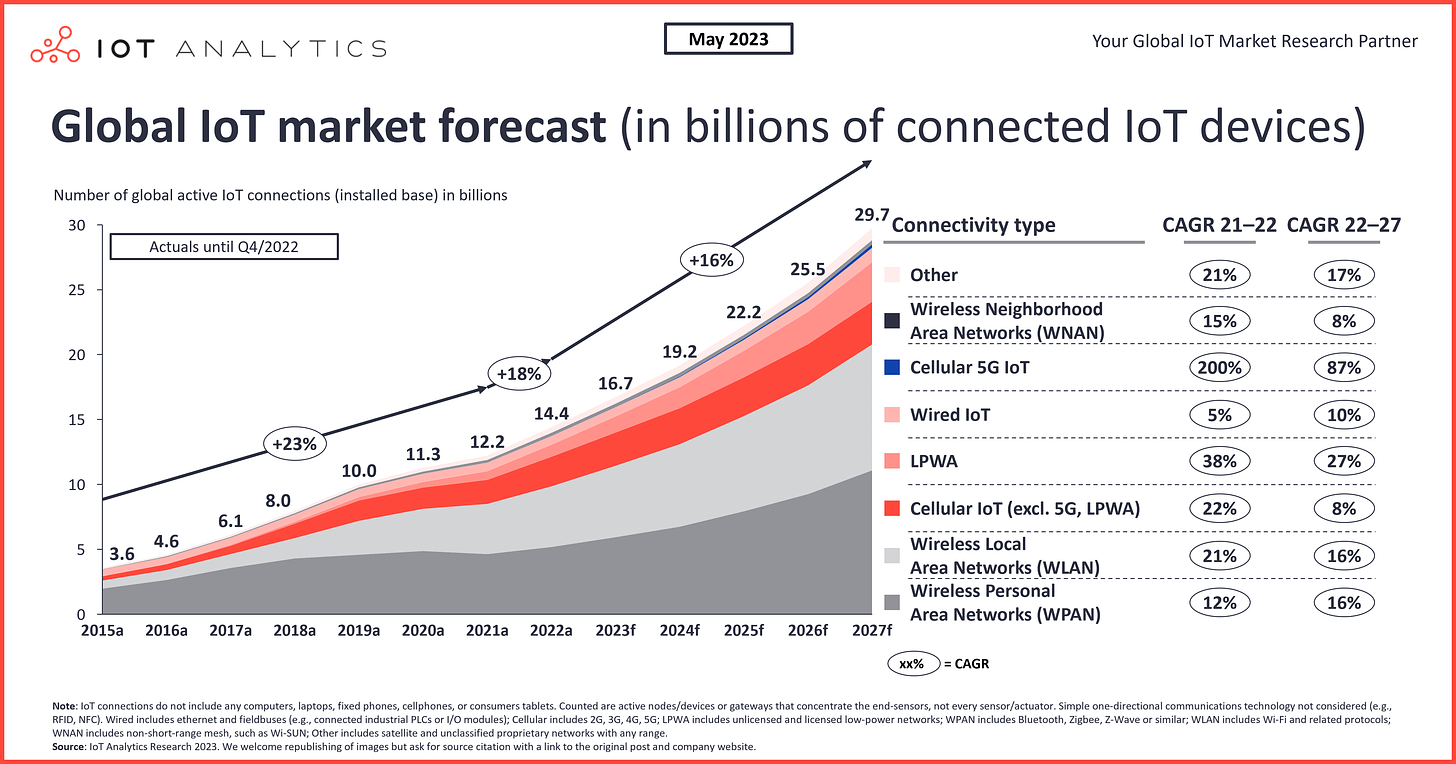

IoT Analytics provides an overview of the number of connected devices in the world measured in billions. Usually these devices are connected to local or personal area networks, but also cellular is becoming an interesting growth market:

Silicon Labs (SiLabs) provides some typical examples of where these SoCs can be installed, from water and electric meters sending back data, to solar panels, street lighting and EV chargers. There are a wide variety of wireless technologies to connect these devices but the best known ones are Bluetooth for short range, WiFi for mid range and cellular for long range.

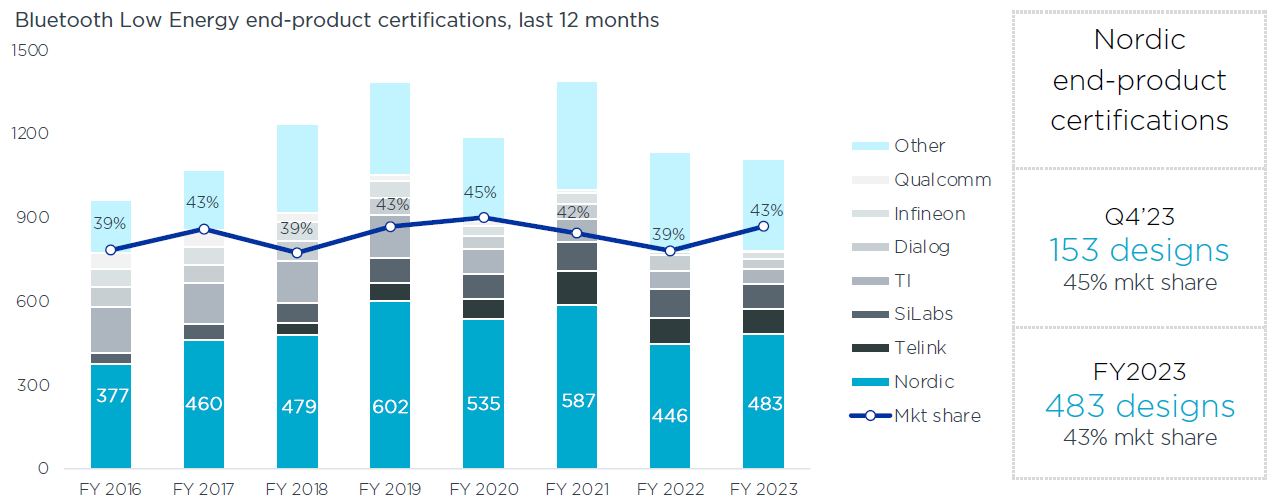

Nordic Semi is extremely strong in Bluetooth Low Energy (BLE) with a 43% market share as seen on the number of design wins below. BLE is used for very low power and short range data transmissions, for example to send data from your smartwatch to your smartphone. Some other uses include tracking where your cat is going, or to receive data from medical devices such as a glucose monitor. We can also see on the chart below that SiLabs has been winning some share as well as Telink, a Chinese player which I suspect has mostly been winning designs in the Chinese market. That said, Nordic retains a fairly attractive share of around 43%.

In the overall IoT market, SiLabs has been achieving stronger growth over the previous years, albeit it also entered a stronger cyclical correction more recently:

Whereas Nordic is very strong in BLE, SiLabs is the strong player in multi-protocol SoCs. This is their CEO giving an introduction to the company:

“We're the largest in the world of what we do and the easy way to think about a wireless SoC, you have on one chip the wireless capability, the general purpose compute, machine learning, power management and security. On top of that, we provide all the requisite software and customer support across multiple wireless technologies. We're one of the only companies in the world that has all the requisite wireless technologies, and we know how to make them work well together. Our end market is growing outside of the cycle around 15% annually and our goal is to always be gaining share within that space, which we've done over the last decade consistently, giving at least 20% growth. And the companies that have this as a side show, it doesn't give our customers confidence that it might not be their core priority as a company. And that's what we saw during the supply crisis, a lot of the bigger companies retrenched and allocated supply elsewhere, this really spooked our customer base.”

Nordic has been busy replicating this strategy by also offering multi-protocol SoCs including low power cellular, which SiLabs has decided to stay out of for now. Both companies make use of a platform approach, where they will only release a limited number of SoC designs, which clients then can adapt via the provided software tools. This strongly reduces inventory risks as the demand for these chips is broad-based, which mitigates the obsolescence risk which you can get with highly customized semis e.g. ASICs.

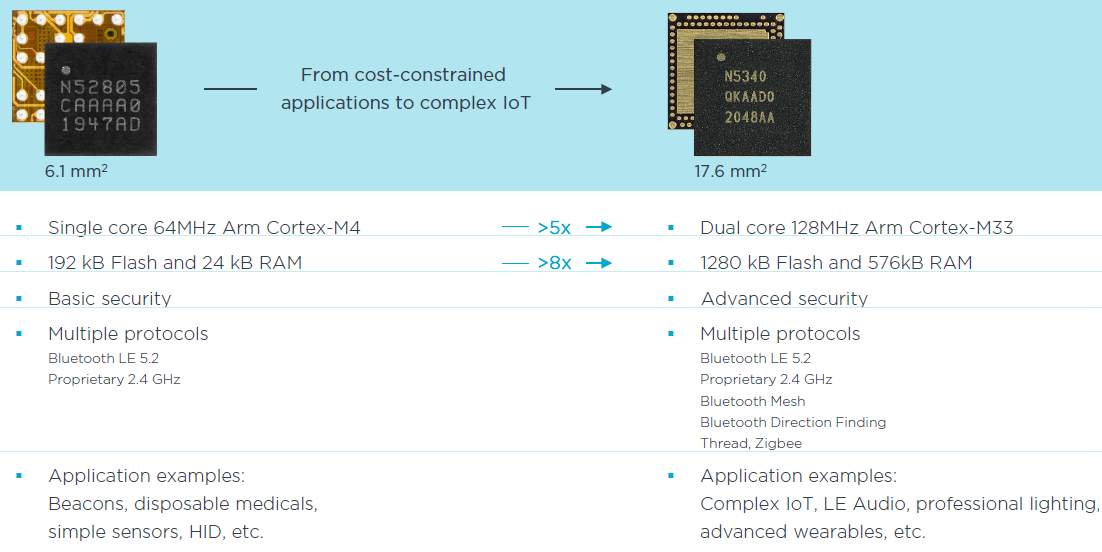

Two examples of Nordic SoCs are shown below, the smaller one is aimed at BLE while the other offers a wider variety of protocols:

Both manufacturers have been launching single and multi-protocol SoCs to address a wide variety of use cases. In addition, both are adding advanced features such as low power AI accelerators and cryptographic security while at the same time both are developing more completely integrated systems, for example by also including power management. So besides the high future volume growth of the IoT market, there is an additional opportunity to increase ASPs, as both SiLabs and Nordic are providing more complete and advanced integrated systems.

SiLabs goes all in on IoT

SiLabs didn’t use to be an IoT specialist, the company had an automotive and an infrastructure semi business, as well as one for handset and PC semis a long time ago. However, when they saw the opportunity arising in IoT, the company decided to divest their other businesses to SkyWorks for $2.75 billion and go all in on IoT. This the previous CEO discussing this move in ‘21:

“We just announced the divestiture of our infrastructure and automotive businesses to Skyworks back in April and that allows us to focus as a pure play on the Internet of Things, which is just a massive opportunity sitting in front of us. It's a $10 billion SAM that we're targeting, lots of runway for revenue growth.

The founding of the company was really around mixed-signal and RF integration and so we did a number of hit products. We took the company public in 2000 and went after the PC and handset markets. We got a 50% share in modems, got 25% share in mobile handsets and those really propelled the company's first wave of growth. We did a number of other products, but we ended up divesting our handset business in 2007.

We sat down and said, we've got these great capabilities, we've had lots of successes in multiple markets, but where are semiconductors going for the next one and two decades. And we saw that the connectivity that's going into PCs and handsets is now going to get really embedded into everything. And we said the integration of wireless connectivity and building SoCs for all these embedded devices is going to be a huge opportunity. We've done a number of acquisitions around this to bring in talent and capabilities, so now it's not just mixed-signal, it's also communication protocol stacks, networking, tools and collecting data. We've grown that business from about $100 million to what will be about $650 million this year and there's a lot of room ahead. You look back at the PC industry and Intel dominated that, you look at the mobile industry and Qualcomm came out ahead, I think that we've got the opportunity in IoT to become the market leader.

There are a lot of wireless protocols that are necessary in IoT, you'll use Bluetooth to talk to a handset, but then you'll connect to a mesh network with Zigbee or Thread, or you'll connect to a WiFi network. And there's a lot of proprietary networks that are supported as well. Between devices, whether it's Google, Amazon, Comcast or Apple, a lot of contributors are rolling out Thread mesh networking, so these devices can communicate with each other at the gateway or at the device level. We've designed our platform to really support all of these protocols in a holistic way and update those over time. And doing that across thousands of different applications and tens of thousands of customers takes a lot of focus. It requires a different approach than just having a microcontroller with connectivity. We're on our fifth generation of development tools and this helps our customers get to market faster. Some customers are experts at wireless, and others are just learning and need a turnkey solution.

Cellular by comparison, can cost 10x more and have a fraction of the battery life. So low-power wireless allows for more than 10x battery life at a fraction of the cost. It opens up the door to so many applications that otherwise couldn't utilize wireless technology. The bulk of the market will be driven by low power, and that's where we are incredibly well positioned.

Security is essential, people have to trust these devices. You've got to embed payment grade security hardware and software into these devices. We're integrating very sophisticated accelerators for security algorithms onto the chip so that you can't hack it. The other important thing is that the hardware is energy optimized. A lot of these applications are running off of batteries, 10 year batteries and so you've got to minimize the amount of data that you're transferring. On top of that, we’re integrating machine learning algorithms. When you have sensor data coming in, you've got to have some intelligence to only transmit when you see something that matters.”

For premium subscribers, we’ll review:

The semi cycle and SiLabs’ whopping current pipeline

How SiLabs and Nordic Semi are moving into new technologies

The software moat of SiLabs’ and Nordic Semi’s businesses

A detailed analysis of the financials and valuation for both companies