Samsara held their capital markets day last week so I had another look at this name to see whether there is an interesting new opportunity.

Business overview

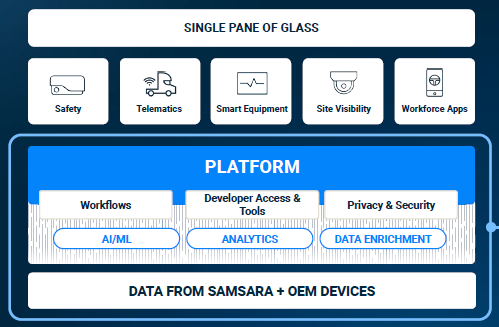

The main goal of Samsara’s cloud platform is to provide insights into how a company’s equipment is being utilized in the field. So think about transportation trucks and all sorts of other equipment used in the construction, manufacturing or energy sectors. Samsara’s sensors collect a wide variety of data and stream it into the cloud, so that a business can have a live overview of their operations.

Historically, physical operations has been a field which has been notoriously under-digitized. A lot of information gathering is still being done by pen and paper, which then later gets processed on an overloaded desk in some more central location with a considerable time lag. Contrast that with the services oriented industries which over the last 30 years have fully shifted to a software and cloud workflow. For every miniscule task which needs to be carried out, there’s probably some cloud app which can help you with that.

Staying a bit longer in the cloud world, perhaps the best analogy for Samsara is Datadog. This latter platform gives you an overview of how all your apps are performing in the cloud, and Samsara aims to provide the same for assets running in the physical world.

Below is an illustration of how to think about Samsara’s platform. Data gets collected from a wide variety of sensors, cameras, and apps, which subsequently gets processed in the cloud. The client can then access this information through a single pane of glass, meaning your desktop or smartphone screen. This client interface is divided into separate modules such as safety monitoring, telematics, smart equipment, site visibility, and workforce, which can be subscribed to separately.

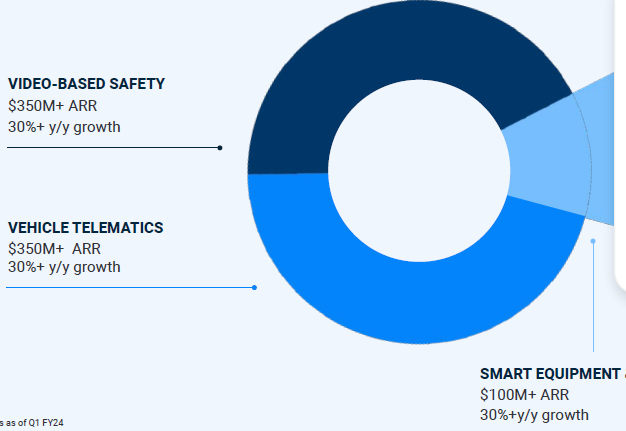

Samsara has become very diversified both in their customer base as well as in their industry exposures as seen on the donut below. ARR stand for annual recurring revenues:

Let’s go through the products in a bit more detail.

The video-based safety module is both to help the drivers of a company’s fleet as well to keep an eye on them. Both a personal assistant as well as a big brother if you like. The cameras monitor the situation on the road to alert the drivers for potentially dangerous situations. Thanks to AI and all the captured video streams, Samsara’s system is continuously getting better at this. Should an accident occur, the recorded stream could also exonerate the driver, saving costly litigation expenses. At the same time the system can keep an eye on the driver to make sure he’s not busy gaming on his phone or hasn’t fallen asleep at the wheel.

Some views of what this looks like on Samsara’s platform:

Telematics is about monitoring the location of your fleet’s vehicles on the road, as well as other metrics such as the driver’s ability to drive in a safe manner, fuel efficiency, engine health and other diagnostics.

The following image shows how Samsara can be used to track equipment in the field or trucks on the road geographically. You can zoom in to monitor exactly where each one is on a continuous basis. This might be useful for example if a particular unit has to be assigned to an urgent job. Or if a piece of equipment is running in the middle of nowhere like at a quarry site and a technician needs to find its exact location.

The equipment monitoring module is very similar to vehicle telematics in functionality but is applied to equipment running in the field. So you can track the exact location of all your equipment but also monitor other diagnostic metrics. Examples of equipment which customers use Samsara for are: generators, compressors, heavy construction equipment and trailers. ,

Below is an example of a customer’s dashboard for the monitoring of its fleet of generators. More metrics can be added here as needed.

This data also facilitates maintenance. Rather than having a piece of equipment being sent in for inspection every twelve months or so, this can now be data driven i.e. when a sensor highlights a recurring problem in a particular component.

Site visibility is similar to the video based safety module for vehicles but then applied to a business’ remote sites. So basically you can monitor with cameras if all operations are running as expected. Samsara is running AI models on this video stream to automatically alert you if there is an incident.

The most recent module Samsara added to their platform is workflow. A lot of equipment checks carried out by personnel are still done by pen and paper. The idea here is to automate this whole process and have the necessary data automatically uploaded to the cloud.

Samsara has been successful at cross-selling these modules to their customers. Whereas two years ago, 42% of large customers had more than 3 products, this number has now risen to 55%. The company seems to be in continuous dialogue with clients to discuss which processes can be automated.

One of Samsara’s main selling points is that their system saves on costs. As a customer’s drivers know their vehicle is being monitored for example, it incentivizes them to drive at constant speeds and in a safe manner, reducing gasoline (or electricity) costs and the probability of a collision. DHL for example disclosed that their accident related costs went down with 49% after introducing Samsara.

On top of that Samsara’s cloud platform also assigns a safety score to each driver, which can be translated into a rewards package for the personnel. Insurers have started giving discounts as well based on this data. A fleet operator on the US East Coast for example saw a reduction in insurance costs of 36%.

In their prospectus Samsara gave a few more examples of customers saving costs with their system:

• A large city government reduced fleet downtime by 28% by using diagnostic fault code alerts (these signal potential vehicle problems).

• A waste transportation company achieved a 58% drop in speeding incidents.

This was confirmed by the Morgan Stanley analyst, some comments he made at a recent tech conference:

“One of the things that we hear on our side of the fence, when we're talking to partners and we're talking to people in the field is the return on investment of the Samsara solution is really resonating in this environment. People are dealing with rising fuel costs, insurance premiums that are skyrocketing, Samsara could really well address those.”

Univar, a global chemicals distributor with a fleet of over 5,000 vehicles presented at Samsara’s capital markets day, they gave the following interesting anecdote:

“Before Samsara, we had 100 terminals across the nation and we were working off different data sets, different platforms. Now we've been able to take all the different data connection points and put it together through Samsara.”

This basically highlight how well Samsara is able to connect to other data platforms.

Reading through various reviews of Samsara’s platform online, which are largely positive, the overall system seems easy to install and get up and running with. One reviewer mentioned for example that Samsara has much quicker location refresh times for their vehicles, around 15 seconds versus one minute for competitors.

Industry overview

This is a large market, Samsara estimates their addressable market to be around $117 billion in 2025 based on consultants’ data with a CAGR of 22%, mainly driven by low penetration rates.

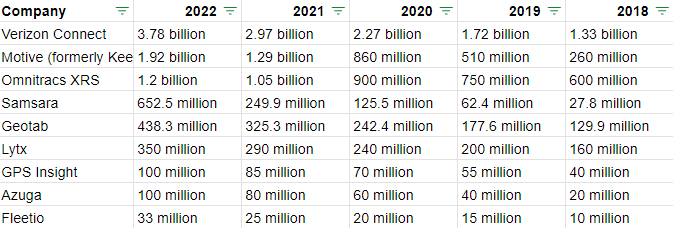

Looking at the competitive landscape, Bard made the following list of players with revenues over time. Verizon Connect, Motive and Omnitracs are larger competitors which have been growing rapidly as well. Trimble is another company I’ve come across with a similar offering but Bard doesn’t seem to have included them. What’s impressive is that Samsara has basically grown from scratch over the last six years to $880 million of revenues this year.

Samsara’s CFO mentioned that the company regularly does free trials with potential customers, as this easily showcases how the system can add value and result in costs savings. This probably has been a smart strategy to grow share as it has lead to high conversions of new customers.

At the capital markets day, Samsara disclosed that they’ve won 5 of the top 10 waste management firms in the US as customers, 6 of the top 10 construction firms, 5 of the top 10 chemical carriers, 5 of the top 10 transportation firms, and 4 of the top 10 grocers. This is an indication they have a solid position.

Clearly Samsara has been executing well and seems to have a good product, however, at the moment I would categorize this industry as competitive which increases risks, unless I learn more in the future that Samsara has a particular competitive advantage.

Do me a favor and hit the subscribe button. Subscriptions let me know you are interested in research like this, which is a good motivation to publish more. Special thanks to the 600 subscribers so far!

Overseas growth opportunity

At the recent Morgan Stanley conference, Samsara’s CFO detailed how they think about their geographical growth strategy:

“We are still so underpenetrated within our core US market that we're very focused on continuing to drive success and execution here. But we are invested in these other international markets as well. We're seeing a lot of success in Canada, a lot of success in Mexico. And then we're in the Western European countries: UK, DACH (the German speaking countries), France and the Benelux region. But while those are just under 15% of our net new annual contract values today, I do expect them to become a medium- and long-term growth driver as well.

We're excited about the Western European market because of its scale. It is a bit larger than North America in terms of number of commercial vehicles. Now what's different is there are regional differences in terms of regulation. So the French rules are a little bit different than the UK rules and those of the DACH region, so we need to make sure that we are appropriately customized on those kind of localization topics.

Our strategy has been to actually break Europe up into multiple regions. UK and Ireland being the kind of beachhead that we've landed with, we've been in that region for a few years and we're seeing great progress. Now, we’re starting to expand onto the continent.”

Financials (current share price is $25.4, ticker IOT on the NYSE)

The attraction with software businesses is that they generate a recurring stream of subscription revenues. In Samsara’s case, a client will typically sign a 3 to 5 year contract, with annual revenues being paid upfront each year. This results in a continuous stream of cash. Samsara’s pricing is also determined on per asset basis, so as a customer adds equipment to their fleet, this results in more revenues for Samsara.

Video based safety is currently Samsara’s largest product category, with vehicle telematics being a close second. Smart equipment and the other modules are still smaller product categories.

A new customer will always be loss making initially, due to marketing, selling and training costs, as well the initial costs of installing the equipment. However, in subsequent years a typical customer will become very profitable. The CFO commented:

“We spend money upfront to land new customers. And then over time, as customers pay their subscription fee and renew with us, they become very profitable such that our customer lifetime value to customer acquisition cost ratio has been more than 8x, which means that for every $1 that we spend to land a new customer, we drive more than $8 of profit over that customer's lifetime which leads to a lot of long-term profitability.”

How to think about financial performance of the business going forward? The CFO made the following comments:

“When we were here a year ago at the investor day and we had just reported our Q1 results, we burned $51 million. In Q1 of this year, we burned $2 million. We are committed to getting to free cash flow break-even in Q4 of this year.”

The company made a large series of beats over the last year but the CFO mentioned that the guidance back then was probably overly conservative, which they’ve somewhat corrected for this year. I’m reading the below that he still thinks beats are probable to likely, although of a lesser magnitude:

“If you recall, we started FY '23 with 30% to 32% revenue growth, and we ended the year at 52% revenue growth, which allowed us to beat by 8%, 7%, 9% and 9% from Q1 through Q4. If we hit our base plan, there could be upside from the 28% to 30% that we're initially guiding, which is the de-risked number, but I would not expect the same level of beats if we don't see those downside scenarios come to fruition that we saw in FY '23. So that's what I was trying to get across. I wanted investors to be aware that our guidance philosophy has changed from where it was as ourfirst year as a public company.”

On dilution, the company is guiding to bring this down over time:

“Our dilution last year was 4.4%, this year, we're forecasting between 3% to 4%, and that's an improvement from the previous guidance that we provided of 3% to 5%. Longer term, we think we can get equity dilution to be less than 2%.”

Wall Street is looking for around 30% top line growth per annum over the coming years resulting in an 8.8x EV to Sales ratio in 2026. Clearly the shares have gotten somewhat expensive here and it is hard in my opinion to model any substantial upside. The business is expected to turn FCF positive as from next year in line with the CFO’s comments. The company has around $620 million of net cash on the balance sheet. So if the business manages to turn FCF positive over the coming twelve months, there should be room to start returning cash to shareholders over the coming years. Gross margins over the last quarter were a healthy 72%, given that the business also includes lower margin hardware (sensors and cameras). As the business continues to shift to increasing software sales, this margin should move up as well over time.

The shares have substantially re-rated over the last 8 months. Should there again be a sell-off in the market later in the year due to macro weakness and the multiple would fall again to around 6 to 8x levels, this would probably be a good buying opportunity.

Overall, this looks like a good company with probably a long runway for growth, especially if they can add some more interesting products over time. A stock to keep an eye on in my opinion.

If you enjoy research like this, hit the like button and subscribe. Also, share a link to the research on social media with a positive comment, it will help the publication to grow.

If you like reading more, I’m regularly discussing tech and finance on my Twitter, and you can find all my past research here.

Disclaimer - This article is not advice to buy or sell the mentioned securities, it is purely for informational purposes. While I’ve aimed to use accurate and reliable information in writing this, it cannot be guaranteed that all information used is of such nature. The views expressed in this article may change over time without giving notice. The mentioned securities’ future performances remain uncertain, with both upside as well as downside scenarios possible. Before making any investment, it is recommended to speak to a financial adviser who can take into account your personal risk profile.