Semis - Nvidia, AMD, Marvell, BESI, KLA, Entegris, Arm, Intel, Navitas, Microchip & TI

A tour of developments in Semis

Now that Q1 reporting season is over and as we’re heading towards season 2 for the year, we’ll go through some of the wider developments in the semi industry. Let’s start off with Navitas, which truly has been a stellar performer with the share price nearly quadrupling over the last month.

Navitas’ Entry into the AI Data Center

This is Deutsche Bank discussing the win:

“NVTS announced a non-exclusive collaboration with NVDA on their next-generation 800V HVDC architecture, signifying a major win for NVTS and validating their commitment to GaN and SiC power solutions. This architecture, designed for high-power AI workloads, addresses the growing power demands of data centers by improving efficiency and reducing infrastructure complexity. NVDA's adoption of the co's GaNFast and GeneSiC technologies, spanning the power delivery chain from grid to GPU, reinforces the efficacy and reliability of NVTS' offerings. By enabling the reduction of copper wiring and eliminating multiple conversion steps, NVTS' technologies contribute to significant improvements in power density, efficiency, and cost-effectiveness.

We view the strategic collaboration between NVDA and NVTS as a much needed "win" for NVTS and consider it a significant validation of NVTS' technology and its potential for long-term growth. We believe this ultimately provides a strong endorsement of NVTS' GaN/SiC solutions, positioning the co as a key enabler for next-generation AI infrastructure. This partnership strengthens NVTS' credibility within the AI data center market, suggesting a significant opportunity for increased revenue and market share as the demand for power-efficient solutions grows with the increasing complexity and energy consumption of AI workloads. While the co is unable to specify the long-term financial impacts of the collaboration at this time, we don't expect to see the benefits to materialize until late CY26 and CY27 (in-line with the expected ramp of NVDA’s Ruben Ultra).”

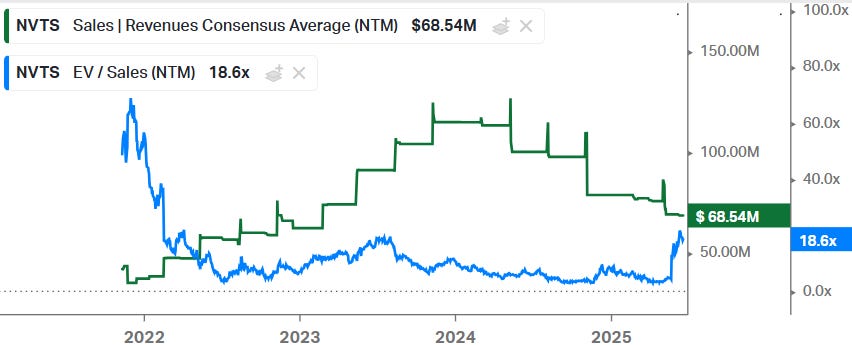

Navitas’ forward revenue estimates have come a long way down due to the downturn in mature semis. The company has an especially good position in the GaN power semiconductor market, which is closely linked to green technologies such as electric vehicles and solar.

As these end markets went into a downturn, Navitas’ growth outlook suffered as well:

Currently, a large part of the company’s revenues are coming from consumer electronics products such as smartphone fast chargers. However, in the coming 5 years and beyond, GaN adoption in semis will continue to rise, especially in industries where power efficiency is important such as the data center, electric vehicles and solar. Thus, Navitas’ should have an attractive long term growth outlook as the specialist in GaN, with the company having a leading market share. The main risk would be mature semi competitors who also play in the SIC space entering GaN and building up capacity, increasing the risk of periods of oversupply. What gives Navitas some protection during downturns is that the company is an asset-lite semi designer. Basically the company develops and designs their semi tech, and then TSMC and X-Fab take care of the manufacturing.

This is Rosenblatt adding further color:

“Given the exponential growth in data center power needs, there needs to be many changes to today's traditional approach to power management. We are convinced that the market is at an inflection point. Today's data center architectures (54V in-rack power distribution) cannot handle the amount of power needed for increasing AI computation (gigawatts of power). This has led to a redesign of data center architectures, such as the 800V HVDC architecture that NVIDIA is developing. This new architecture eliminates several AC-DC and DC-DC conversion steps. Through Navitas' product portfolio, the GaN and SiC technologies cover power delivery from beginning (the grid) to end (server/GPU). Some products in the portfolio include high-power GaNSafe power ICs, medium voltage GaN devices, GeneSiC technology, and IntelliWeave. In conjunction with this collaboration, Navitas announced its latest 12kW power supply unit (PSU) for high-power rack densities of 120kW.”

The question is what to do with the shares now. We definitely think that it makes sense to take some money out given the strong run the shares had while most of the revenues will only come in 2027. Thus, it’s likely that the shares will trade lower again in the interim at some stage. There is also a substantial risk that the company runs into balance sheet problems should we go into a macro downturn. The current cash burn is around $50 million per annum while the company has close to $70 million in net cash on its balance sheet. Thus, in a prolonged macro downturn, things could get ugly and the company would have to raise debt or equity.

The bull case would be that current sales should be closer towards a cyclical bottom—we’ll discuss the cycle in mature semis later—assuming the global macro environment stays healthy. Secondly, it’s likely that due to the high growth in the GaN market, Navitas will be going towards $300 million in revenues later this decade, which would imply the company having a market share of 10-15% in the wider GaN market. Put these revenues on a 7x sales multiple and you can get to a market cap of $2.1 billion later in the decade vs the current market cap of $1.34 billion. These revenue estimates are based on the company’s investor day and from estimates by industry research house Yole, and these were from before this Nvidia announcement. Lastly, the company is also a takeover target given their strong position in the high-growth GaN market.

Thus, given the steep valuation near term, we’re inclined to take profits here at this stage although it’s a name we could enter again at some stage. It’s definitely an interesting story to keep track off.

For premium subscribers, we’ll go through much more names in semis—including Nvidia, AMD, Marvell, BESI, KLA, Entegris, Arm, Intel, Microchip & Texas Instruments.