Semis on Fire - A New Niche Semi Winner From AI

TSMC, Broadcom & A New Niche Semi Winner From AI

Semis on Fire - TSMC & Broadcom

Over the past several months, token consumption has been exploding in the cloud. Anecdotally, the AI workloads we’re running in the cloud have continued to slow down over the past few months, especially when US business hours start, which is a good indicator that GPU utilization has been increasing. In particular, ChatGPT regularly feels slow, while Grok3 slowing down might just be a function of xAI shifting GPU capacity to the mighty SuperGrok. So, it’s no surprise that TSMC raised its outlook for the year. This is TSMC’s CEO on the call:

“We believe the demand for semiconductors is very fundamental and will continue to be robust. Recent developments are also positive to AI's long-term demand outlook. The explosive growth in token volume demonstrate increasing AI model usage and adoption, which means more and more computation is needed, leading to more leading-edge silicon demand. We also see AI demand continuing to be strong, including the rising demand from sovereign AI. Therefore, we now expect our full year 2025 revenue to increase by around 30% in U.S. dollar terms, supported by strong demand for our industry-leading 3-nanometer and 5-nanometer technologies underpinned by growth in our HPC platform. Amidst the uncertainties, we will remain mindful of the potential tariff-related impact and be prudent in our business planning going into second half 2025 and 2026 while continuing to invest for the future megatrends.”

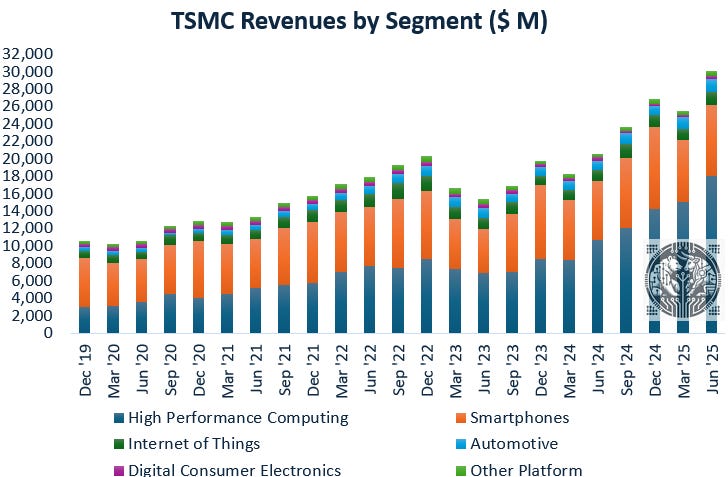

TSMC’s revenue growth is being driven by the high-performance computing segment..

.. which continues to grow at 70-80% year-over-year rates:

TSMC’s CFO clarified that due to strong AI demand, they don’t expect the CoWoS market to balance anytime soon:

“The demand from AI is getting stronger and stronger, and so now we are in a mode trying to narrow the gap for CoWoS. I don't want to use the word balance. The last time you guys misunderstood what I said. So, I will say we try to narrow the gap, all right? So, momentum is still there and very healthy.”

A major new tailwind for AI demand, which was only announced this week, is that Nvidia will again be allowed to export its H20 chip into China. The logic is that the US wants to limit China’s ability to develop a competing AI stack, running on Huawei silicon and software, and manufactured by SMIC. While this silicon is much less powerful than Nvidia’s, if you network a lot of them together into a giant cluster, you still get a huge amount of computing power. Thus, it makes much more sense to allow Nvidia to capture a large share of the Chinese AI market, which will get developed anyway as the genie is out of the bottle, and then have those profits flow back to the US. It makes much more sense to have that capital being reinvested in US R&D as opposed to Huawei-SMIC R&D. The Chinese AI market will be huge and so this is an obvious positive for both Nvidia and TSMC.

Demand for TSMC’s next node, N2, is very high. This is TSMC’s CEO:

“We expect the number of new tape-outs for 2-nanometer technology in the first 2 years to be higher than both 3-nanometer and 5-nanometer in the first 2 years, fueled by both smartphone and HPC applications.”

Historically, Apple made up all of the demand in the initial year(s) when TSMC introduced a new node, while the high-performance silicon designers such as Nvidia, AMD, Broadcom etc. remained one or two generations behind. With the explosion and competitive race in AI, these high-performance silicon players are now looking to transition to the leading edge more swiftly. This is a major positive for TSMC as its leading edge wafers come at much higher ASPs, and it will allow the company to reach target gross margins faster on the new node due to larger volumes.

Due to the huge demand for leading edge silicon, TSMC is building out three massive fab clusters—one in Arizona with 6 advanced fabs (including N4, N3, N2, A16 and A14) and 2 advanced packaging fabs, and two fab clusters in Taiwan including 11 fabs and 4 advanced packaging fabs in total. We also got an update on the call on the progress in A14, TSMC’s next major node after N2:

“Featuring our second-generation nanosheet transistor structure, A14 will deliver another full node stride from N2 with performance and power benefits to address the increasing structural demand for high-performance and energy-efficient computing. Compared with N2, A16 will provide 10 to 15 percent speed improvement at the same power or 20% to 30% power improvement at the same speed, and about 20% chip density gain. Our A14 technology development is on track and progressing well with device performance and yield improvement on or ahead of schedule. Volume production is scheduled for 2028. We will continue our strategy of continuous enhancement with A14, including a Super Power Rail offering planned for 2029. We believe A14 and its derivative will further extend our technology leadership position and enable TSMC to capture the growth opportunities well into the future.”

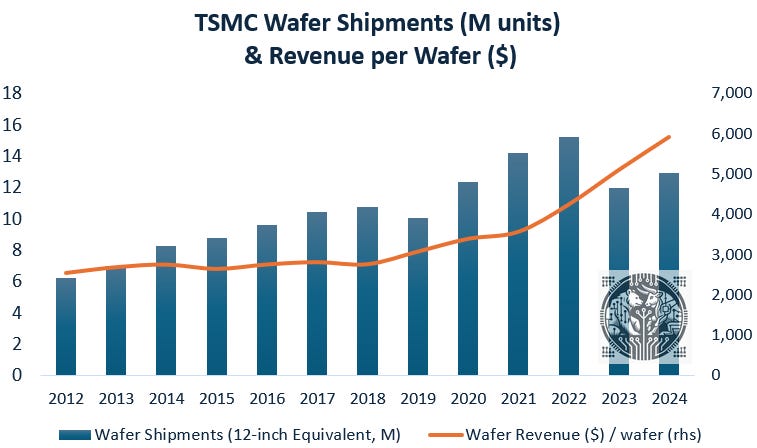

This innovation roadmap is extremely important for investors as next nodes always come at much higher ASPs, driving strong revenue growth for TSMC. Wafer volume growth hasn’t been a growth story at TSMC over the last years, meaning that the strong revenue growth since the covid peak has come from wafer mix—i.e. selling more N3 and N5 wafers at much higher ASPs versus N7 and N16 wafers.

Although wafer shipments picked up tremendously during the last quarter as TSMC shipped 3.7 million wafers, a number reaching similar levels as shipments during the peak phases of the covid semi boom:

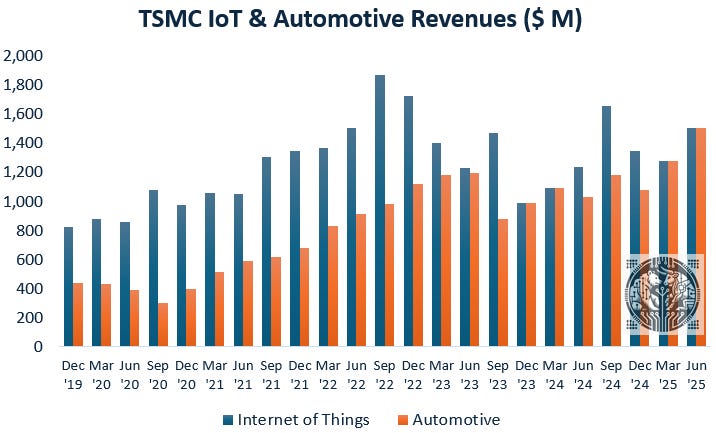

This is helped by also mature semi markets such as automotive and IoT picking up..

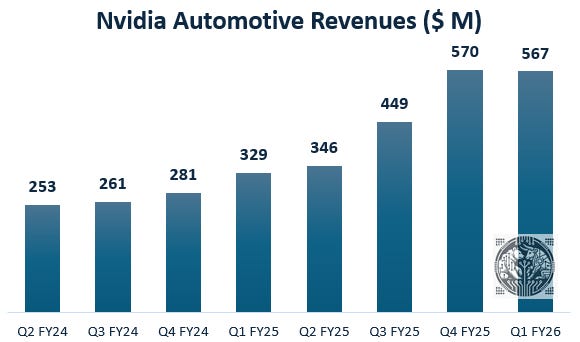

.. although automotive is also being driven by the rise of autonomous driving. Nvidia has been winning plenty of OEMs to build autopilots on its Thor and Orin chips, with this business now generating over $500 million per quarter:

All of the above is naturally positive for semicap as well, as TSMC’s capex will make new highs this year:

And the bull case for semicap stocks is that despite peak capex levels, TSMC’s capex-to-revenues ratio remains modest:

The only short term negative is that TSMC is currently seeing gross margin headwinds due to the weak dollar—wafers are priced in $, while costs are in TWD. But it sounds like the company will be working to increase wafer ASPs, as well as make use of other levers to increase gross margins. This is the CFO on this topic:

“NT dollar is the reporting currency of our financial statements. Nearly all of our revenue is in U.S. dollars, while about 75% of cost of goods sold is in NT. Therefore, fluctuations in the exchange rate between U.S. dollar and NT will have a sizable impact to our reported revenue and gross profit margin. The sensitivity of the revenue to dollar NT exchange rate is nearly 100%—that is every 1% appreciation of NT against U.S. dollar will reduce our reported NT revenue by 1%. The sensitivity of our gross margin to the same 1% exchange rate change is about 40 basis points. That is if NT appreciate 1% against the dollar, our gross margin will come down by about 40 basis points.

As a reminder, 6 factors determine TSMC's profitability: Leadership technology development and ramp-up, pricing, capacity utilization, cost reduction, technology mix and foreign exchange rate, which is not in our control. When the foreign exchange rate is unfavorable as it is currently, we will focus on the fundamentals of our business and lean on the other 5 factors to manage through it, as we have successfully done in the past. Thus, even with the unfavorable foreign exchange rate, we believe a long-term gross margin of 53% and higher remains well achievable.”

Coming back to the outlook, JPMorgan reached a similar conclusion about AI demand after meeting with Broadcom’s management, while also seeing a gradual U-shaped recovery in non-AI semi markets:

“We hosted an investor group meeting with Broadcom's President and CEO, Hock Tan, CFO, Kirsten Spears, and VP of IR, Ji Yoo. The discussions centered around strong AI demand trends, which are driving strong growth in Broadcom's custom AI XPU business and driving demand for its high performance networking portfolio. Additionally, there are gradual recovery trends in the non-AI business (seeing positive order inflection) and sustained growth in its VMware business. Key takeaways in our view were:

1) AI demand continues to remain strong, with incremental demand from inferencing workloads that were not accounted for in the prior 2027 SAM forecast, potentially leading to upside (although too early in the adoption curve to make a definitive call).

2) Strong execution in product technology development, with the 2nm 3.5D AI XPU product tape-out on track for this year and the team is on track to tape-out first-generation AI XPU products this year with its two leading prospect engagements (we believe with Arm/Softbank and OpenAI).

3) AI compute workloads are driving strong networking demand and presenting significant dollar content capture opportunities in scale-up networking (5-10x more content versus scale-up networking).

4) The team is seeing a gradual "U" shape recovery in its non-AI semiconductor business, reflected in the bookings/order inflection the team is seeing now, which could contribute to the positive EPS revision cycle next year.

5) The VCF platform conversion is expected to sustain strong growth in its VMware business until late 2026/2027, at which point VMware's revenue base is expected to reach $20B in annualized revenues, with growth returning to more normalized levels of mid to high single-digit% thereafter.

6) Semiconductor operating margins are expected to continue expanding, driven by the operating leverage of the model, despite gross margin headwinds from the AI XPU business.

Lastly, the team’s focus will be on reinvesting in the business over the next 1-2 years on the large AI growth opportunities, rather than pursuing M&A, which could dilute attention and resources.

Overall, we see accelerating AI fundamentals combined with improving fundamentals in the non-AI semiconductor business and further VMware revenue unlock driving strong revenue and earnings growth. Broadcom is the #2 global AI semiconductor supplier and the #1 custom chip ASIC supplier, and we reiterate our Overweight (OW) rating on AVGO.”

Semis are on fire, which is a great environment for stock pickers to find new opportunities. In the second part of this post, we’ll detail a small, niche semi name which is now starting to see (potentially) huge demand from the AI end-market. We’ll do some detailed modeling on the size of this new revenue opportunity, along with giving the insights from industry insiders on the company and this new tech.