Klaviyo, a bigger opportunity than Hubspot in '16?

A software play on the growth in e-commerce

E-commerce remains an interesting area for investment exposure as penetration rates around the world still leave a lot of room for growth. Even in the top 10 countries by penetration rates, e-commerce is still only taking up around 15 to 35 percent of retail sales, which means that plenty of countries will still have penetration rates of below 15%:

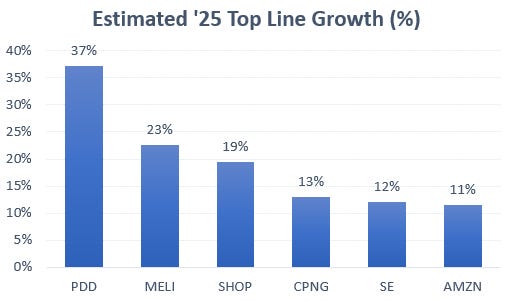

Consequently, a variety of e-commerce names should be able to generate double-digit top line growth rates for some time to come:

Software businesses are usually attractive for investors: revenues tend to be sticky, giving scope for price increases over time, while bringing in recurring and largely non-cyclical cash-flows. These characteristics have turned many of the good quality software names into attractive compounders over the last decades.

One feature that attracted me to Klaviyo’s software is that their pricing is based on the volumes of data that run over their platform. Thus, small mom-and-pop e-commerce merchants — typically operating over Shopify — will face little cost initially for bringing their data into Klaviyo. This gives them the opportunity to grow their businesses with low initial investments, which then over time brings in revenue growth for Klaviyo as their customers’ businesses grow. So the software is not sold on a per seat basis like you have a with a lot of other subscription models, e.g. $24k per annum for a Bloomberg terminal.

Klaviyo is a marketing automation platform for e-commerce merchants, although they are now planning to move into other verticals as well. The platform allows you to automate and customize your email, SMS, and push notification campaigns as a merchant. So not really the most exciting business in terms of advanced technology, like say an ASML or TSMC, it’s a typical boring piece of business software. However, there is a potential data advantage here. As with the use of AI, Klaviyo’s platform can learn which types of campaigns tend to work better in terms of sales conversions and then bring these suggestions to the merchants.

The company mentioned on the Q3 call that they already have 135,000 customers, and that their platform generated $37 billion in additional revenues for their customers. This would mean that the average customer generated around $280,000 of sales over the Klaviyo platform, with the company obtaining a take rate of 1.3% as reflected in their $473 million of annual revenues.

As the company was only founded in 2012, clearly growth has been strong, and on the last quarterly results top line growth remained close to 50%:

An example of Klaviyo’s dashboard and of an email campaign you could automatically send out to users, in this case to those who left items in their shopping basket:

You could similarly target previously loyal customers who now haven’t returned to the store over the last three months, so you could try to bring them back with an attractive 25% discount on their next shopping basket for example. Klaviyo’s strength is that you can really segment customers in loads of ways and then create specific campaigns to appeal to these groups. With the use of LLMs, we’re probably moving towards a world where every email could be customized for a particular customer. Also other AI features such as making new product suggestions based on past purchases are usually good at converting into sales.

Klaviyo detailing their platform in the prospectus, as well as the disadvantages of legacy solutions:

“Other software solutions were not purpose-built to harness customers’ first-party data to deliver impactful consumer experiences. Data-focused offerings, such as cloud data warehouses or operational databases, provide the ability to store and analyze significant volumes of data for general-purpose use cases but are not purpose-built for consumer data and lack the front-end application layer. Marketing solutions are insufficient because they lack the underlying data intelligence. Simple marketing solutions use a flattened and narrowed view of a consumer’s historical data. This basic profile data alone significantly limits the granularity of segmentation businesses can use. Profile data is also difficult to combine with event data, which includes all digital touch points of a consumer’s engagement with a brand and provides necessary real-time information.

In an attempt to bridge this gap, other marketing solutions use a patchwork of third-party technologies, such as separate consumer data, learning, and messaging applications. These solutions often require significant technical expertise to implement, operate, and maintain, which limits flexibility, reduces speed, and increases costs. Furthermore, these solutions are not able to provide clear revenue attribution, minimizing ROI.

By vertically integrating our data layer and marketing application, we make it easy for businesses to create and store unified consumer profiles and then use those profiles to derive new insights and ultimately drive revenue generation. We purpose-built a centralized, scalable, and flexible cloud-native data store for our customers to intelligently aggregate and process first-party consumer profile and event data without friction. This approach enables our customers to seamlessly generate unified and highly-granular consumer profiles, populated with data from customers’ systems and from over 300 third-party integrations, from eCommerce platforms – such as Shopify, Salesforce Commerce Cloud, and WooCommerce – to loyalty, customer service, and shipping solutions.

We built an application layer on top of our data layer to provide a comprehensive set of tools and features that enable our customers to easily turn consumer preferences into insights and actions. Combining our data layer and application layer into one vertically-integrated platform allows our customers to rapidly segment their consumers, easily create highly-personalized experiences, and automatically send messages customized to their unique brands.

Our platform and customers benefit from significant network effects. We assembled over 6.9 billion consumer profiles across our customer base, and in the twelve month period ended June 30, 2023, we processed over 695 billion events, which are data on how consumers engage across channels, such as opening an email, browsing a website, or placing an order. As we add more customers and more anonymized data on our platform, we are able to better refine our predictive models of consumer behavior.

Our platform offers simple, one-click drag-and-drop customizable templates for designing messages and generative artificial intelligence tools for creating content. For advanced functionality, we offer a suite of tools to enable developers to build rapid automations for different use cases and quickly integrate with other systems efficiently. Our platform also allows our customers to compare their performance against similar companies in their respective industries and makes recommendations on how to optimize future engagements.

We are maniacally focused on making our platform intuitive and exceptionally easy-to-deploy, driving our customers to expand their usage of our platform in a self-serve manner.”

Take what they said about competitors with a grain of salt, there are a number of competitors with good products as we’ll see below. However, the point they made on data being a competitive advantage is an interesting one, as this would make it hard for new entrants in the field to start competing. So this would mean that the players with the largest amounts of data would be able to provide better AI algorithms to drive better returns for clients. So cost of the platform would then become a secondary factor, if you can generate 10% higher revenues with Klaviyo, you don’t really care whether the competitors’ take rate is say 0.5% versus Klaviyo’s 1.3%.

Enjoying this? For premium subscribers:

We’ll go in-depth into Klaviyo

We’ll make an analysis of whether Klaviyo could be looking at a solid revenue growth runway akin to Hubspot

We’ll discuss the risks

We’ll do an in-depth analysis of the financials and valuation for the company