Introduction

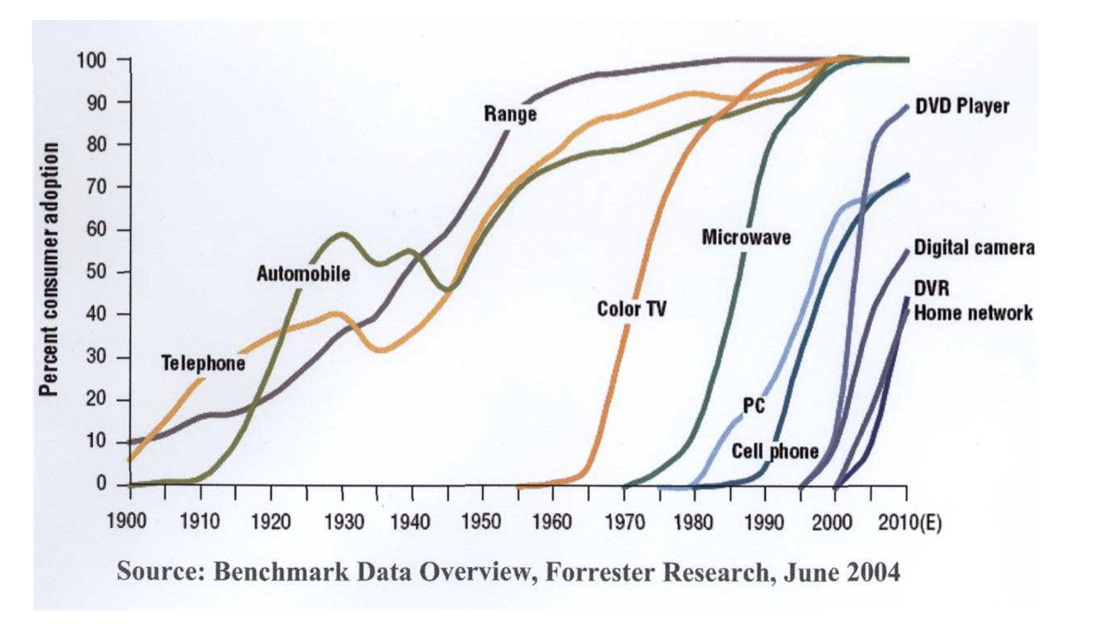

This will be the first episode of a two part series on autonomous vehicles (AVs), which will likely become one of the highest growth arenas during the coming decade. Currently we’re living in a world without much vehicle automation. However, green shoots are starting to emerge. Teslas in FSD (full self driving) mode are gradually requiring less and less interventions, while robotaxis such as Cruise and Baidu are expanding operations in more and more cities. We could be at the start of a classic sigmoid-curved adoption pattern which is typical for new technologies — slow at first, with a gradually increasing slope thereafter until high adoption rates have been reached, after which the slope can flatten again until the new technology is fully adopted. Looking at history, the speed at which technological transitions are taking place has only only been increasing. The transition from horse and carriage to the automobile was relatively slow, whereas the transition from VHS to DVD happened in a span of less than 10 years. And another 10 years later, DVDs were largely replaced with streaming services such as Netflix.

However, even 100 years ago, the transition from horse and carriage to the automobile went incredibly fast in the largest and most advanced cities. One only has to compare New York’s streets in 1903 to those of 1913. In the former, I’m seeing one car parked in the picture..

.. While ten years later, the streets are packed with cars..

Companies exposed to these types of transitions usually provide some of the best investment opportunities. The market frequently underestimates the opportunity set. Especially when the company driving the transition has a sufficient moat to protect itself from new competitors, so that it is in a position to capture the profits from this new market. The operating leverage on a only partly variable cost base can be tremendous.

Ford is an obvious example here of an innovator, enabling the mass adoption of cars with its moving assembly line. However, as new entrants started competing, its dominant market share gradually eroded over subsequent decades. Ford is only a small player on the automotive scene today. The likes of Amazon, Apple, Microsoft, Nvidia and Google are examples of disruptors who’ve been able to hold on to fairly strong market shares.

So, the aim of this two part series will be to identify one of more Nvidias in the autonomous vehicle world ten years from now. Ideally, as smart investors, we’ll be looking for a business with only limited downside risk if the technological transition which we’re anticipating doesn’t occur. We can sell the shares then later on with no or only limited losses to reorient capital towards new openings. On the flipside, we should get large upside in the shares if indeed the technology breaks through. Additionally, we’re looking for a business with a sufficiently wide moat so that new competitors won’t be able to get a foothold in the industry. In autonomous driving, this should be provided by the data advantage of the largest players, as AI training is a scale game. We have here a first solid candidate which comes to mind..

A tour of Mobileye

Mobileye is probably the perfect name for those sceptical on the development of full autonomous driving, but interested in investing in high-growth quality tech names with a strong market share positioning. The company has a hands-off product similar to Tesla FSD, with also eyes-off as well as full robotaxi systems going into production in the coming years.

The hands-off product named ‘SuperVision’ only makes use of cameras. With the next products in the coming years also utilizing a second sensor system made up of imaging radars and one lidar. The latter system will act as a second, independent decision making body. For example, if both the independent vision and radar systems agree on a particular action the vehicle has to make, there should be no or extremely little risk of making a mistake. If the two systems reach a different conclusion, automatically the vehicle can start operating with more caution, giving preference to the recommended action with the lowest probability of causing an accident. The hands- and eyes-off system is called ‘Chauffeur’, while the robotaxi product is named ‘Drive’.

Mobileye’s CEO updated us on current business developments during the Q2 call:

“We can now count nine large established OEM prospects in what we consider advanced stages for products like SuperVision and Chauffeur. In most cases we are not competing against anyone. Currently, this list of OEMs represents about 30% of global volume. This is very encouraging because the vast majority of the rest of the industry remains very open to us. The process is about physical testing to convince the OEM of the performance and the design domain of the system, establishing what role the OEM will have in customizing. What appeals to the OEMs is that our product portfolio is scalable, cost efficient, and, above all, displaying leading and cutting edge performance. The ability to provide efficient and high-probability products across all vehicle price points, for both consumer-owned and mobility-as-a-service (MaaS) solutions, all based on the same proven core technology, is a huge selling point to OEMs.

Our work with Volkswagen Group is a good example. Since 2018, all new vehicles across the group have used Mobileye provided ADAS (advanced driver assistance systems). We have the SuperVision design win with Porsche. Porsche shares common platforms with other premium brands of the Volkswagen Group. While not formalized yet, we expect SuperVision to be adopted by the other premium brands to increase economies of scale. In fact, Audi and Bentley executives are already on record expressing excitement to bring SuperVision to their products. An additional benefit is that it creates a bridge to Chauffeur.”

Mobileye’s product portfolio is pictured below — the neat design of the system allows an OEM simply to add more EyeQ chips and sensors to a vehicle, in order to progress to higher levels of autonomous driving capabilities. EyeQ chips process sensor information to turn this into driving decisions based on the trained AI models.

These EyeQ dies are still being upgraded. Eye6Q is manufactured on Intel’s 7nm node and will have 8 CPU cores, one GPU for image signal processing, and another four AI accelerators. These accelerators are optimized for Mobileye’s AI workloads and are therefore lower cost than general purpose solutions as well as more power efficient, an important factor in vehicles where range is a crucial factor. Eye7Q will be on 5nm, having 12 CPU cores with again one GPU and four accelerators.

The company’s IR detailed their progress here at the Goldman conference:

“EyeQ6 will be our new workhorse chip for high-volume ADAS programs, and launches in Q1 of 2024. EyeQ7 is a single die with all the processing power needed for full self-driving. That's on track as well. But we can easily put two EyeQ6 chips instead — SuperVision is two EyeQ6, Chauffeur on highway is three, and Chauffeur everywhere is four.”

The visual input from a SuperVision system:

Mobileye has a long history of working with leading automotive brands to implement driver assistance systems. From the prospectus: “As of October 2022, our solutions had been installed in approximately 800 vehicle models and our System-on-Chips (SoCs) had been deployed in over 125 million vehicles. We are actively working with more than 50 Original Equipment Manufacturers (OEMs) worldwide on the implementation of our ADAS solutions, and we announced over 40 new design wins in 2021 alone. We currently ship a variety of ADAS solutions to 13 of the 15 largest automakers in the world.” The company’s EyeQ chips are included in more than 7 out of 10 vehicles with a traditional ADAS system. Clearly they have a strong positioning with their traditional business.

Strong relationships are continuing, with the large automotive groups from around the world launching models with Mobileye tech inside:

The automotive industry has witnessed both trends towards consolidation as well as fragmentation. Large automotive groups in the West have been consolidating brands to gain scale and offset market share losses caused by a series of waves of new entrants — the Japanese in the eighties, followed by the Koreans in the nineties, and now we’re in the midst of a new wave with both the Chinese and pure EV manufacturers gaining share. Automotive consolidators in the West include GM, Stellantis, and Volkswagen. Each of which owns a portfolio of brands such as Stellantis with Chrysler, Jeep, Dodge, Ram, Fiat, Peugeot, Opel and Maserati. Similarly Volkswagen manufactures VW, Audi, Porsche, Bentley and Lamborghini vehicles among others.

These relationships between the OEMs and Mobileye are now deepening, as the momentum towards vehicle automation is gaining strength — Mobileye’s CEO: “Working in our favor is an increase in competitive pressure as Tesla and the Chinese startups push the envelope on hands-free technology. We have noted an increase in seriousness within the OEMs over the past one or two years, and have seen some OEMs that appeared to be far away from us on advanced technology move rapidly to align behind our approach. This is all very positive for us as a technology and cost leader.”

There are also OEMs aiming to build their own systems, which is obviously not without risk. Developing innovative tech is extremely hard, especially for legacy or traditional companies who don’t have the culture and often struggle to attract the best engineering talent. However, there will be a few exceptions here such as Mercedes, which seems to have developed capable tech in partnership with Nvidia.

Mobileye’s CEO commented on the trends in competition with OEMs: “We have a large number of serious engagements with OEMs that in the past were very bullish on talking only about in-house development, and we are now around the table talking with them about SuperVision products and beyond. That’s the majority of the competitive landscape. It’s not the likes of Nvidia and Qualcomm. They are offering the tools for in-house development by OEMs, so the competitors are the OEMs themselves. Once we started putting vehicles on the road with our technology where people can test, OEMs can test, now also the public can start testing, the difference is becoming visible. It’s all about cost versus performance, right? Even if they have the same performance as SuperVision, but cost four times more, then it’s not competitive. I think this is becoming visible now that things are really in production.”

For premium subscribers, we’ll dive into:

Mobileye’s rollout of SuperVision in China

How mapping can provide Mobileye with a competitive advantage

Mobileye’s next level Chauffeur and Drive products

Thoughts on Mobileye’s and Tesla’s approaches to self-driving

A look at Mobileye’s founder, the Elon Musk of Israel

How Mercedes teamed up with Nvidia

A calculation on the possible size of the AV market and how various pricing models can give large upside in Mobileye’s shares

A financial analysis and thoughts on valuation for Mobileye