Picks & Shovels for the Biotech Industry, and One Under-the-Radar Opportunity

A brief tour of the space & A deep dive on a niche leader

Introduction, Picks & Shovels for the Biotech Industry

Looking at the supply chain for the biotech industry, there a lot of similarities with semiconductors. At the center of the semi supply chain are really the foundries, where chip design houses send their blueprints to have their silicon manufactured. In biotech, the fabs are called the CDMOs, or Contract Development and Manufacturing Organizations. Large pharma companies source their biological drugs from the best quality CDMOs, making it hard for new entrants to take share. Just like in semis, there can be mix between in-house and outsourced manufacturing. For in-house manufacturing, the pharma company can produce 30% or so of its needed volumes in-house, mainly for risk diversification and to get some leverage in negotiations. For outsourced manufacturing, Lonza is typically regarded as the highest quality player with the best product and reputation. A sort of mini-TSMC of the biotech industry.

Manufacturing plants have to be filled with manufacturing equipment. In the case of semis, we have blue chip names such as ASML, Applied Materials and Tokyo Electron supplying the most advanced equipment to the foundries. Similarly for bioprocessing, this is a fairly consolidated industry with Danaher, Thermo Fisher, Sartorius, Merck (the European one) and Repligen being the highest quality providers. The difference with the semiconductor equipment providers is that bioprocessing suppliers have a much larger exposure to recurring revenues. This is because they sell a lot of continuously needed consumables for the manufacturing process. For example, Danaher estimates that more than 80% of their bioprocessing business comes from recurring revenues. For semicap on the other hand this is typically only around 20 to 25% of revenues, increasing the cyclicality of the business.

A procurement manager at one of the largest pharma companies in the world gives further background on the bioprocessing space, this is an expert available via Tegus:

“The biologics market has been developing tremendously over the past 10 to 15 years. Traditional medicines, i.e. small molecules, are simple to manufacture. You manufacture them at a low cost and at high volumes. Biologic products are the total opposite. They are extremely complex to manufacture and they need to go through 25 to 35 different processing steps. In small molecules, we can make them within five to 10 steps. So biologic products are low volume, highly complex and have high value. For small molecules, we produce tons of product yearly whereas for biologic products, we only produce kilograms. But every kilogram is worth at least 30x of what a small molecule is worth. And these volumes will continue to increase due to the increase in demand.

We have a well established supply base for bioprocessing equipment. Even though those vendors are able to provide more or less the same level of quality, compliance and capacity; we do see some differences between them. For instance, we know that Sartorius can offer us a fully integrated solution for bioprocessing lines, and that their equipment is just state of the art. If I compare head-to-head a bioreactor of Sartorius with one from any of the other competitors, the Sartorius bioreactor will have a lifetime of at least 25 years with the proper maintenance and repair. Whereas their competitors' equipment would only have a lifetime of probably 15 to 18 years with the same level of service and maintenance.

For bioreactors and fermenters, the most costly bioprocessing equipment and components, Sartorius would have with us somewhere between 35% and 45% of our total need. For other equipment, such as lab and chromatography, Thermo Fisher and Danaher have somewhere between 50% and 55% of our wallet share. For fluid management equipment, filters, centrifuges and all those kinds of things, Sartorius would have between 40% and 50% of our wallet, with the balance being provided by other suppliers.

Ideally, we would like to have only two vendors. One for bioprocessing equipment and the other for lab components. If that's the case, then you are able to standardize your equipment across the globe. So every single bioprocessing line would look exactly the same. But obviously the pharma industry is far away from ideal. So that share of wallet I mentioned is not steady, it changes based on projects and opportunities. Sartorius can have the highest product quality in bioreactors, but if that equipment is extremely expensive compared to Thermo Fisher's or Danaher's, then we will question that.

Prices are usually fixed for one year and then based on raw materials and PPI indexation, suppliers are able to request a price adjustment on a yearly basis. During the pandemic, there was a very special case in which those players were getting a lot of price increases. Before the pandemic, let's assume that prices for bioreactors, lab equipment et cetera were at 100. By the beginning of 2022, prices for that same equipment would have gone up from 100 all the way to potentially 120. And right now, prices have significantly gone down again from 120 to 108 approximately. So prices have been decreasing, but they have not achieved that 100 level of before the pandemic.

What is the prediction for the next three to five years? Well based on our market intelligence, prices for the same reactors and lab equipment are forecasted to continue to increase from 108 over the next three to five years. We are seeing that already. We know that all these guys are going to come back to us in January 2025 and that they are going to request a price increase of at least 2% or 3%.”

In bioprocessing, cells are grown in upstream bioreactors where these cells can produce the needed biological molecules such as proteins, mRNA, viral vectors et cetera. The simplest method to understand is fermentation. Here you grow genetically modified bacteria or other cells in a bioreactor, feed them sugar and other nutrients, and then they produce the biological molecules you've designed them for. Subsequently, you purify and filter these molecules out of the soup and voila, you have the active pharmaceutical ingredient (API).

Obviously purity is very important here and Danaher is especially strong in downstream chromatography, i.e. the separation of mixtures. On the other hand, culturing the cells as we described above is called upstream bioprocessing. Sartorius was the pioneer here in single-use bioreactors, which make use of disposable bags, so that you don’t have to clean out anymore a steel bioreactor with high precision. This is obviously difficult and costly, as it has to be perfectly clean to prevent contamination in the next batch. So Sartorius is seen as the strongest player in upstream technologies.

That said, each of the major competitors — i.e. Danaher, Sartorius, Thermo Fisher and Merck — provides a wide portfolio of equipment and can typically fulfill most of a CDMO’s needs. Repligen on the other hand is more of a niche player focusing on specialty technologies. Danaher illustrates how after the acquisition of Cytiva, they can provide the key upstream and downstream equipment for a bioprocessing line:

Just like large parts of the semi market, the bioprocessing market has been going through a strong cyclical correction post the covid electronics and life sciences booms. In the case of bioprocessing equipment and consumables, the drivers were really the same as in semis. During covid, customers became anxious if they would be able to get supplies, causing them to over-purchase and start hoarding excessive inventories.

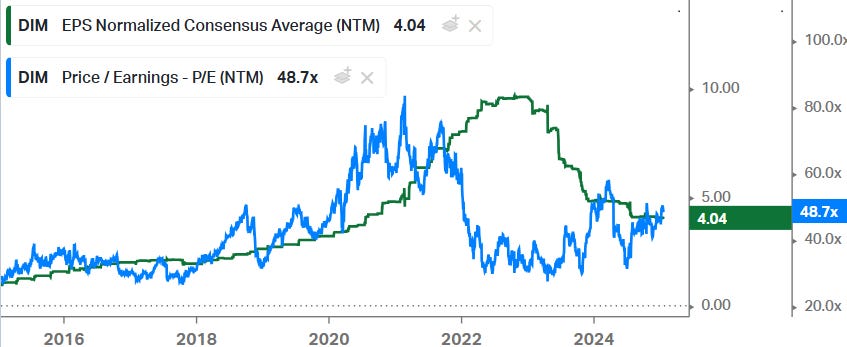

Once the cycle turned and end demand started declining, customers began sourcing components from their inventories as opposed to placing new orders with the manufacturers. This brought in the strong cyclical downturn for the providers of bioprocessing equipment and consumables. This can easily be seen in the EPS cycle of Sartorius as shown in the green line:

And also for Danaher, although this is a more diversified life sciences player with also large diagnostics and lab equipment businesses, making it suffer less in the cyclical downturn:

These types of down cycles usually continue until customers have worked down their inventories sufficiently and have to start placing more orders again with the manufacturers. And once end demand picks up, usually inventory levels have to be increased again, creating a new strong bull cycle.

Looking at the case of Sartorius, it looks like we’re now close to entering this new bull cycle. Firstly, a key customer just told us that pricing will be moving up for the first time in three years. Secondly, if we look at the EPS trendline in the chart above, it looks like we’re now substantially below the normal trendline if we strip out the covid boom. Finally, also the company’s order intake has been on an upwards trend again, eyeing the last six quarters on the gray line below:

Similarly, also Repligen is seeing a return to growth. This is the company’s CEO at the recent JP Morgan conference:

“For those of us who have been in the business for a long time, we remember the good old times where a bad year was 8% growth and a great year was 12% growth. I don't see reasons why this shouldn't go back to the same pattern. What has been the real game changer for us in quarter 3, was to see the CDMO business being back. The health of CDMOs is showing you the overall health of the ecosystem. And we had our orders and sales going up more than 20% in quarter 3 with CDMOs. This is exactly the last piece we were missing to feel very comfortable that the turnaround is here.”

So Sartorius is a name we like here. We should be close to the bottom of the cycle, the company has a great market positioning and growth outlook, and the business model is attractive with around 75% of revenues being recurring with the sale of consumables. The current valuation is already capturing a certain amount of the recovery, although investors can still make an attractive IRR in this name. For example, putting 2028 consensus EPS of EUR 8.2 on a 35x forward PE gives an IRR of 14%, factoring in some share buybacks.

This looks like a reasonable multiple given that Sartorius has traded most of the time between 30 to 40x forward EPS, it rarely has gone below and actually regularly above. Leaders that dominate their niches and who are exposed to attractive growth rates tend to trade on premium multiples, as long term investors are frequently unwilling to sell them.

Looking at picks-and-shovels types of stocks for the biotech space is an interesting ground for stock pickers. Investors get exposure to the attractive themes of the health care sector such as an aging population, pricing power and advanced high growth therapies. While you don’t have to deal with the patent cliff and the highly competitive landscape that the pharma and biotech companies find themselves in.

Mini-TSMC Lonza provides a nice overview of the expected growth rates for the various types of pharma therapies:

For premium subscribers, we will do a deep dive on a strongly positioned player who is a pure-play supplier to the biotech industry for some of these high growth therapies. We came across this company via a scientist at a major pharma company who mentioned how he is relying on this company, and that they are the premium player in their space with the highest pricing. It’s a name we had never even heard of and we don’t believe that there has ever been a write-up on this name. While actually, it’s a straightforward investment case which should bring in a high long-term IRR for investors, much higher than Sartorius. It’s a good quality company, with a solid business model and practically all of its sales coming from recurring revenues.