Introduction, current developments in GaN and SiC

Gallium Nitride (GaN) is a semiconductor material that will power the next generation of green tech such as electric vehicles and solar. And due to its better efficiency in controlling power, it’s now also seeing application in the datacenter. The other material powering the green revolution, and which is able to handle even higher voltages, is Silicon Carbide (SiC). However, in applications where there is overlap between the two, meaning that the required voltage levels can be handled by both GaN and SiC, there are compelling arguments to favor GaN due to faster charging times and smaller size.

This the VP of Technology at Power Integrations, a power semiconductor manufacturer, explaining this:

“We continued with the development of the next-generation technology, gallium nitride and we also looked at silicon carbide a few years ago, but we decided against this at the time. The gallium nitride that we have developed is superior in many ways to other gallium nitride technologies that are available today, we recently announced a 1,250 volt GaN product. At 750 volts, 900 volts and 1,250 volts, we are already competing favorably with silicon carbide. As we move forward to even higher voltages, that overlap will increase and GaN will always win whenever it can overlap with silicon carbide because of better performance and most importantly, much lower costs. The holy grail will be when GaN will be able to achieve both the very high voltages and the high powers that today are the domain of silicon carbide, for example, in electric vehicle drive trains. That is a little bit further away because it requires breakthroughs in the GaN technology, but we think it's feasible and we will be looking at that.”

This a technical engineer of On Semi commenting on GaN vs SiC and where each is preferred:

“So between silicon carbide and gallium nitride, GaN tends to be preferred in microinverter applications. So where you're looking for the absolute smallest form factor possible, one of the benefits of GaN is that it runs at much higher switching frequency. So with silicon carbide, the configuration of the device and the different material properties allow it to run higher than silicon, into maybe the couple of hundred of kilohertz. With GaN, you can really run into the megahertz range. Your switching frequency correlates to the size of your passives like your boost inductors for instance, so if your switching frequency goes up into the megahertz range, your boost inductors get very small. So for those microinverter-based designs, GaN tends to be preferred. But again, for higher power designs such as solar string inverters, silicon carbide would be preferred, mostly due to the higher thermal conductivity of the device.”

As you push the switching frequency up, you can deliver more power with a smaller size. This is especially helpful in EVs as more power means faster charging times, and a smaller size means less heat losses, saving energy for the vehicle and thus a longer EV driving range. While GaN shines in higher frequency, SiC’s stronghold continues to be the high-power domain.

Due to these advantages, power semiconductor giant Infineon sees several end-markets which are currently transitioning to SiC, subsequently making the move to GaN by the end of the decade. These include servers, onboard EV chargers and high-voltage residential solar, while other markets are transitioning from silicon to GaN directly:

Due to GaN’s ever increasing number of applications, projections for the size of the market have continuously been revised upward over the past years:

An example of a company making the move from traditional silicon to GaN now is Enphase. This is the company’s CEO on the April call:

“Let me provide you with an update on IQ9 Microinverters with gallium nitride. We expect IQ9 microinverters to deliver higher power at lower costs. Multiple vendors have been providing us with GaN parts, and we are increasingly confident in the reliability of our design. We expect to launch the product in the first half of 2025 to address two markets: one is residential and the other is three-phase small commercial markets.”

A microinverter converts the direct current (DC) generated by a single solar panel into alternating current (AC) for use in the electrical grid or the home. As converting power from DC to AC is called inversion and the device is small and compact, we get the name microinverter.

An overview of where both GaN and SiC power semiconductors are seeing application is illustrated below:

Note that industry players such as Power Integrations are now discussing how GaN can see application at even 1,000 to 1,250 volts, which would make GaN suitable to be introduced in the EV powertrain. Previously, it was expected that the material would only see application to power the onboard charger (OBC) and for DC to DC conversion i.e. changing voltage levels.

However, Navitas’ CEO discusses how as voltage levels powering EVs move up over time, SiC can retain its dominant position:

“Right now, silicon carbide is a big market at around $4 billion, about 75% of that is all in EV and specifically the electric motor. Tesla buys something like $1 billion just themselves. Silicon carbide is better at higher voltages — 1,000 volts and up or 20,000 watts and up — whereas GaN is better below those levels. If you think about an EV, if you have a 400-volt battery then GaN can be a perfect fit for charging and discharging that battery because it's 650-volt GaN, which is a nice design margin. There is a trend to 800-volt batteries and at that point, the 650-volt GaN is not adequate and 1,200-volt silicon carbide is a perfect fit.”

These are the CEO’s thoughts on the overall power semi market and the widespread opportunities for GaN:

“We started gallium nitride focused on mobile chargers as a way to showcase and prove to the world, GaN was ready for mainstream adoption. We're seeing that now blossom into mainstream adoption with 10 out of the top 10 mobile players adopting our gallium nitride technology. But that's the tip of the iceberg, now we're going into every other major market. Gallium nitride is a perfect fit for what we call sort of low to medium power, up to about 20 kilowatts. So we're talking about disrupting a $20 billion market today that is headed, as we electrify our planet, to turn into a $30 billion, $40 billion, $50 billion market, taking advantage of GaN and SiC to create efficient power chips.

What's been a real challenge for GaN, they're very hard to drive correctly, it needs a very precise voltage to turn it on. And it wants to switch very fast. So it needs to be both precise and with perfect timing, no latency. To do that, most companies use an external silicon driver. But silicon drivers only switch as fast as silicon, not as fast as GaN. Navitas invented a GaN integrated circuit, where we integrated the driver directly on the chip. With this monolithic integration, we deliver the precise voltage and with zero delay. Once we did this for mobile chargers, the market took off. And for the first time, we're bringing that GaN IC into high reliability and high-performance markets like the data center, solar and EVs. We're just in the forefront now of starting that sampling and we’re seeing those customers start to ramp in the next 12 to 24 months.”

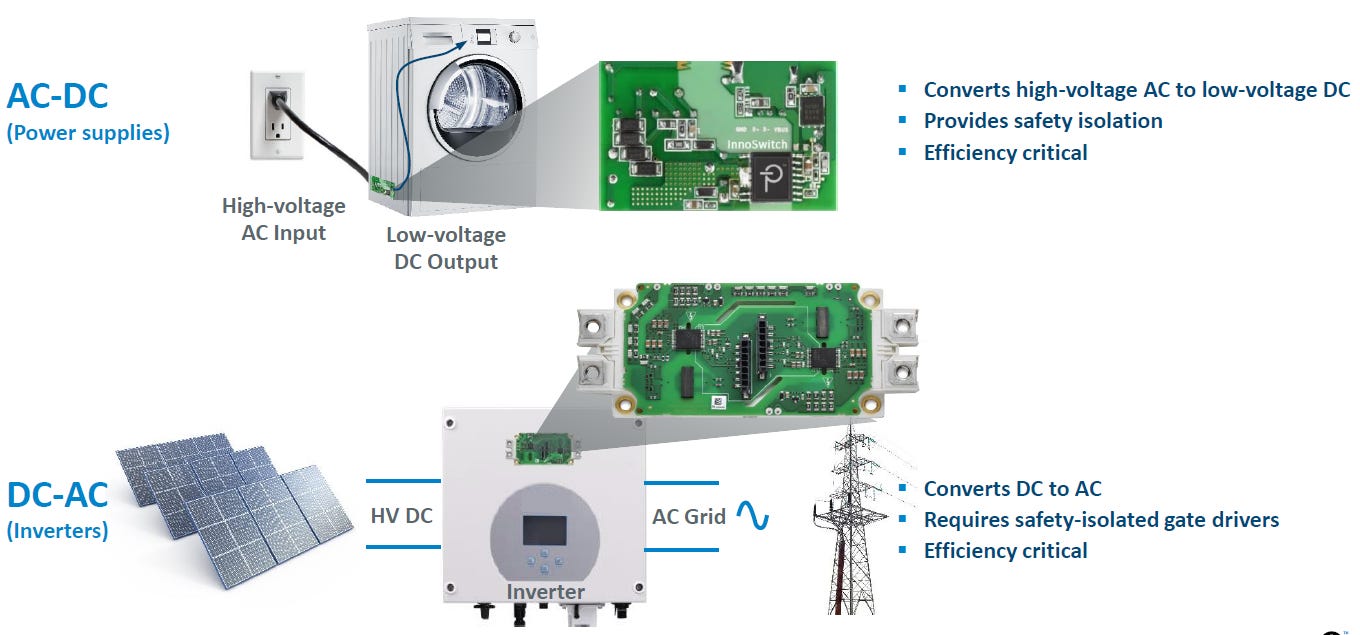

Power semiconductors — whether silicon, GaN or SiC based — are used everywhere where power needs to be controlled or converted. The most obvious example is the conversion from alternating current to direct current, AC to DC, or vice versa, DC to AC. But power semis are also used to convert direct current to a different voltage level, DC to DC. Additionally, they are used to control the flow of power i.e. on-off switching, as well as to amplify a signal.

Japanese power semiconductor manufacturer Sanken illustrates how power semiconductors can change voltage levels to handle a variety of tasks:

Power Integrations shows how this works in the real world:

Infineon is currently the leader in this market, mainly thanks to its strong position in high-power and silicon-based IGBTs. However, as the silicon-based market transitions to the novel materials discussed above, we have a set of new competitors emerging such as Navitas which currently leads in GaN.

This is Infineon’s Head of Power Semis on the direction of the various materials in the market:

“While all these three materials will coexist for quite a while, the transition to wide bandgap means the future market growth in power semiconductors will be predominantly SiC and GaN. In automotive, gallium nitride enables efficient and compact onboard chargers. As is happening often with disruptive technologies, their speed of adoption and market growth beyond an inflection point is underestimated. We see that market researchers continuously increased their projections for growth rates over the coming years. According to Yole Development, GaN for power management applications offers a cumulative market potential of over USD 6 billion over the next 5 years and it would not come as a surprise to us if these estimates in hindsight proved to be conservative.

In order to optimize its potential in power systems, gallium nitride comes with specific requirements. Whereas silicon carbide can be seen as a drop in replacement to silicon, GaN is calling for bespoke topologies, a customized system architecture. This explains why the adoption of gallium nitride is somewhat lagging that of silicon carbide. You've got an overall power discrete market that today is greater than USD 10 billion worldwide, where the silicon part of that is showing some growth but the vast majority of the growth is driven by wide band gap and in particular, by gallium nitride. So this addressable market has a potential into the billions when you think 5 years out, and when you think 5 to 10 years out, obviously that's much bigger.

We have significant confidence that the customers are now really putting their R&D resources in designing in gallium nitride. This is where we see those customers are willing to try the new topologies. What we want to do here is just position ourselves, make sure that we are truly ready for the tipping point.”

For premium subscribers, we’ll analyze:

Navitas’ strong pipeline growth despite end-markets currently facing cyclical headwinds.

How power semiconductor content is evolving in the datacenter with AI.

The competitive environment across the GaN and SiC value chains, and which area definitely to avoid.

The key risk for the GaN industry.

Navitas’ new SiC business.

The strategy of power semiconductor giant Infineon in GaN and SiC.

The cycle in Navitas’ end-markets.

A detailed financial and valuative analysis of the company and its peers, with thoughts on which companies are investable here, and the IRR that Navitas’ investors can obtain.

Navitas, building a large revenue pipeline

One of the most attractive features of Navitas is its strong revenue growth, with the company again doubling its revenues last year: