Intel, TSMC, SK Hynix, Unity, Panic in Software

Our findings in tech

Intel’s Stumble & Hope

After years of share losses in the CPU market, Intel is finally seeing stronger demand for its products. However, this time, the company didn’t have the necessary supply available. This is Needham on the mishap:

“Intel is currently facing supply constraints, most acute on Intel 10/7 where the bulk of its volume resides. As a result, 1Q revenue guidance of $12.2BN came in below Street ($12.5BN), though management indicated revenue would have tracked well above typical seasonality if sufficient supply were available. A more pronounced revenue decline in CCG relative to DCAI is expected in 1Q, as internal supply continues to be prioritized toward server demand. While under-shipping is expected to persist beyond 1Q, the quarter should be the trough for supply constraints. Supply is expected to improve gradually through the year, with revenue tracking better than seasonality in the remaining quarters, led by DCAI.”

JP Morgan points out that data center CPU demand will be strong, while consumer markets will see weaker demand due to surging memory prices:

“Wafer supply should begin to improve in Q2 as Intel transitions CCG wafers to DCAI and continues to drive yield improvements, but this will still likely prove insufficient given the level of demand for traditional server CPU compute that is materializing on the back of rapidly rising volumes of AI inference workloads (traditional CPU compute is increasingly being leveraged for a variety of tasks/processes incl. workload orchestration, pre-/post-processing, data retrieval etc.). Intel will also no longer be able to lean on inventory drawdown as a means to support revenue growth in Q1, exacerbating the impact of the capacity shortage.

Looking beyond near-term supply-demand dynamics though, Intel is addressing the shifting demand landscape by streamlining its server CPU roadmap, focusing on high-end Diamond Rapids and Coral Rapids SKUs, and pushing to accelerate go-to-market timing as it looks to stem share loss to AMD (and potentially recapture share at key hyperscale and enterprise customers). The outlook for Client/CCG is less “rosy” though, with memory/storage supply constraints and elevated pricing likely to crimp growth for the PC market this year (as we highlighted in our 4Q preview, our global team is now forecasting a 9% decline in PC shipments in 2026).

On net, we still think there is enough of a demand tailwind in DCAI to more than offset a decline in CCG this year, driving LSD-MSD % Y/Y overall growth for INTC. Gross margin should improve incrementally through 2026 as volumes ramp, 18A yields improve, and higher pricing in server CPU begins to take effect, though we still anticipate GM exiting 2026 barely at the 40% level.”

The big hope for Intel is that the company can start building out a credible foundry business towards the end of this decade. While we think it is likely that the company will start seeing smaller orders for future products from the US semi designers as there is strong support for Intel in Washington, including from the White House, it’s unlikely that these customers will commit to large orders for the foreseeable future as Intel will have to prove itself.

For example, Jensen might be willing to give Intel orders for their gaming GPUs, and potentially Broadcom/AMD/Marvell/Qualcomm could give them one or two smaller products as well. These could also for example be less advanced products such as IO dies in a chiplet architecture. This would still provide a credible bull case as should Intel execute well on those, it could expand its foundry business over time. While TSMC is obviously awesome, no one wants to be beholden to a single supplier in tech. For example, Jensen also gave gaming GPU orders to Samsung not too long ago.

So, besides political support, we do think there would be organic interest as well from the advanced semi designers to be able to source from an additional credible foundry, and with US-based fabs. Naturally, this is if Intel can do it. However, Samsung is building out a fab hub in Texas as well; so obviously Intel is facing a strong competitor to be a second supplier to the semi industry. Also UBS is constructive on Intel’s Foundry story:

“We remain constructive on the story in foundry and with the release of the 14A production design kit (PDK 1.0) late this year, we see INTC possibly signing deals with one or more of NVDA, AAPL (M-Series), and maybe Amazon and a high-end consumer product. This will likely be a positive catalyst and we are tweaking our PT up just slightly in recognition, but we still struggle with the earnings power here - especially as INTC is giving up about half of the incremental profits to Apollo and Brookfield due to the financing agreements signed several years back.

Moving to new products on its 18A process will help foundry margins, but hurt product margins, so we think the net effect is only modestly positive. Ultimately, we quite like the story but the stock has gone up so much and the bull case to support further upside from here is 3-4 years away, in our view. So we land in about the same place as before with a slight PT increase from $49 to $52 based on SOTP and a little more confidence that external foundry deals are coming late this year.

For an indicative bull case foundry analysis, we consider 15% of AAPL, NVDA, and AVGO TSMC wafers moving over to Intel 14A in 2030. At a $32.5k wafer price this works out to $6.9B of external foundry revenue for front end. We add $5B of advanced packaging and Intel’s own internal wafer consumption works out to $42.7B at the same transfer price, suggesting $54.7B of foundry revenue in this scenario. At a 25% op margin and 10.5x EV/EBIT multiple, this works out to $143B of EV or $118B after subtracting the SCIPs, substantial upside (to our base case foundry valuation). Still, the nearest catalyst is a customer announcement at the end of this year and even then the ultimate movement in Intel’s financials will be remote, with volume production expected only in 2029.”

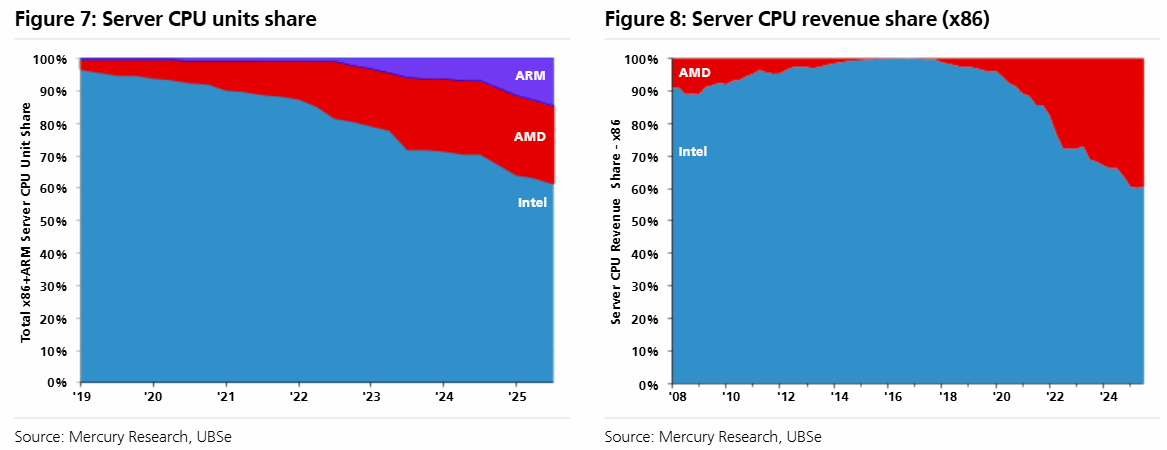

While Intel has been a large share donor in data center (and consumer) CPUs:

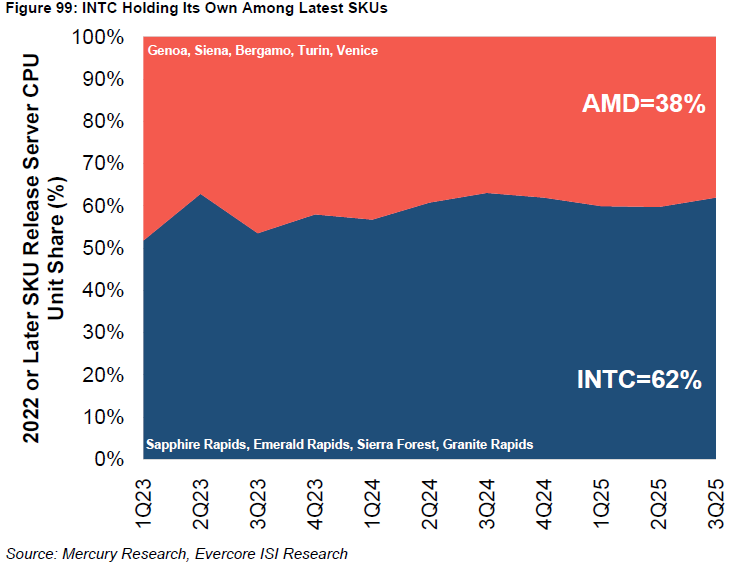

Evercore points out that Intel’s market share on their latest data center CPUs has been solid vs AMD:

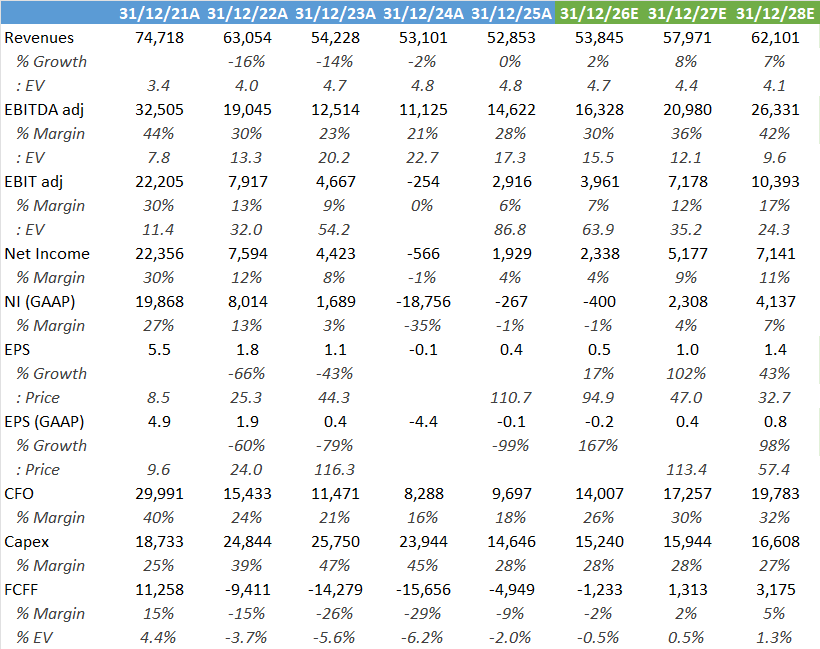

Overall, the outlook for Intel is looking a lot better now than in previous years. It looks like 18A is going to be a solid node with yields that will get to sufficiently high levels. At the same time, AI workloads in the data center provide a new growth opportunity for the company’s otherwise rather dull CPU business.

We do think that consensus estimates look reasonable here and that the company can start growing its top line again. In the last two quarters, FCF has turned positive again—the first series of two consecutive quarters of positive FCF since 2021—with Intel actually generating $1 billion in cash. However, even if the company can work itself back to $3-5 billion of annual FCF over time, investors are still only getting a 1-2% FCF yield on the current EV of $250 billion. This illustrates how the market is now pricing in quite a rosy scenario already.

We don’t dislike Intel but execution has to be fairly flawless to justify current valuations. We can see the shares doing well as we think the company will manage to get orders for some of the smaller future products from the leading US semi players. Both Lip-Bu and Jensen are good buddies with the President, with the latter two also being Intel shareholders. Washington wants leading edge semi manufacturing in the US and no doubt that Lip-Bu will have told them that he needs customers at 14A in order to do so, like he has been saying on the earnings calls. However, needless to say, Intel remains a speculative story at this stage and it’s not the sort of stock where we would hold a large position in. We would rate it as a ‘soft/speculative buy’ at best.

Next, we’ll dive into further developments in leading edge semis with insights into TSMC, SK Hynix, and the overall DRAM and NAND industries. Finally, we’ll also review the sell off in Unity and the current panic in software stocks.