Power Semis in the AI Data Center

We’re interested in the power semi space for a number of reasons. First, these types of semiconductors will start playing an increasing role in both the AI data center and their connected power sources. Second, these are not expensive stocks, as these companies are still crawling out of the semi downturn post the covid electronics boom. Thirdly, these companies are exposed to a variety of attractive end-markets, ranging from robotics to EVs, drones and green energy. Robotics and increasing levels of automation in the wider economy can provide a big tailwind over the coming ten years, making mature semis in general interesting plays on the long term growth in edge AI.

William Blair notes that ON Semi can make $100k per MW of AI compute:

“Power is the key bottleneck to AI infrastructure, making power density and efficiency critical. Onsemi now estimates its power semi content per next-gen 1 MW AI rack has doubled from $50,000 to $100,000, supported by its broad SiC and GaN portfolio. The company generated $250 million from these applications in 2025 with high- teens sequential growth, with much larger upside expected as higher power architectures scale toward 2030.”

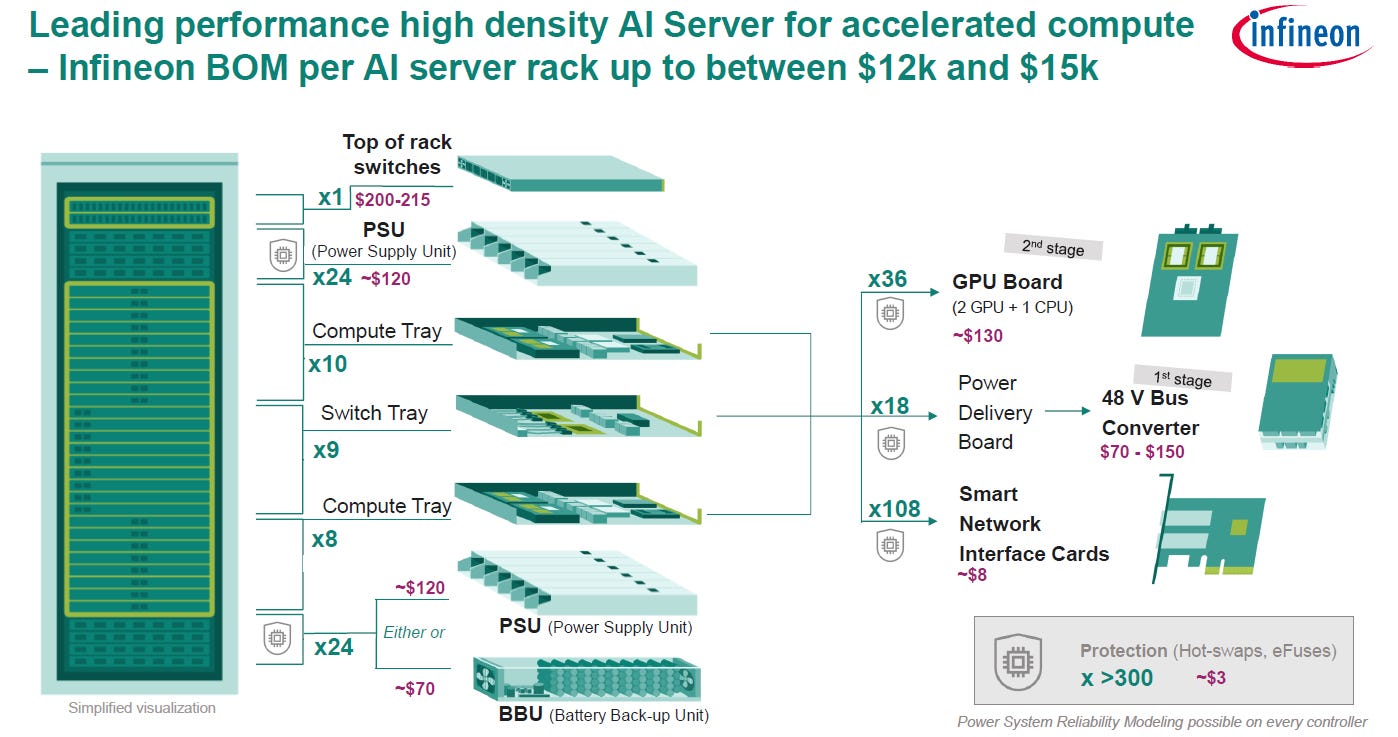

Infineon is another key player in power semis and guides for $12k–$15k of content for a current 130kW AI rack. Taking the midpoint, $13.5k of power semi content per 130kW rack means $104 per kW, or $104,000 per MW.

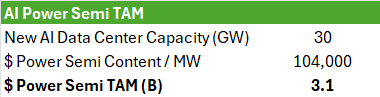

If 30GW of AI compute will be added per annum, this means a power semi TAM of around $3.1 billion from AI compute alone:

Based on Infineon’s recent comments on the conference call, it looks like the German leader in power semis will grab a large share of this market:

“Our unmatched portfolio breadth, system understanding, speed of innovation, quality and delivery capability make us the partner of choice for all relevant GPU makers and cloud providers. Our revenues from AI power solutions keep growing steeply. We re-confirm our target of around EUR 1.5 billion for this fiscal year. This number is still supply limited, capped by how fast we and our manufacturing partners can bring up capacity. And let me be clear, in contrast to some peers, which in their disclosure do not differentiate between AI and other enterprise data center business, the EUR 1.5 billion of Infineon are purely related to AI. Separately, we do another EUR 500 million, give or take, of classical data center revenues.

Meanwhile, projections of build-out of AI data centers and related infrastructure keep going up. More and more, AI is showing tangible benefits in real-life use cases. Several of these we witnessed in our own company, for example, improving speeding up chip design, software development or customer engagement. The demand from our customers for the coming years is still going up quarter by quarter. Therefore, we are doubling down on AI. We have decided to pull in EUR 500 million this fiscal year to accelerate AI-related capacity increases in order to fuel growth beyond the running fiscal year.

These investments, including the conversion of existing IGBT capacities are capital efficient and will underpin our market leadership. Large part of them will be used for a faster than originally planned ramp-up of our new power and analog/mixed-signal module fab in Dresden. Fortunately, we are able to accelerate the opening of the facility to the summer. With the additional capacity, we project to achieve AI-related revenues of around EUR 2.5 billion in our 2027 fiscal year. Said differently, we will add another EUR 1 billion of margin accretive business next year, thus expanding our AI revenues by a factor of 10 within just 3 years.

We are not only engaged with 1 or 2, but with all hyperscalers and relevant GPU makers across the globe. And for us, of course, the second stage part is giving us particular growth momentum as vertical power delivery modules have a much higher value. It’s the biggest opportunity I’ve seen for the company in the last 30 years, but also technically very challenging with very demanding customers.

From a utilization point of view, you can assume that the 300-millimeter factories will soon be fully loaded as we are converting IGBT to AI MOSFETs. Then, we still have some idle capacity in non AI-related technologies, but also here, we expect a certain spillover or halo effect from this AI boom, meaning that MOSFETs going into telecommunication or automotive will also see demand.”

Based on what the various competitors are saying on their conference calls, we believe that Infineon currently has a fairly dominant share in this market.

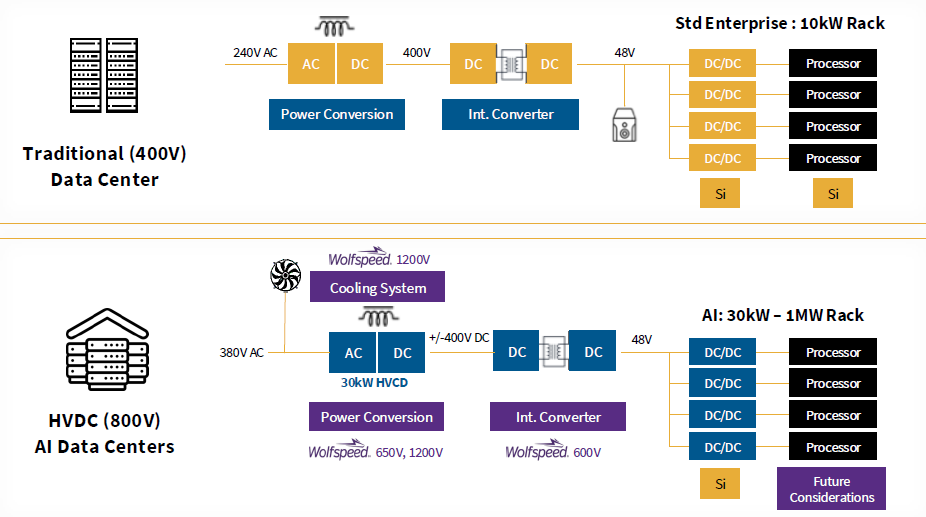

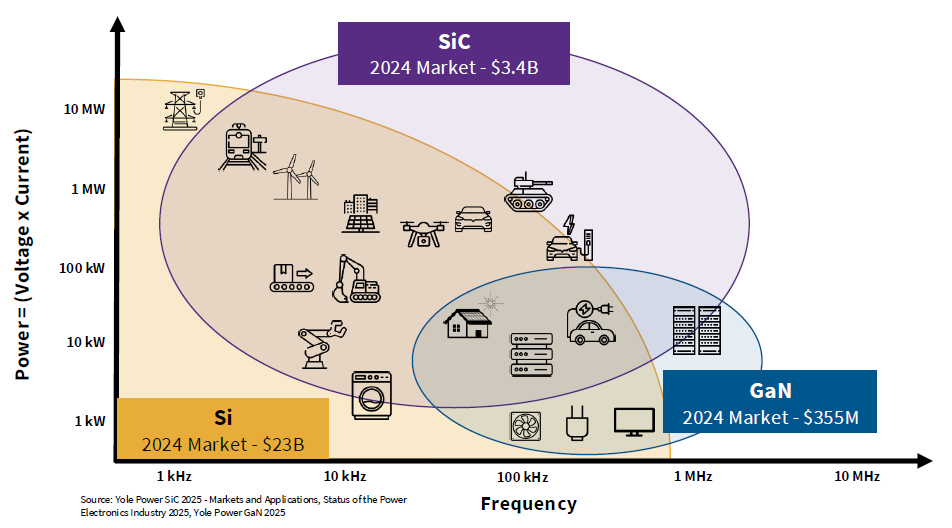

Wolfspeed illustrates that power semis are also used in cooling, as well as to convert power from the grid so that a single GPU can work at a lower voltage level. This will mainly be done by SiC (silicon carbide) whereas GaN (gallium nitride) is more heavily used at the rack level.

The reason is that SiC is better at handling high power, whereas GaN is better at high frequencies. Yole estimates the SiC market to grow at a 21% CAGR from 2026 to 2030, but GaN should grow faster as it will take the larger market share in the AI data center.

Let’s go through some of the players in this market. If dominant player Infineon can’t keep up with demand, it’s likely that the other players will see a demand boost as well.

Wolfspeed, the SiC Specialist

Wolfspeed is a pioneer in SiC and has historically held a strong market share in this market. Infineon actually tried to acquire Wolfspeed in 2016, which is how we first gained knowledge of Wolfspeed’s strong SiC capabilities. However, this acquisition got blocked by the US government on national security grounds, as Wolfspeed makes SiC modules for the US military.

Wolfspeed has now completed a state of the art SiC fab in New York State for $6 billion, however, as the EV market went into a downturn over the previous years, the company blew up due to excessive leverage. Basically, Wolfspeed loaded up on debt to build this fab but when SiC demand came in lower than expected, shareholders got wiped out.

This debt load has been restructured now—basically, the old debt holders have now become the new equity holders, and trading resumed a few months ago on the New York Stock Exchange. The good news is that the financial situation is now looking much better—the fab is ready, allowing the company to limit capex in the coming years, while the balance sheet has now $1.3 billion in cash and with a reduced debt load of $2 billion, giving an overall net debt figure of $700 million.

The bad news is that fab utilization is still low, which resulted in negative gross margins last quarter, and so the company will need to see either strong growth coming from EVs and industrials, or alternatively, start winning deals in the AI data center space. The cash burn was $74 million last quarter, so the $1.3 billion in cash gives shareholders more than 4 years of runway at the current state. However, new management is heavily focused on cutting costs while at the same time getting those new SiC wins. The company had a design win with Toyota last quarter for example for their battery electric vehicles (onboard charger SiC chip). At the same time, also Wolfspeed’s AI data center revenues are growing tremendously, although this will be from a very low base.

This is new CEO Robert Feurle, who is semiconductor veteran with previous VP roles at Infineon and Micron:

“We have continued to build solid momentum across the business this quarter from achieving 50% quarter-over-quarter growth in AI data center revenue to producing a 300-millimeter silicon carbide wafer and securing key customer wins. We’re concentrating in a few key areas: strict financial discipline, advancing our technology leadership, and driving operational excellence. A central theme across these priorities is diversifying our revenue base, particularly in industrial and energy, including applications tied to AI-related power demand and grid modernization.

We remain focused on driving costs out of our footprint as we navigate underutilization headwinds. We have officially completed the shutdown of all 150-millimeter device production in our Durham campus, roughly a month ahead of schedule, transitioning our entire device platform to higher efficiency 200-millimeter manufacturing. We continue to improve production efficiency and speed to optimize the earnings potential of the business. The results of these efforts will be even more apparent when demand accelerates and we begin to increase fab utilization.

We have organized our go-to-market strategy around 4 verticals that we believe will drive growth in our business in the near to midterm—automotive, industrial and energy, aerospace and defense, and materials, and we are already seeing strong traction from these early efforts. Our first vertical, automotive, remains a core market despite muted EV demand due to a mix of macro and structural factors, which include higher interest rates in the U.S. and Europe, the elimination of certain government incentives in the U.S., excess supply across the market and intensifying competition globally, including China. Despite weaker near-term demand, our portfolio is aligned with OEMs that provide us efficiency, range and power density. A great example of this is our recently announced partnership with Toyota, one of the most respected and quality-driven automakers in the world, to power the onboard charging systems for their BEVs.

In industrial & energy, we are leveraging our expertise to expand our reach, concentrating on AI data center power, grid storage, solid-state transformers and broader grid modernization applications. We have the expertise to extend into the AI data center, which operates at significantly higher voltages than legacy data centers. As voltages increase, we believe an increasingly larger portion of this addressable market will be better served with silicon carbide technology from grid to rack, compared to legacy silicon-based solutions. Our devices are already embedded in critical AI data center power systems, and we have doubled our data center revenue in the last 3 quarters with 50% quarter-over-quarter growth from Q1 to Q2. Further, we are actively collaborating with a broad ecosystem of partners to support the industry transition from legacy 400-volt architectures to next-generation 800-volt AI platforms.

Data center build-outs and widespread electrification have driven a surge in global energy demand. We’re already seeing silicon carbide adoption across wind and solar applications as evidenced by our recently announced collaboration with Hopewind to advance the next generation of wind power solutions.

Turning to aerospace and defense. We believe there is a growing opportunity due to the tailwinds from defense modernization and electrification, including direct energy platforms. U.S. government has already recognized silicon carbide as strategically significant to national security with both the Department of War and the Department of Energy designating it as a critical material. Additionally, the U.S. government has emphasized the strategic importance of secure domestic semiconductor supply chains for national security applications.”

During the Q&A, Feurle gave more details on what they are working on in the AI data center:

“Today, you’re around 100 kilowatt per rack. That’s moving in 2 years to like 600 kilowatt per rack and into like a megawatt rack in the 2029-2030 time frame. This means you have to figure out how do you power these racks and this is where Wolfspeed can play, stepping that voltage down. And then, as more and more renewables come into the mix, you also need a lot of energy storage systems in between. So, that’s the next portion where we are focused on. Then, you need to get this energy into the data center with transformers, right? And there is a transition happening from traditional transformers to solid-state transformers where silicon carbide is the perfect solution.”

Wolfspeed is currently making around $475 million in annual revenue from power semis and $200 million from SiC wafers. From previous management, we know that the SiC power semi fab has a revenue capacity of around $2 billion, which could result into $1.2 billion of annual FCF. We’re not sure yet whether new management will confirm these numbers, but they provide some guidance on what a bull scenario could look like.

The current market cap is $722 million, and with the net debt of $700 million, this results in an enterprise value of $1.4 billion. So, currently, the shares are valued at an EV-to-Sales of around 2x.

Let’s work out a realistic scenario to see if there is substantial upside. If a cyclical recovery in EVs and industrial end markets doubles revenues, and then the company wins another $500 million in AI data center sockets, it’s well possible that over time we can add another $1 billion in revenues. Assuming a 50% contribution margin, this should result in $500 million of additional FCF. With further cost optimizations, this could well result into $200-300 million of overall positive FCF for the company on an annual basis. Valuing this at 15x FCF would give a market cap of around $3.8 billion.

So, Wolfspeed could be interesting here. There should be a coming boom in power semis driven by AI demand and we’re also at the start of a cyclical recovery in industrial end-markets, going through conference calls from TI, ADI and Microchip. And then if Warsh comes in to cut rates, this should boost automotive demand such as EVs.

We also think that Wolfspeed should see more design wins due to its US-based fab capacity as hyperscalers and GPU makers increasingly secure their supply chains, such as by shifting more advanced logic manufacturing to TSMC Arizona. At the same time, Wolfspeed’s current cash position and cash burn give new management ample runway to turn things around.

The main risk would be a macro downturn in the coming years. Should there be a credit, geopolitical, or other event impacting the global macro, the risk would be that Wolfspeed’s cash burn deteriorates further which will no doubt send the shares quite far south. However, due to the strength of the current AI investment cycle and the demand this is creating for power semis, we do think the risk-reward is towards the upside here for Wolfspeed. Needless to say, this remains a speculative story as the company will need a substantial amount of design wins related to AI data centers to turn things around.

Next, we will dive into opportunities in power semis and the overall semis industry, including a few likely layups for investors. Finally, we’ll discuss our findings on AMD.