We continue to like picks and shovels plays for the biotech industry. Let’s look at some thematic drivers. First, an aging population in developed markets will drive an increased demand for medical treatments. Secondly, we’re shifting from simple molecules—which were cheap and easy to manufacture—into biologics and new tech such as cell and gene therapies which require more specialized supply chains, manufacturing and R&D. Third, the medical field is extremely data intensive which makes it perfect for AI to boost innovation, for example in medical diagnosis, personalized medicine, and drug design.

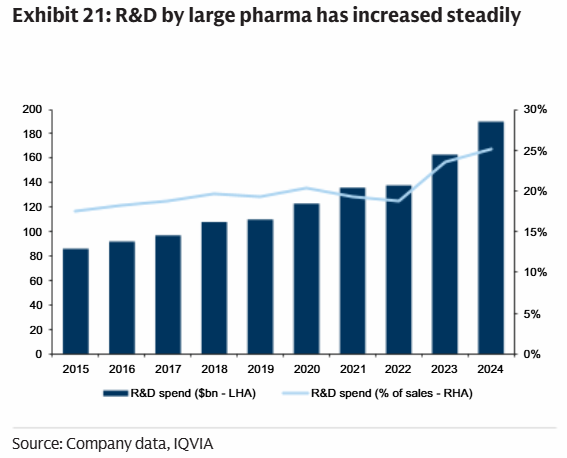

Generally, exposure to pharma R&D is an interesting thematic for investors:

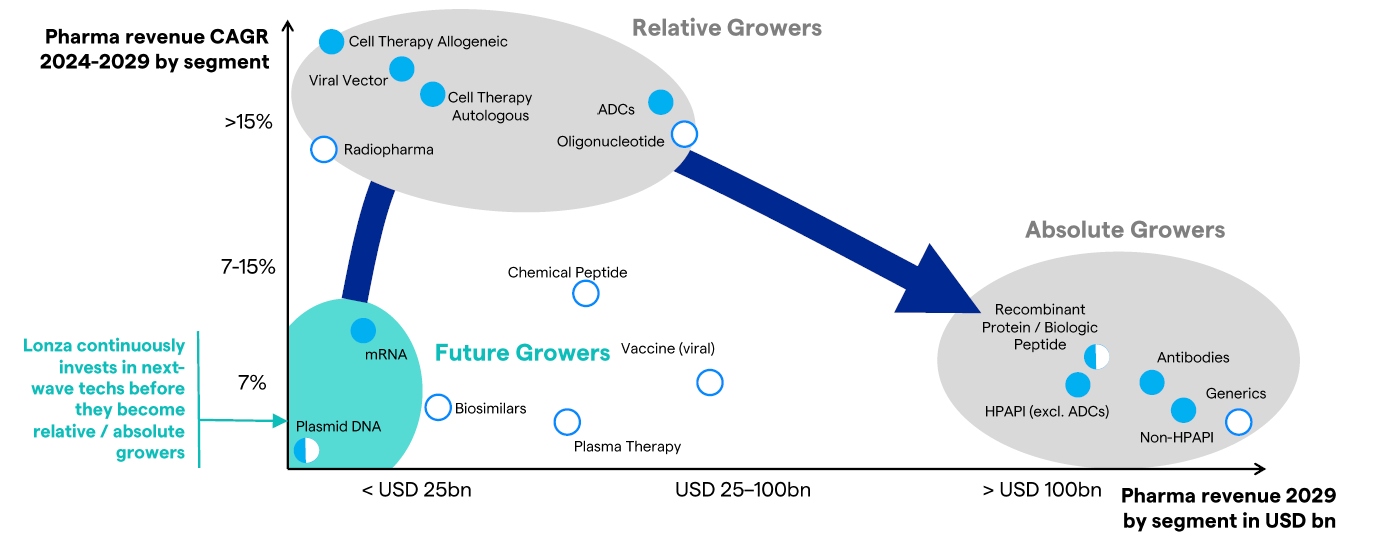

Especially when you can start selecting niche picks & shovels providers with high exposure to the high growth therapies:

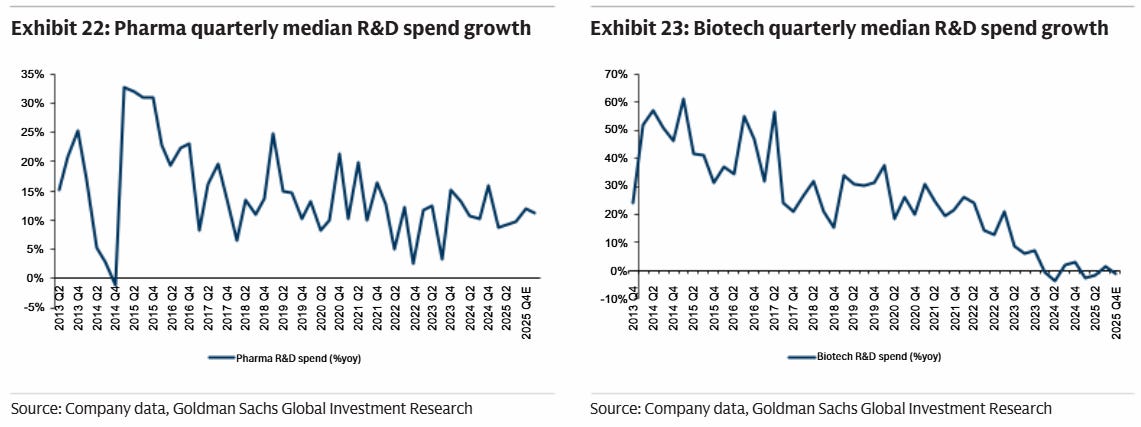

However, post the covid lifesciences boom, biotech R&D went into a cyclical downturn with growth rates coming to a halt (chart on the right):

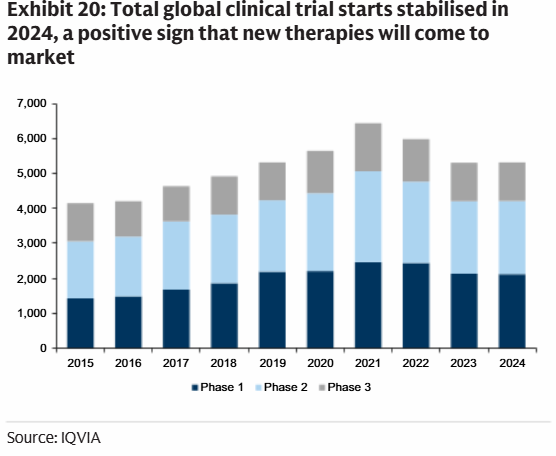

With new clinical trial starts going into a downturn:

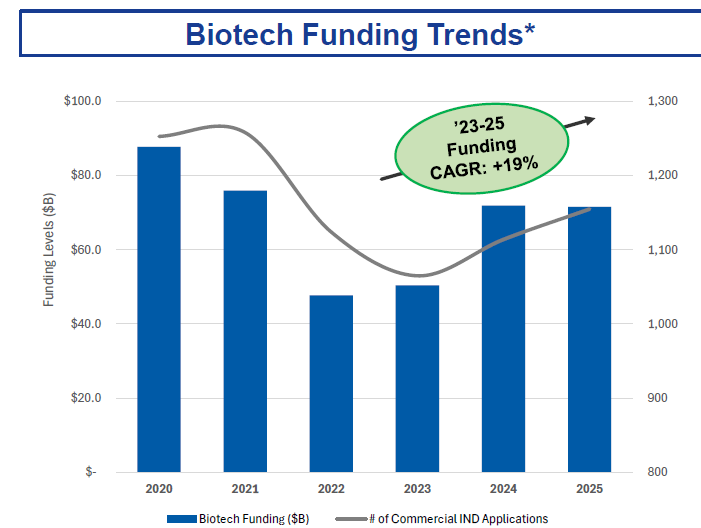

Since then, biotech funding (raised capital) started recovering in recent years:

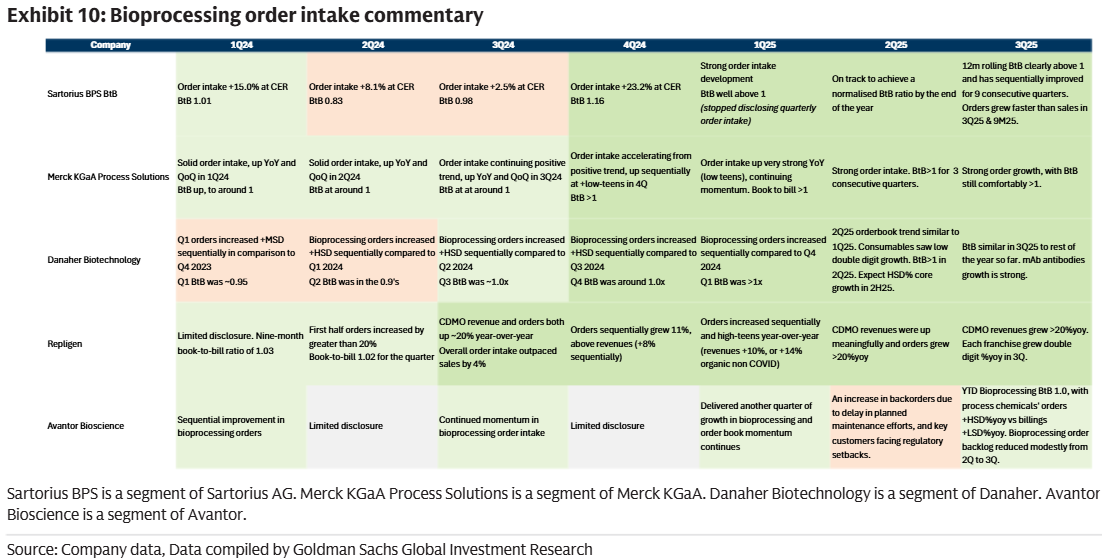

And this has already started to translate into improved order flow and book-to-bill ratios for the bioprocessing providers:

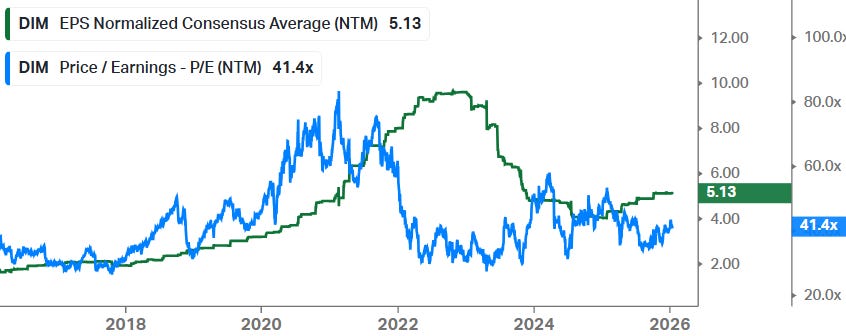

Sartorius Stedim (DIM.FR) is a good quality player in this space, and the downturn post covid is well illustrated in its forecasted EPS chart below. Forecasted EPS have now started to gradually recover and with improved order flow commentary. So, it looks like we’re past the trough now and can start moving into a new upcycle in the coming years:

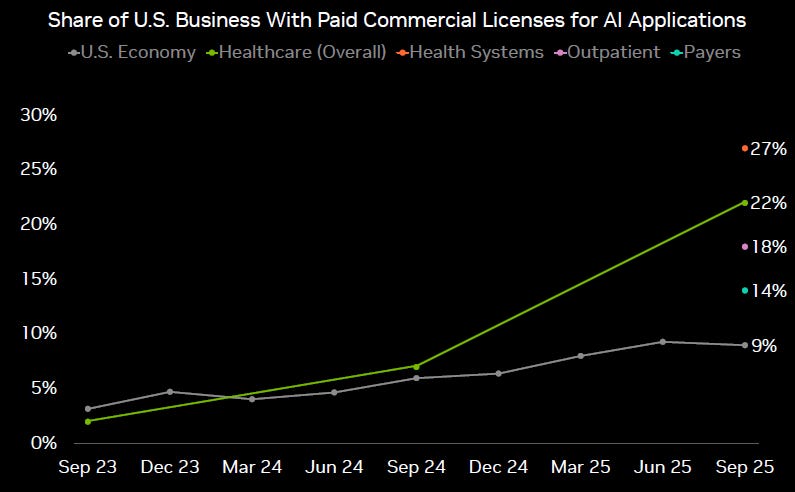

Nvidia mentioned at the JP Morgan conference that they’re seeing high AI spend in the health care sector overall, with AI usage growing at three times the rate of the overall economy. Again, this is a positive indicator for future innovation potential in this space.

Lonza is somewhat similar to TSMC in the semiconductor industry, as the company is a leading manufacturer of biologics for pharma and biotech customers. In the biotech supply chain, these types of fab players are called the CDMOs (Contract Development and Manufacturing Organizations). So, Lonza typically has some of the best insights when it comes to the outlook for the overall industry. This is the CEO at the JP Morgan conference this week:

“First of all, the underlying pharma market itself is an attractive one, not very cyclical, growing at 6% to 7% a year in terms of value. Then there is the increase of outsourced manufacturing of pharmaceutical companies to partners like Lonza, which adds incremental growth of 1% to 2%. Lonza has active market selection where to invest, into which technologies and subsegments, adding another 1% to 2% of growth increment. This leads to a growth of 8% to 10% on average over time to the CDMO market addressable by Lonza. Then there’s the Lonza Engine, which adds to our capability and actually enables us to outgrow by another 2% to 3%. So, there is a growth potential of 10% to 13% for us available.

The clinical pipeline of more than 7,000 molecules is growing at 9%. We cover services from early phase discovery through clinical phases and to commercial large-scale manufacturing. We are able to address above 90% of the innovative pipeline in pharma. We see that the number of innovative molecules being contributed by small biotechs and midsized companies in this pipeline is actually at 75%. Why is that relevant? Because biotechs actually don’t invest in their own manufacturing capabilities, and every dollar they spend is in terms of innovation. And we also see a relevant trend in terms of pharmaceutical companies outsourcing manufacturing to capable CDMOs. There will likely be a preference of the pharmaceutical companies to create additional capacities in the US. Lonza is operating a well-diversified global manufacturing network. So, we see ourselves in a good position to help our customers regionalize their supply chains.

70% of our business is commercial business although clinical and early-stage biotechs work is important for us to have this pull-through and learn about what’s going to be needed in the future. It’s a business that we want to do and nurture, but it’s not a big growth driver for us upwards or downwards depending on how the biotech industry goes. Usually, when you see an uptake in funding, this takes 2 to 3 quarters to actually materialize. Why? Because companies need to review their development plans, issue RFPs, and then CDMOs have to come back. So this takes time. And the earlier the phase, the smaller these amounts are. There’s a lot of redevelopment work and batch manufacturing that is involved in this. But, it’s usually a healthy sign for the industry.”

Also Goldman sees attractive growth in the coming years:

“In EU Life Science, our analysis suggests that end markets in Biologics continue to look attractive with new therapies and new classes driving growth. In addition, recent news flow suggests US policy risk could have lessened, which, despite the EU names not having significant exposure here as a percentage of revenues, is a positive for sentiment. We continue to believe the underlying Bioprocessing market is in a strong position to deliver growth in the mid-term.”

So, the question now becomes where to position? We never invest in the drug manufacturers or biotech names themselves. This is a hugely complicated and competitive landscape where only highly specialized analysts that read medical publications on a daily basis are well positioned to make stock picks on which drugs they’re going to invest in.

While we’ve seen some investors argue that patents provide a ‘formidable moat’, we note that the effective time that a pharma company can exclusively sell a particular drug molecule is only 10-15 years. So, pharma and biotech companies continuously have to face patent cliffs with generic competitors coming in to sell a discount version of the same molecule. In our view, pharma companies have to continuously reinvent the wheel in order to find new revenue drivers as their products go off patent. At the same time, drug development costs keep exploding and it becomes ever harder to actually successfully bring a drug molecule to market. At the same time, competition is innovating as well and can bring to market new drug molecules with better efficacy or side effects profiles, posing a continuous risk of disruption for even gold standard treatments. This is something that Novo Nordisk investors found out last year.

So, we prefer to invest in the picks-and-shovels providers supplying the plethora of competition in the biotech and pharma space. These are industries which are much more similar to other tech industries such as semiconductors for example, where you regularly have a limited number of leaders that dominate a particular niche. At the same time, you get exposure to rising drug development R&D which provides an automatic tailwind.

Post the JP Morgan conference, we came across a handful of highly-specialized niche leaders and with attractive market positions that we haven’t reviewed before. In this article, we will dive into the first name. This is a smaller company, but with high margins and with high long-term growth potential, including some opportunities that the market is missing. Finally, we’ll also discuss our current biotech picks & shovels portfolio.