History & Outlook of the Memory Industry, Nvidia's Outlook, and Winners We're Selling

Memory, Accelerators & AI Apps

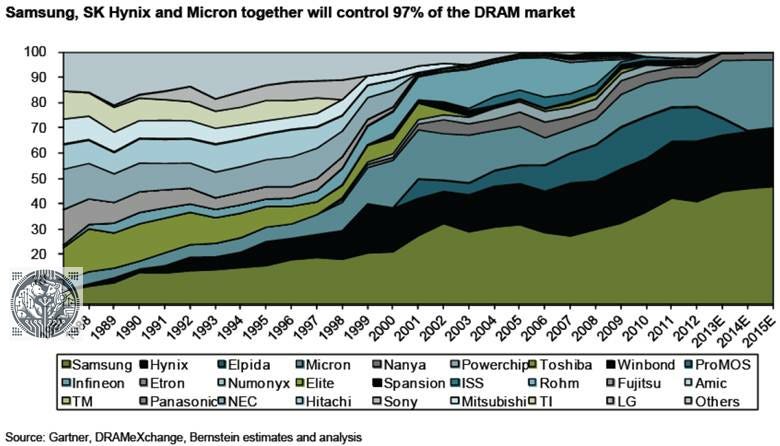

Historically, the memory industry was known to be a very low quality business. There were three factors for this. Firstly, the industry was highly competitive with a plethora of competitors competing. Over the decades, this gradually improved. Competitors were gradually shaken out, and around a decade ago we moved to the three player market in DRAM which we still have today:

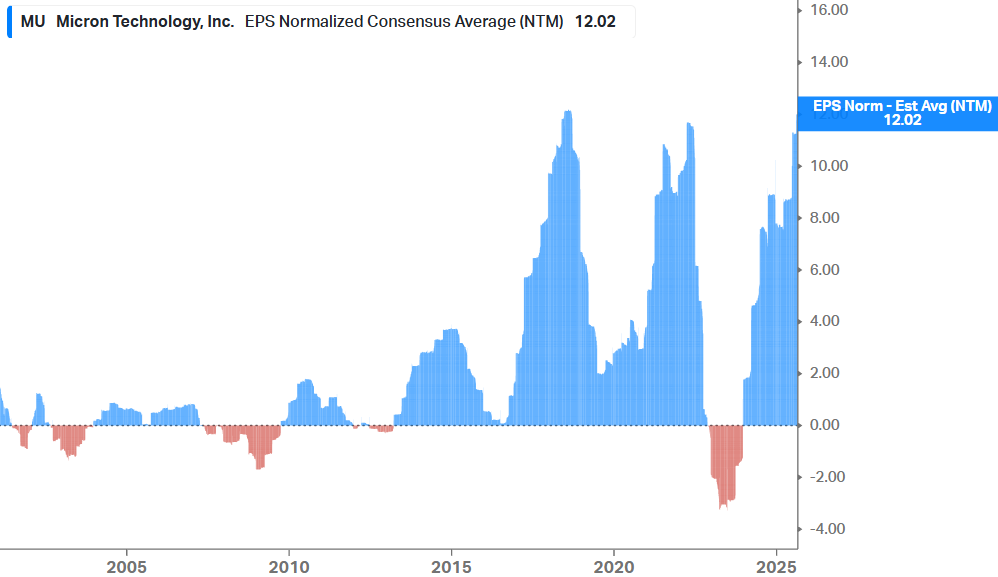

As the industry moved into this oligopoly structure, pricing discipline improved which resulted in better margins and EPS:

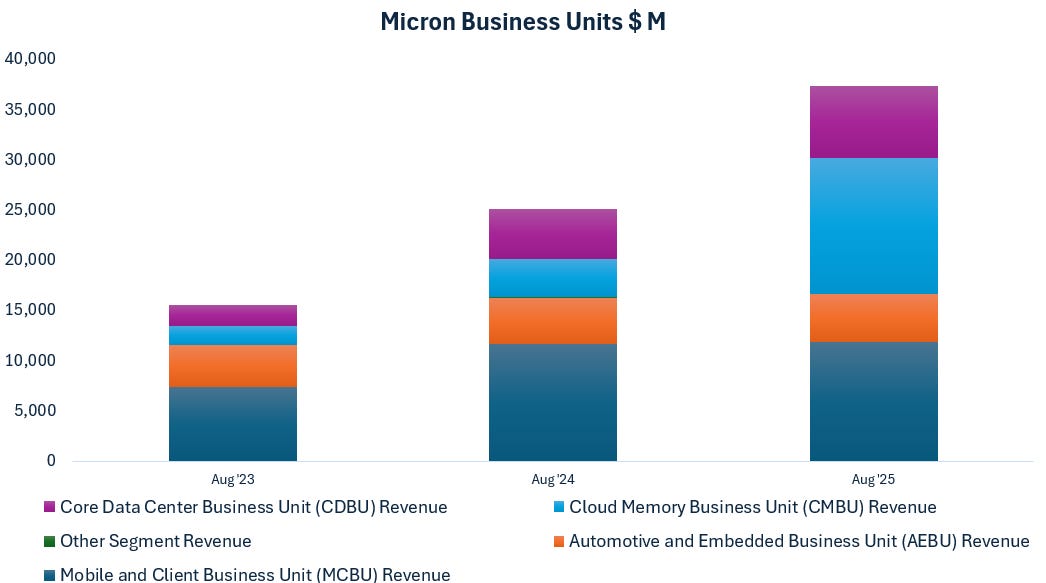

However, as the industry remained extremely cyclical, these stocks weren’t Buffett-style buy-and-hold investments, but rather tactical opportunities to play during an upcycle in the semis market. End-markets also weren’t that exciting. Revenue exposure to the mobile and client markets was high, two end markets that had gone ex-growth:

However, with the rise of AI, end market exposure for the memory players has dramatically shifted towards the data center. Last quarter, the two data center related segments comprised 54% of revenues for Micron. Besides being one of the most attractive growth markets in semis in the coming five-ten years, the data center market also has a number of other attractions. Firstly, customers are taking out multi-year contracts, which enhances revenue visibility and stability for the memory players. This is SK Hynix’s CFO on this week’s call:

“It is true that in the memory market, some businesses have shifted to order first, produce later approach with the emergence of HBM which have massive investment and long lead time. In addition, with strong HBM demand coming from our customers, the company was able to secure visibility into the customers’ demand from the contracting stage with long-term agreements. For both the memory industry and the company, this has led to greater market predictability and business stability than in the past when it was much more volatile.”

One of the historical problems for the memory players was that memory was basically a commodity. You could swap out one vendor’s DRAM and replace it with that from another. This is now changing in the crucial HBM market where growth is exploding. SK Hynix’s CFO explains:

“Custom HBM will gradually increase from HBM4E. So products will be developed in close collaboration with customers from the early stage of design of GPU or ASIC products, unlike in the existing standardized HBM. This will lead to much longer term and strategic transactions between customers and a small number of suppliers, contributing even more to business stability and profitability improvement on the part of the memory suppliers.”

All of the above has led to better dynamics in traditional memory markets as well. Industry consolidation led to better pricing and investment discipline, and the growth in HBM is resulting in supply constrains and long term agreements in conventional memory markets:

“Now if I may add, memory companies are allocating capacity to ramp up HBM supply. And this has led to supply constraints in conventional memory, resulting in supply shortage of conventional memory, for which demand is actually growing. And as a result, we are seeing an increase in customers who want to sign long-term agreements for conventional memory products as well. Some customers are very much actively responding to the current supply shortage by issuing prepurchase POs for 2026. Now, given the customers’ demand and the company’s capacity for next year, not only HBM, but DRAM and NAND capacity has essentially been sold out.”

For premium subscribers, we will dive further into current developments in the memory market, we’ll do some interesting modelling on Nvidia, Broadcom and AMD, discuss the outlook from here, and finally, we’ll highlight a few trades which we will be making (selling some winners).