The AI Explosion & Semis

Token consumption in the cloud is doubling on an almost monthly basis. This is Sundar from Google:

“The growth in usage has been incredible. At IO in May, we announced that we processed 480 trillion monthly tokens across our surfaces. Since then, we have doubled that number, now processing over 980 trillion monthly tokens, a remarkable increase. The Gemini app now has more than 450 million monthly active users, and we continue to see strong growth in engagement with daily requests growing over 50% from Q1. And Veo 3, our new short video product reached nearly 1 million monthly active users.

Overall queries and commercial queries on Search continue to grow year-over-year. And our new AI experiences significantly contributed to this increase in usage. We are also seeing that our AI features cause users to search more as they learn that search can meet more of their needs. That's especially true for younger users. We know how popular AI Overviews are because they are now driving over 10% more queries globally and this growth continues to increase over time. AI Overviews are now powered by Gemini 2.5, delivering the fastest AI responses in the industry. We also saw strong growth in the use of multimodal search, particularly the combination of lens or Circle to Search together with AI overviews. This growth was most pronounced among younger users.”

Obviously, as queries move more to LLMs and AI agents, disruption in Search is a long term threat to Google. Although at the moment the company’s bread-and-butter search business is still growing well.

Google is obviously not an expensive name for attractive EPS growth, although the key risk is that its key earnings driver—the search business—gets disrupted over time:

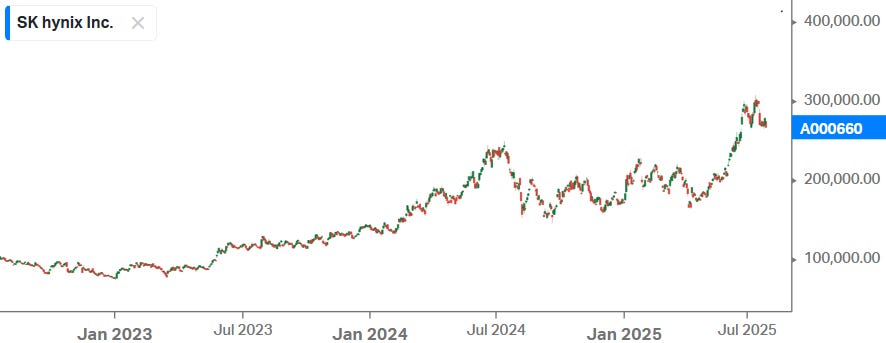

One of the key beneficiaries of the explosion in AI is SK Hynix, the South-Korean memory manufacturer who holds the strongest position in the HBM market, and the company described the current business environment well:

“The past quarter began with concerns about a slowdown in demand due to trade tensions and overall economic uncertainty. However, demand for AI memory continued to grow, driven by aggressive AI investments from big tech companies. This was further supported by customers' preemptive purchasing to prepare for external risks, resulting in a more favorable environment than initially expected. Both DRAM and NAND shipments exceeded our original guidance and pricing conditions also improved. As a result, second quarter revenue increased by 26% Q-o-Q and 35% Y-o-Y, reaching an all-time high of KRW 22.2 trillion.

Given demand is expected to grow from new product launches in the second half, we believe the likelihood of sharp demand corrections due to customers' inventory adjustments would be low. Looking at demand by application, we expect healthy demand growth in the server market, driven by increasing investments from big tech companies despite macro uncertainty. In the AI market, big tech companies have begun full-fledged competition by unveiling AI agents with enhanced reasoning models. These models perform iterative thought processes to solve problems autonomously, requiring systems capable of processing significantly more data than conventional AI models. This evolution is expected to further drive demand for high-performance, high-density memory. Additionally, ongoing investments by governments and corporations for sovereign AI are likely to become a new long-term driver of AI memory demand. In the PC and smartphone market, the proliferation of AI applications is expected to drive replacement demand this year. Memory content per device are also expected to grow with wider adoption of high-performance memory required to support the AI functions.

Our HBM3E products are receiving high marks from all customers for their performance and supply reliability, and we plan to maintain industry-leading competitiveness as we transitioned into HBM4. In March, we supplied industry's first samples of HBM4 to customers. We are currently working closely with partners to optimize system-level performance and are preparing to deliver products on time for our customers' needs. Construction of our Yong-in fab Phase 1 is on track for completion in Q2 2027. And through these facilities, we aim to secure the manufacturing infrastructure necessary to meet future demand. Our total investment for this year is expected to increase compared to the previous plan as we now have secured visibility on next year's demand figure based on discussions with customers. We assessed that some proactive investment this year is necessary to ensure timely support of our HBM products.”

Thus, the outlook for AI in the cloud market remains very strong due to the two scaling laws—the first being the expansion of model sizes and reasoning via reinforcement learning in the training phases, and the second being increasing levels of reasoning in the inference phase. With the low penetration rates of AI workloads in the general economy, we’re looking at a strong runway of growth in the coming years, resulting in the current explosive growth rates we’re seeing in the cloud today.

This is UBS on SK Hynix post the results:

“Today, SK Hynix's stock price declined 9%, amid debate on HBM 2026 contract negotiations. We reiterate our Buy rating and PT of Won350k for the following reasons: 1/ Our channel checks continue to indicate that SK Hynix will likely secure a largely stable market share in the HBM market in 2026 around 50% of total bits. 2/ This is on the back of continued lead at Nvidia, but also as we recently noted, strong share gains at ASIC vendors. 3/ We see upside in overall cloud AI demand, as evidenced by TSMC comments in today's 2Q25 conference call, the recent announcement regarding H20 exports to China resuming ( link ), and general pent-up demand from tier 2/3 customers more so into the GPU segment into 2026.”

Goldman downgraded the stock due to possible HBM pricing headwinds in ‘26:

“We downgrade SK Hynix (Hynix) to Neutral from Buy with an updated TP of W310,000 implying 5% upside. While we continue to be constructive on the long-term outlook for the HBM market powered by the rising need of the high bandwidth to improve the efficiency of AI workloads by both the GPU and ASIC customers, we believe HBM pricing could decline for the first time in 2026, with increasing competition and pricing power gradually shifting to the major customer where Hynix has an outsized exposure.”

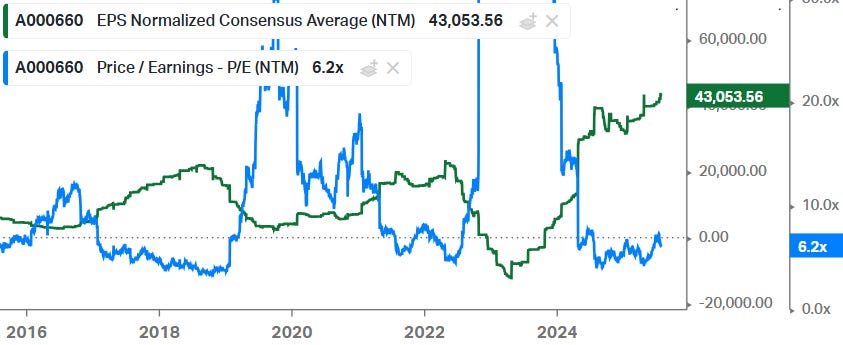

SK Hynix is currently trading on a peak-of-the-cycle multiple, and so if its earnings continue to move higher in the coming years—which looks likely—the shares will continue to do well:

Tesla is one of the most interesting names in edge AI applications due to its development of humanoid robotics and robotaxis. Tesla could well be the best hardware engineering firm (ex semis) in the world today, and so the company is well positioned to capture its share of these potentially vast new markets. While China is becoming impressive as well at hardware engineering with companies such as BYD and Xiaomi, we don’t think that the US government will allow Chinese humanoid robots to be inserted into US homes and factories. So the competitive field for Tesla will actually be limited. While humanoid robots will only start driving strong revenue growth in 4-5 years or so, the robotaxi market could be more imminent, with Tesla looking to cover 50% of the US population in the near future (they will focus on large cities). Elon is known for frequently setting over-ambitious goals, but he is also known for achieving incredible breakthroughs at all his companies—from SpaceX to Neuralink, Xai and Tesla. This is Elon on their robotaxi product:

“In a couple of weeks or so, we're getting the regulatory permission to launch in the Bay Area, Nevada, Arizona, Florida, and a number of other places. So as we get the approvals and we prove out safety, then we will be launching autonomous ride-hailing in most of the country. And I think we'll probably have autonomous ride-hailing in probably half the population of the U.S. by the end of the year. That's at least our goal, subject to regulatory approvals. I think we'll technically be able to do it. So assuming we get regulatory approvals, it's probably addressing half of the population in the U.S. by the end of the year. But we are being very cautious. We don't want to take any chances. And so we're going to go cautiously. But the service areas and the number of vehicles in operation will increase at a hyper-exponential rate.

The Cybercab, which is really optimized for autonomy, has got probably sub-$0.30 per mile potential over time, maybe $0.25. It's really -- like if you design a car from scratch to be a cost-optimized robotic taxi like Cybercab -- for example, we're not trying to make its cornering like incredibly well like a Model 3 would or Model S would, all of our cars that are driven by people are super fun to drive. They've got incredible acceleration, incredible cornering capability. But we're confident that very few people in a Cybercab want to be hurtling around. So we've produced the top-end speed, which means we can use more efficient tires. We don't need as much acceleration. We want stopping distance, but we're not expecting it to be heavily used. It's a gentle ride. Essentially, if you design it for a gentle ride and then you have a much more optimized design point. So that's why it seems probable we could achieve that. Especially, Optimus is serving, cleaning up the car and doing maintenance and stuff. And doing automatic charging. So I think the actual cost per mile of Cybercab will be very low. The cost per mile of our existing fleet will be higher, but still very competitive. So maybe something over $0.50, I'm just guessing, yes. So really, it tells us robotaxi will go from tiny to gigantic in terms of operations in a pretty short period of time. Like my guess is it has a material impact on our financials around the end of next year.

On the full self-driving front, we're continuing to make significant improvements just with the software. So we're expecting to increase the parameter count. Actually, at this point, we think we can probably 10x the parameter count. So this is actually a very tricky thing to do because, as you increase the parameter count, you get choked on memory bandwidth. So still a lot of improvement on the existing hardware to happen.”

Obviously if Cybercab can launch successfully and charge $0.4-0.5 per mile, we’re looking at an Uber killer. The customer will have the vehicle to him or herself while travelling immensely cheaply, so demand is likely to be huge under that scenario. The key milestone will be proof that the vehicles can drive around much safer than human drivers can. As soon as one of Tesla’s robotaxis will injure a human, or merely be involved in an accident, expect the media to initiate a large scale attack. This is an obvious risk factor to a successful rollout.

The other exciting product is Optimus, which Tesla is successfully training to do simple tasks such as robotaxi maintenance and factory tasks. This is Elon on the humanoid robot:

“We're getting Optimus to the point where it is a phenomenal design. So we're in Optimus version 2 right now, sort of 2.5. Optimus 3 is an exquisite design, in my opinion, and I predict it will be the biggest product ever. It's a very hard problem to solve. You have to design every part of it from physics-first principles. There's nothing that's off the shelf that actually works. So you got to design every motor, gearbox, power electronics, control electronics, sensors, the mechanical elements. We also got to train Optimus to use its limb sensors with a neural net. But we'll be applying the same techniques that we applied for our car, which is essentially a 4-wheel robot.

And Tesla, it is important to note that Tesla is by far the best in the world at real-world AI. Google is good at AI, but they're not good at real-world AI. And by far, Tesla has the best inference efficiency. And people talk about parameters, but the actual constraints in the hardware are how many gigabytes of RAM and how many gigabytes per second can you transfer from RAM. Therefore, it is not a parameter constraint. It is a byte constraint. And Tesla has the highest intelligence density of any AI by far. Intelligence density will be a very big deal in the future.

There will probably be prototypes of Optimus 3 end of this year and then scale production next year. We're going to try to scale Optimus production as fast as it's humanly possible to do, so we'll try to get to 1 million units a year as quickly as possible. We think we can get there in less than 5 years, it's my sort of guess. That's a reasonable aspiration and it seems like an achievable target.”

So, Tesla is a name we like, but you have to believe that they can capture a share of the robotaxi or humanoid robotics markets, otherwise the current valuation at $1 trillion doesn’t make any sense. For example, some modelling on the humanoid robotic market alone shows an attractive IRR, and it’s well possible that the company can sell hundreds of millions of these over time if these bots can be useful in factories and homes..

While 20 million in 2032 already looks unlikely, you can model in a much higher PE multiple if these things start to take off. The annual smartphone market is 1.34 billion units. If Tesla can sell 100 million units of Optimus over time per annum, the revenues would be around $3 trillion. Put that on 10x Sales and you get a $30 trillion market cap.

Turning to robotaxis, capturing 5% of the global number of miles driven in passenger vehicles results in a 37% IRR:

Again, a 5% penetration rate in 2030 is likely too optimistic, but you could model in a much higher PE multiple if robotaxis really take off as growth rates will be explosive.

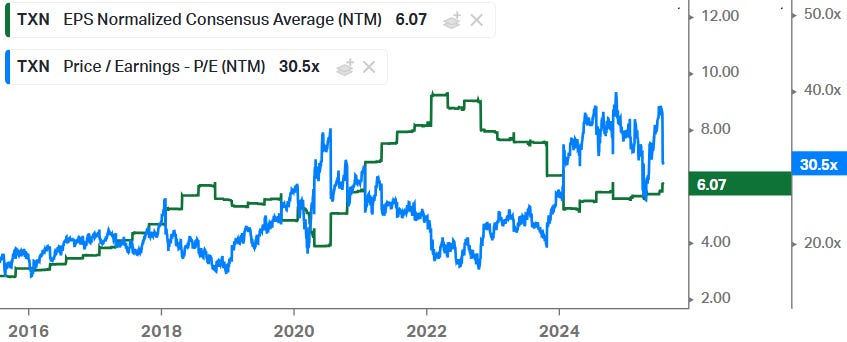

In the meanwhile, in mature semis, Texas Instruments delivered a disappointing guidance. This is Deutsche:

“TXN delivered a trademark beat for 2Q (revs +2% above mid-pt), but the surprise came in their guide being a “seasonal” +4% q/q, slightly below DBe on both revs and EPS. After guiding (and reporting) well above seasonal revenue growth in 2Q, TXN’s 3Q guide returning to “seasonal” appears to be a reflection of the 2Q strength being driven by tariff-related pull-ins (China especially strong q/q) more so than the desired emergence of the cyclical tailwinds.

Positives: 1) TXN delivered a typical beat off of an already above-seasonal guide in 2Q led by its Industrial business (DBe +14% q/q), with all other segments also growing q/q except for a somewhat surprising lsd% drop in from the co’s Auto segment. 2) The co remains confident that it has turned the cyclical corner and that the long-awaited upturn has begun, as all segments (ex-Auto) are showing sequential improvements. The co’s view is that the Auto upturn is just a matter of time. 3) TXN described in general terms the benefit it expects to see from the tax legislation recently passed in the United States, with the net take that its GAAP tax rate will be slightly higher in 3Q/4Q25 before falling in CY26 and beyond. More importantly, its cash tax rate should also be lower in CY26 and beyond.

Overall, we believe TXN’s shift to a more conservative outlook and the resulting slight reduction in our rev/EPS estimates is not the outcome implied in the co’s premium valuation multiple (~25% above 5yr avg). Consequently, we expect the valuation to somewhat normalize, maintaining our Hold rating and $190 P/T.”

We disagree with the above conclusion from Deutsche as TI is currently trading on bottom-of-the-cycle earnings, so naturally this results in a premium PE multiple:

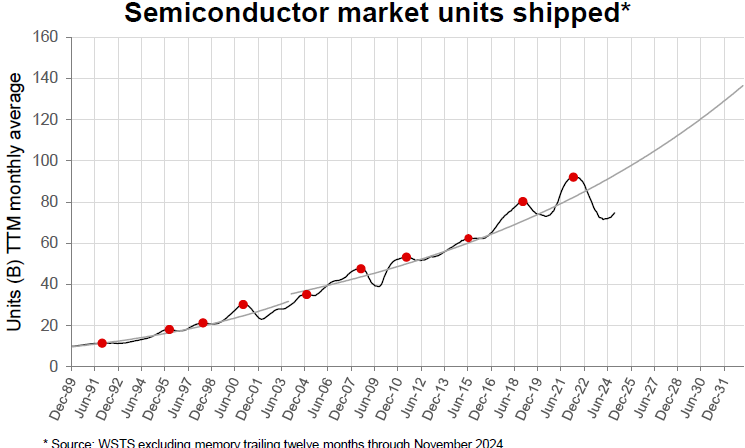

The downturn can easily be seen in semi shipments—we’re currently in one of the worst downturns in history post the covid semi boom:

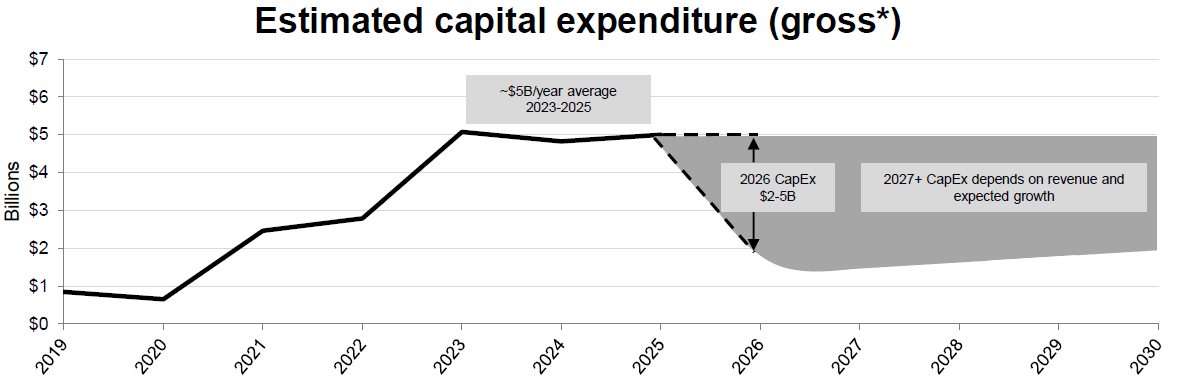

And TI can start generating an attractive 5.5% FCF yield in ‘28 on consensus numbers, as either capex levels normalize or revenue growth returns:

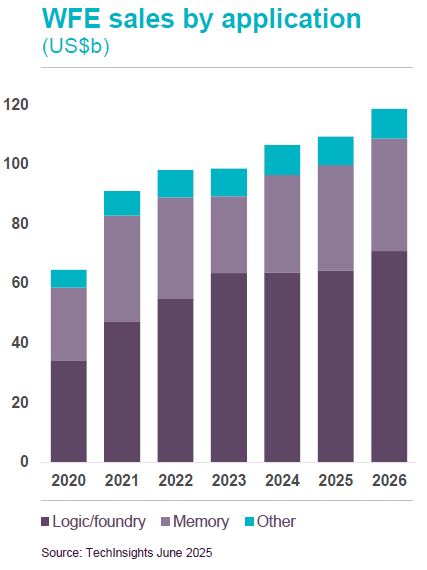

All of the above means that semicap should continue to be an attractive industry—AI is driving high growth in leading edge semis, while mature semi markets are still at the bottom of the cycle. Meanwhile, due to the rising complexity of leading edge semis, capital intensity and wafer ASPs will continue to increase.

Bears are out for ASML claiming the story is broken. For premium subscribers, we’ll dive into ASML and a number of other names we like in semicap.