Outlook in Leading Edge Semis - ASML's EUV Downturn, TSMC's Roadmap, and One Long Term Winner

A tour of the space

TSMC’s Outlook

Q1 tends to be a seasonally weaker quarter for TSMC, mainly due to the downturn in smartphone sales post the holiday season:

The main driver of TSMC’s spectacular growth over the last two years has been high-performance computing, which is currently growing at an 80% rate driven by the boom in AI data center demand:

Mature semis remain a dull story for the moment, the IoT market is clearly still lacklustre while automotive semis are gradually growing as OEMs are adopting self-driving computers in their latest premium models:

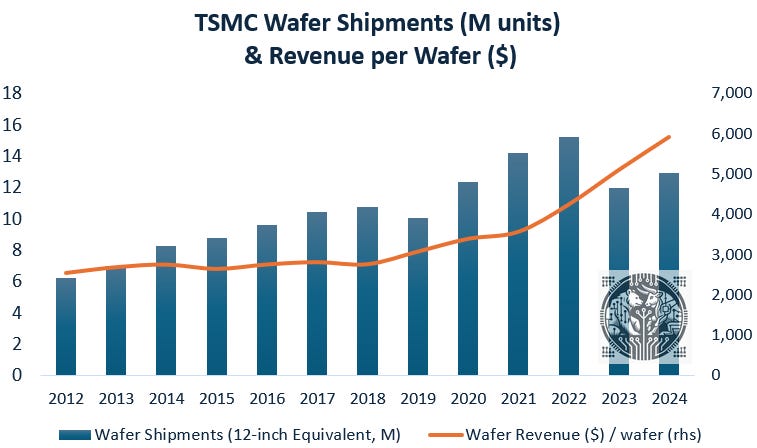

Due to the depressed nature of the mature semis market, TSMC’s wafer shipments are only gradually recovering. The good news is that the advanced wafers come at much higher ASPs, allowing TSMC’s revenue per wafer to have grown by 70% over the last three years:

N3 wafers are priced at around $18k to $20k and thus overall ASPs will continue to grow as N5 demand will be moving onto N3 in the coming years. And this will be followed by N2, which is ramping up later this year. N2 wafers will be priced at around $24k to $25k, giving another 26% rise in the price of a leading edge wafer.

TSMC’s historical revenue chart node by node illustrates how all the company’s revenue growth is coming from its dominant position at the leading edge—i.e. N7, N5 and N3:

Moving towards the outlook for the coming years, naturally President Trump’s tariff negotiations are clouding the general macro outlook. However, we are taking the view that the US will likely successfully conclude trade deals with most partners in the coming months. This is also what happened during Trump’s first term—he renegotiated NAFTA to replace it with USMCA and subsequently negotiated the ‘phase-one trade deal’ with China. All indications are that Trump is making a similar play here, this time with the goal of concluding new trade agreements with all US trading partners.

As the initial tariffs were only announced at the start of April, naturally semi companies haven’t seen much impact yet. This is CC Wei on the topic and the company’s overall outlook:

“Now let me talk about the recent tariffs. We understand there are uncertainties and risks from the potential impact of tariff policies. However, we have not seen any change in our customers' behavior so far. Therefore, we continue to expect our full year 2025 revenue to increase by close to mid-20s percent in U.S. dollar terms. We might get a better picture in the next few months, and we will continue to closely monitor the potential impact to the end market demand and manage our business prudently.

Now, I'll talk about our AI demand outlook. We continue to observe robust AI-related demand from our customers throughout 2025. We reaffirm our revenue from AI accelerators to double in 2025. AI accelerators we define as AI GPUs, AI ASICs and HBM controllers for AI training and inference in the data center. Based on our customers' strong demand, we are working hard to double our CoWoS capacity in 2025. Recent developments are also positive to AI's long-term demand outlook. In our assessment, the impact from recent AI models, including DeepSeek, will drive greater efficiency and help lower the barrier to future AI development. This will lead to wider usage and greater adoption of AI models, which all require use of leading-edge silicon. These developments only serve to strengthen our conviction in the long-term growth opportunities from the industry megatrends of 5G, AI and HPC.

To address the structural increase in the long-term market demand profile, TSMC employs a disciplined and robust capacity planning system. Externally, we work closely with our customers and our customers' customers to plan our capacity. Internally, our planning system involves multiple teams across several functions to assess and evaluate the market demand from both a top-down and bottom-up approach to determine the appropriate capacity build. Based on our planning framework, we are confident that our revenue growth from AI accelerators will approach a mid-40s percentage CAGR for the next 5 years period starting from 2024.

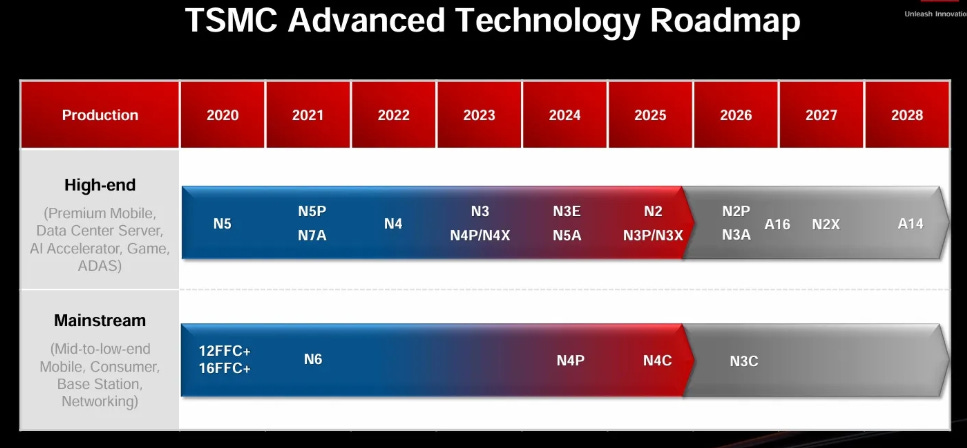

Volume production of N2 is expected to start in the second half of 2025, and we are preparing for multiple phases of 2-nanometer fabs in both Hsinchu and Kaohsiung science parks to support the strong structural demand. Our 2-nanometer and A16 technologies lead the industry in addressing the need for energy-efficient computing and almost all the innovators are working with us. We expect the number of new tape-outs for 2-nanometer in the first 2 years to be higher than both 3-nanometer and 5-nanometer in their first 2 years. N2 will deliver full node performance and power benefits with 10% to 15% speed improvement at the same power, or 20% to 30% power improvement at the same speed. The density increase in the chip is more than 15% compared with N3E. With our strategy of continuous enhancement, we will also introduce N2P as an extension of the N2 family. N2P features further performance and power benefits on top of N2, and volume production is scheduled for second half 2026.

We also introduced super power rail, or SPR, as a separate offering. Compared with the N2P, A16 provides a further 8% to 10% speed improvement at the same power, or a 15% to 20% power improvement at the same speed. And there is an additional 7% to 10% chip density gain. A16 is best suited for specific HPC products with complex signal routing and a dense power delivery network. Volume production is also scheduled for second half 2026. We believe N2, N2P, A16 and its derivatives, will further extend our technology leadership position and enable TSMC to capture the growth opportunities well into the future.”

This is the chart illustrating the strong tape-out demand for N2:

CC Wei tends to be fairly brief in his answers to the analysts, he sort of seems to think that the sell side is too dumb to understand the tech anyways. So it’s really a shame that former chairman Mark Liu has stepped down, as he used to provide a lot of background on what’s happening in advanced semi technology. So there wasn’t much there in CC’s answers, the only real interesting bit was him giving some further background on CoWoS demand:

“I know there's a lot of rumors about CoWoS. The last time when we talked, the demand is almost insane and much, much higher than we can prepare. And now it's a little bit better. I think we need to still build a lot of capacity to meet the demand, as I said, we have to double our CoWoS capacity. We're still fully loaded and for 2026, it's still a healthy momentum while we continue. We will work very hard to make sure that demand is not much, much higher than the capacity. We're working very hard, and I believe that it will be more balanced next year.”

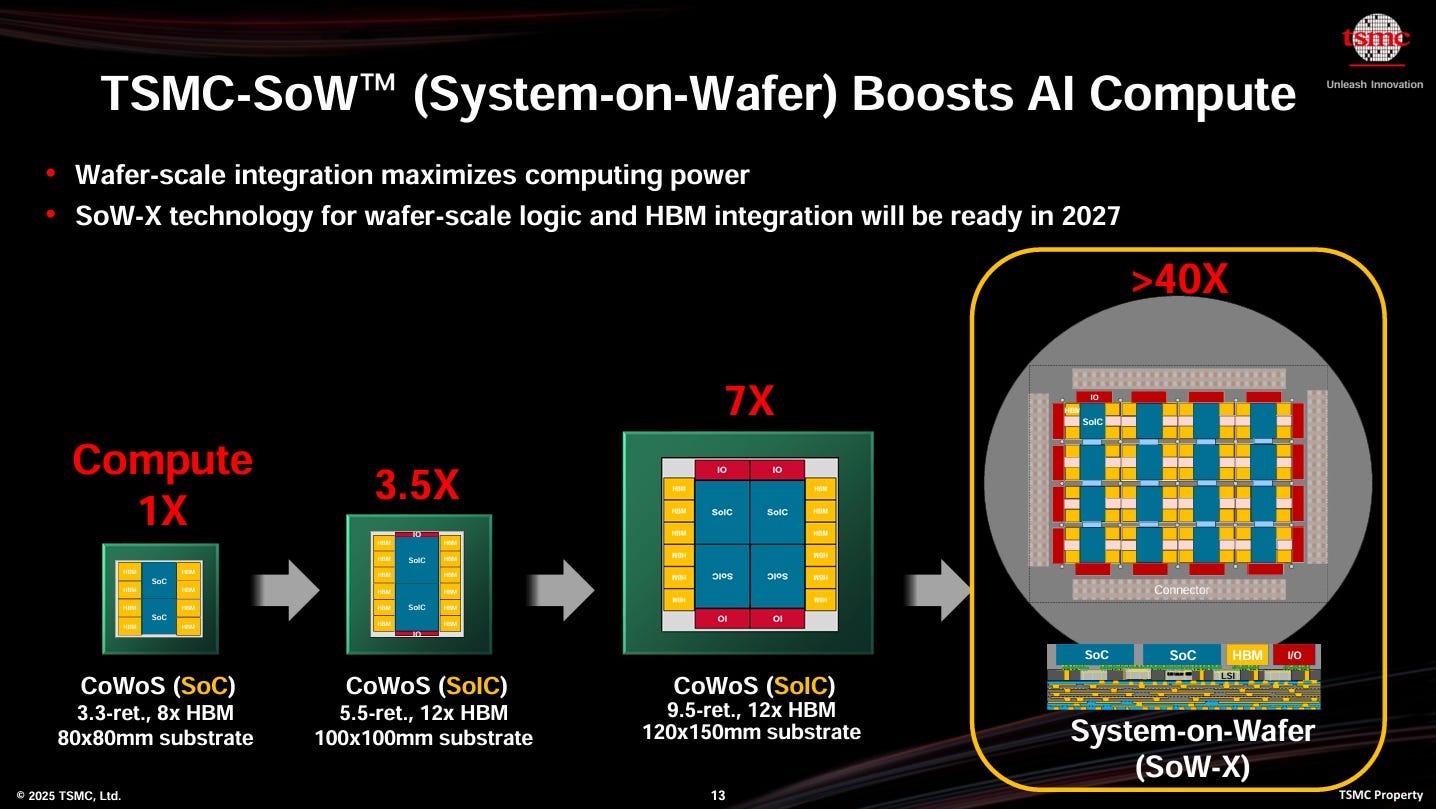

Due to the rise of AI, TSMC has been moving to the forefront of advanced packaging techniques with offering besides CoWoS, also SoIC and co-packaged optics (CPO):

Its next generation system-on-wafer (SoW) tech will allow for massive computing power to be integrated into a single system:

And each of these technologies will have their own roadmaps to increase density and thus bandwidth. Data transfer is a huge bottleneck in AI and so there is a huge focus to increase bandwidths in the industry.

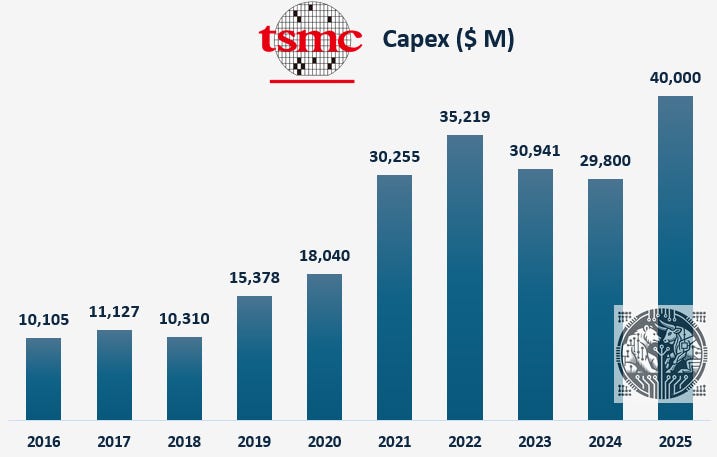

Overall, we have an aggressive technology roadmap for TSMC, which is good news for the semicap names as this will boost TSMC’s capex levels:

While TSMC’s capex is gathering momentum, the capex intensity is still at moderate levels at around 36% of revenues:

The company has plenty of cash to finance these levels of capex, as high gross margins have tripled the company’s free-cash-flow over the last two years:

However, going forward, gross margins will see some impact from TSMC’s international strategy as overseas fabs will have lower margins due to the higher cost base. The good news for investors is that TSMC is building a massive fab hub in Arizona, which will help the company’s valuation multiples over time. Due to the company’s current fab base being largely in Taiwan, this has been depressing valuation due to the threat of a Chinese invasion or naval blockade around Taiwan at some stage. So the more manufacturing increases in the US, the more the market will increase TSMC’s multiple. This is TSMC’s CFO on the gross margin outlook:

“We have just guided our second quarter gross margin to decrease by 80 basis points to 58% at the midpoint, primarily as the margin dilution impact from our Arizona fab starts to kick in. We expect the impact from overseas fabs to grow more pronounced throughout the year as we ramp up further in Kumamoto and Arizona, and forecast 2% to 3% margin dilution impact for the full year 2025.

As we have said before, under today's fragmented globalization environment, overseas fab costs are higher for everyone, including TSMC and all other semiconductor manufacturers. With our additional $100 billion investment plan in Arizona, we forecast the gross margin dilution from the ramp-up of our overseas fabs in the next 5 years to start from 2% to 3% every year in the early stages and widened to 3% to 4% in the latter stages.

We will leverage our increasing size in Arizona and work on our operations to improve the cost structure. We will also continue to work closely with our customers and suppliers to manage the impact. Overall, with our fundamental competitive advantages of manufacturing technology leadership and large-scale production base, we expect TSMC to be the most efficient and cost-effective manufacturer in the region that we operate. Thus, even considering our global manufacturing expansion plans, we believe a long-term gross margin of 53% and higher is achievable.”

This CC Wei discussing the company’s plans to build out a massive fab hub in Arizona:

“Next, let me talk about TSMC's additional USD 100 billion investment plan to expand in Arizona. All our overseas decisions are based on our customers' need, they value some geographic flexibility and this is also to maximize the value for our shareholders. With a strong collaboration and support from our leading U.S. customers and the U.S. governments, we recently announced our intention to invest an additional USD 100 billion in advanced semiconductor manufacturing in the United States. This expansion includes plans for 3 additional wafer manufacturing fabs, 2 advanced packaging fabs and a major R&D center. Combined with our previously announced plan to build 3 advanced semiconductor manufacturing fabs in Arizona, this brings our total investment in the U.S. to USD 165 billion. This supports a strong multi-year demand from our customers.

Our first fab in Arizona has already successfully entered high-volume production in Q4 '24, utilizing N4 process technology with a yield comparable to our fab in Taiwan. The construction of our second fab, which will utilize the 3-nanometer process technology, is already complete and we are working on speeding up the volume production schedule based on the strong AI-related demand. Our third and fourth fab will utilize N2 and A16 process technologies, and are scheduled to begin construction later this year. Our fifth and sixth fab will use even more advanced technologies. The construction and ramp schedule for this fab will be based on our customers' demand.

We also plan to build 2 new advanced packaging facilities and establish an R&D center in Arizona to complete the AI supply chain. Our expansion plan will enable TSMC to scale up to a giga-fab cluster to support the needs of our leading-edge customers. After completion, around 30% of our 2-nanometer and more advanced capacity will be located in Arizona, creating an independent leading-edge semiconductor manufacturing cluster in the U.S. It will also create greater economies of scale and help foster a more complete semiconductor supply chain ecosystem in the U.S. I would also like to mention that TSMC is not engaged in any discussion with other companies regarding any joint venture technology licensing, or technology transfer and sharing.”

For premium subscribers, we will dive much deeper into leading edge semis. First, we will dive deep into ASML’s current problems, which resulted into a downturn in EUV revenues:

Combined with new orders that remain in a downturn—note the contrast with TSMC’s booming revenues and outlook:

While Chinese revenues saved the year for ASML:

Thus, ASML has been making its revenues from less attractive areas—Chinese revenues are at risk of a strong cyclical pullback, while EUV revenue has been pulling back already. At the same time, new orders remain lackluster, which introduces challenges for the company to meet its revenue targets in the coming years. We’ll dive into these topics. Subsequently, we will do an in-depth review of a smaller semi name that should be a long term winner from developments at TSMC. And finally, we will discuss valuations in the leading edge semi value chain with our top stock picks.