A look at Credo

JP Morgan initiated on Credo, a niche silicon player in the AI data center:

“Credo is well positioned to capitalize on rising AEC demand, with industry unit shipments forecasted to expand at a 60%+ CAGR from <1 mn in 2022 to 10 mn+ in 2028, supported by increasing deployments from major companies such as Amazon, Microsoft, and xAI as well as broadening adoption by others, including Meta and potentially Oracle, Google, and more, which are currently engaging with the technology. Underlying the increasing and broadening adoption are expanding use cases beyond the traditional NIC-to-ToR connection inside a server rack, as AECs are now being used for short-reach rack-to-rack connections, intra-switch rack connections, and eventually scale-up use cases. These dynamics are creating an ASP tailwind, as early adoption of short-reach 100G “straight” cables by a single company ( ASPs in the low hundreds ) is transitioning to a variety of ranges, more complex form factors, and data rates extending to 800G for multiple companies ( ASPs in the mid-hundreds ), which, when combined with the shipment forecast, translates into a $4 bn+ market opportunity by 2028

Credo became the first supplier of AECs in 2018, creating both the product and the market, and remained the primary supplier for many years. Despite the more recent entry of well-known players such as Marvell, Broadcom, and particularly Astera – which has gained notable traction in the market recently – Credo still commands an overwhelming majority of the share, estimated to be ~80%. This leadership is driven by Credo’s ability to deliver an entire, qualified, and tested solution, where the silicon to finished cable is based on its in-house IP (vs. peers providing only the silicon or module), which gives Credo advantages in time-to-market, ease of deployment, reliability, and cost. While we expect other peers to gain market share over time as large customers multi-source, we anticipate that Credo will maintain its overall leadership, with other suppliers primarily serving as second or third suppliers.

Beyond Ethernet AECs, Credo’s product portfolio also encompasses other interconnect technologies, such as optical DSPs and PCIe retimers. While Credo currently has limited share and will be competing against established peers, these markets represent significant opportunities – estimated to track to $6 bn and $2 bn in 2028, respectively – and even minor share gains could translate into a solid growth opportunity for the company. Importantly, the aforementioned implies an aggregate interconnect TAM expanding at a +45% CAGR and reaching more than $12 bn in 2028 .

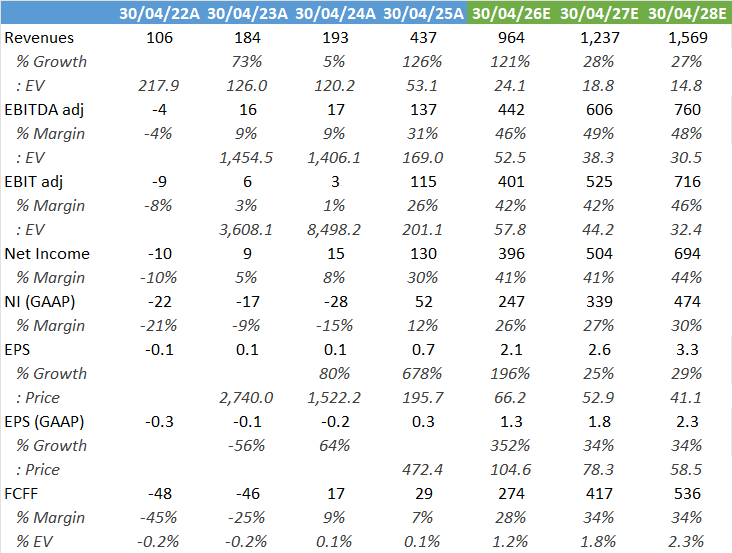

We are forecasting a revenue CAGR of 50%+ from FY25 to FY28E, including growth of 100%+ in FY26E. This forecast is underpinned by increased deployments of AECs by Credo’s two large, more longstanding customers, new deployments across three additional customers, as well as strong growth for Optical DSPs and solid growth currently assumed for other solutions ( both from a low base ). Importantly, our expectations are ahead of industry forecasts for AEC unit shipments, which are projected to grow at a 40%+ CAGR over the same period. We believe this outperformance reflects new use cases beyond NIC-to-ToR (e.g., rack-to-rack, switch rack), the ramp-up of new customers, and pricing tailwinds.

We are projecting earnings growth to outpace revenue, with an earnings CAGR of 70%+ from FY25 to FY28E, driven by gross margins tracking toward the high end of the long- term range (63%-65%), supported by increasing scale and an improving product mix as well as operating expense growth at a pace below revenue. These factors should also drive a solid improvement in free cash flow generation, which, against the backdrop of a very healthy balance sheet, could lead to a greater appetite for capital allocation that has been limited to date and would represent upside to our model. We introduce a December 2026 price target of $165 based on valuing shares of Credo at ~48x our CY27 EPS estimate.”

The below image shows what Credo does – the purple cables are Active Electrical Cables (AECs). These are low-power, copper-based interconnects that integrate advanced silicon to extend signal reach. These are heavily used in AI data center networking for shorter distances with the most common use cases being inter-rack and top-of-rack communication.

The attraction with Credo is an 80%+ market share in the AEC market where volume growth is even higher than in the accelerator market. While competitors such as Marvell, Broadcom and Astera are moving in, Credo has further growth opportunities in other interconnect technologies.

There are not many companies which can effectively compete at the leading edge as semi design costs continue to explode. So, typically, there are a handful of competitors in these markets, or less. This makes these industries and companies attractive for investors to play the exploding growth in leading edge silicon, as these are not commoditized businesses. This can easily be witnessed in attractive gross margins. You can see that both Astera and Credo are generating similar gross margins to Nvidia:

The attraction with both TSMC and ASML is that these upstream companies in the value chain currently face no or only very limited competition, which gives them clear upside to keep moving gross margins up over time. We expect that TSMC will be moving its gross margins up to 65-70% long term, and similarly, it’s likely that ASML will move towards a 60% gross margin as well. Obviously, Astera and Credo have a handful of competitors, which could give some gross margin pressure over time, especially when the pace of growth slows down at some stage. That said, we think these latter businesses are definitely investment grade as well in the context of a diversified portfolio.

For investors in the name, we’d simply stay long as we continue to be bullish on the AI cycle, while Credo is obviously fairly well positioned.

It’s a punchy multiple, but then again EPS are exploding:

For premium subscribers, we’ll dive further into developments in AI with a number of stock picks. Finally, we’ll take a detailed look at a very small but highly innovative company that should be looking at a long runway of attractive growth.