Alphawave Semi is a fabless semiconductor company focused on high-speed connectivity in data centers. Fabless means that the company licenses their intellectual property (IP) and chip designs while the semiconductor manufacturing plants (fabs for short) in the Far East do the actual manufacturing. This can be a highly profitable business model, some of the most successful companies in this space include Nvidia, AMD and Qualcomm.

Connectivity tech is continuously evolving to achieve increasing speeds and bandwidth, but also to lower power consumption. On top of that, whenever a new generation of CPUs (central processing units i.e. general purpose chip), GPUs (graphics processing units, needed for artificial intelligence training) or DRAM (working memory) arrives, these will need a new interface for connectivity. So there’s a continuous demand to upgrade connectivity chips.

With the growth in the demand for data processing, this is an attractive end-market to be in. Researchers forecast this space to grow at 20% per annum over the coming five years.

Why would you license IP from another semi company rather than designing it yourself? Well, it takes multiple years to get these designs finished with a cost attached which easily goes into the millions of dollars. So any pre-designed building blocks you can use typically result in large cost savings. The only reason you would design parts yourself is when you want to differentiate your product by having some unique functionality. Only large companies are in a position to this, for example Apple will design some of their chips themselves, as does Google. But typically they invest these resources where they need differentiation, such as with their artificial intelligence (AI) chips.

Despite having been founded only in 2017, Alphawave disclosed to having now over 40 customers in their IP business. Last year they also moved into custom design with the acquisition of OpenFive, where they customize larger chip designs based on the client’s requirements. This business has 85 customers, of which 40 are in the design phase and 45 in production.

With IP, a single design win brings in a one-off revenue of around $5 to $10 million with ongoing royalties thereafter of 1 to 2% from the revenues the client generates on the chips. In Custom Design, upfront revenues are $15 to $50 million due to the larger chip design with afterwards all the ongoing revenues going to Alphawave as they themselves here do the shipping of the products from the fabs. So IP is a business with lower revenues but extremely high margins (90%+ gross margins) while Custom Design generates higher revenues at 50 to 60% gross margins.

In the second half of last year, the business was roughly split 47% recurring revenues (royalties and shipments from chips in production) vs 53% upfront revenues.

At their capital markets day, the company mentioned to be working now with 7 out of the top 10 semi companies globally. The company gave the example of Samsung, “We started with Samsung in 2017. Now we have 6 design wins with Samsung.”

As already briefly mentioned, the company’s designs are sent to the fabs in the Far East. This is a very consolidated industry with only Taiwan Semi (TMSC) and Samsung forming a duopoly on the high end. Highlighting Alphawave’s strength in moving to the latest tech, they won TSMC’s open innovation platform award for three years in a row now. Similarly last year the company won Samsung’s Innovation Award for the first time.

The conclusion from these observations is that the company has been executing well on important metrics i.e. growing their client base as well as ability to innovate.

The connectivity in data centers is achieved with good old cabling. To be clear, Alphawave provides the semiconductor tech to connect all these cables. Firstly, cables are needed to connect the racks of servers and storage. Traditionally, these cables were made of copper, but with the next generation, these should transition to optical tech making use of the PAM4 standard. This is basically a technology to transmit data by light waves. The generation after that will start to include coherent optical tech, which is again a more sophisticated way of transmitting data by light waves. This time by not only modulating the amplitude of the light wave but also its phase. So this creates a two dimensional way of transmitting data rather than one dimensional which obviously boosts bandwidth.

Alphawave stepped into this new coherent optical tech last year with the acquisition of Banias, which brings with it a major North-American hyperscaler as customer with a $300 million revenue commitment. A hyperscaler is the term commonly used for the cloud providers and other companies which run large amounts of large datacenters, such as Meta. Banias has developed a patent-protected technology for low power and low cost coherent optical connectivity. Revenues from this business will start to kick in as from next year when first shipments will be made.

Then you have the spines of the data center, connecting the racks of servers. These spines have historically used optical cabling already with some coherent optical in the mix as well. Finally, you need to connect the cluster of data centers within a single geography to give the look and feel like you’re actually operating within one data center. This is already fully done with coherent optical tech currently. So typically the most advanced connectivity tech sees its first adoption to cover the longest distances. And then gradually it gets adopted over shorter distances reaching finally the short distances between and within racks of servers.

Coherent optical tech continuous to evolve as well, the next generation will see its bandwidth double. This is fairly typical - bandwidths in data transmission overall tend to double every 2 to 3 years. Looking at the demand picture for this tech, it’s forecasted to grow at 36% per annum over the coming four years.

In order to be at the forefront of innovation, the company discussed at their capital markets day to focus on hiring engineering talent while incentivizing them by turning them into shareholders in the business. 90% of the company’s employees are employed in R&D and engineering, with stock-based compensation being over $11 million last year.

Management has extensive background in the semiconductor industry, both from roles at large, leading houses as well as startups. CEO and co-founder Tony Pialis previously co-founded two semiconductor IP companies, both of which got acquired. He also served as vice president of analog and mixed-signal IP at Intel between 2012 and 2017. Alphawave’s head of custom silicon Mohit Gupta previously led similar business units at Rambus and SiFive. Meanwhile vice president of connectivity Babak Samini had a similar role at Microchip. Finally, Jonathan Rogers, the head of engineering, previously held a director of Engineering position at Intel.

The company sees themselves now as sufficiently vertically integrated, from IP to custom design, as well as having sufficient scope horizontally with their IP covering servers, storage, networks, CPUs, GPUs, FPGAs (configurable processors) and DRAM (memory), and being able to provide the latest coherent optical tech. They repeatedly mentioned at their capital markets day to not to be looking to do any further acquisitions. But I have to say, with a tech company, you can never be sure.

Scrutinizing the competitive landscape, the two key large competitors are Broadcom and Marvell. On top of that there will be a number of smaller startups competing in this space, such as Credo, which IPO-ed one year ago. Due to the geopolitical friction between the US and China, Chinese competitors should be less of a concern as North-American hyperscalers are likely to rely less on Chinese suppliers, both due to concerns with regards to espionage as well as supply chain risks.

Do me a favor and hit the subscribe button. Subscriptions let me know you are interested in research like this, which is a good motivation to publish more of the analysis I’m carrying out. Special thanks to the 400 subscribers so far!

In IP, the two large software providers for semiconductor design, Cadence and Synopsys, also provide large portfolios of IP. So they will be key competitors as well in this space.

The advantage for Alphawave against these giants could be that with a continuously evolving connectivity tech; a smaller, more nimble company with an employee base that has more skin in the game - as the potential to grow the business is much larger - could move faster. Large tech companies are notorious for struggling to innovate and frequently just buy the newcomers in the field to get their hands on the latest tech and remove competition.

The advantage for the large players however is that they will be able to cross-sell more products and potentially lever longer and deeper client relationships.

Trying to figure out market shares, Alphawave’s total addressable market at their 2021 IPO was around $1 billion, which would have given them a market share of around 5% at the time. Due to two acquisitions the company made, one in custom silicon (OpenFive) and one in coherent optics (Banias), the addressable market has now expanded to $10 billion (2023 projection). This would give them a projected market share of around 3.5% in the coming year based on guided revenues. Anecdotally, the company mentioned to be competing with a handful of competitors in delivering the latest generation of connectivity chips.

The head of Custom Design mentioned his unit to have a market share of around 10 to 12% in their niche. If Alphawave would have built this capability themselves, it would have taken them around a decade. So it’s not like a new competitor can quickly come in and take substantial market share, there’s a lot of engineering involved and it takes considerable time to build designs.

That said, I expect this to be a competitive market and it will be up to the Alphawave team to execute well. What will provide an automatic tailwind however, is the high growth rates in their market.

What’s also in the company’s favor, is that typically the hyperscalers don’t want to be reliant on a single supplier, but prefer a variety of suppliers per product. This, combined with the need to move to new tech, opens the door for new players such as Alphawave and Credo to grow their business.

At the company’s IPO last year, there was a still a key focus of growing their Chinese business. However, due to the new cold war 2.0 between the US and China, the focus is now fully on the North-American hyperscalers. Alphawave guides to have over the long-term 10% of revenues coming out of China. The company has a Chinese joint-venture with WiseWave but mentioned to halt further investments here.

A new development in the semiconductor industry will be the move to chiplets. Chiplets are about breaking up large complex processors into smaller units which can be cobbled together in close proximity like Lego blocks. Obviously this will increase the demand for high-end connectivity as all these pieces will need to connected.

Basically, chiplets are individual silicon dyes packaged side-by-side with a millimeter or so between them. Then this combination operates and is sold as a single chip. The benefits are firstly that it enables the implementation of larger chips. You can build larger processors with more ‘Lego’ blocks which combined provide more processing power. Secondly, you can mix and match exactly the blocks you want, so it enables a high level of customization. For example, you can decide to go for the highest performance of your compute dyes, yet for input-output you might select one earlier generation. Lastly, you can focus on developing the technology where you need differentiation and for the other functions you can use available off the shelf chiplets.

Regarding guidance, the company is projecting annual revenues of $1 billion by 2027 (organic growth), which would translate into them capturing around 5% of their market. This would mean the company having to grow their revenues by 30% per annum post 2023. This isn’t priced into the shares at all though – if you model in a 30% EBITDA margin, this would mean the current Enterprise Value (EV) of $810 million is trading on 2.7x 2027 EBITDA. The company also has $59m in net receivables, so as these get converted into cash in the coming months, the EV is basically 2.5x ’27 EBITDA. The share price at time of writing is around 94 GBX (Great British pence).

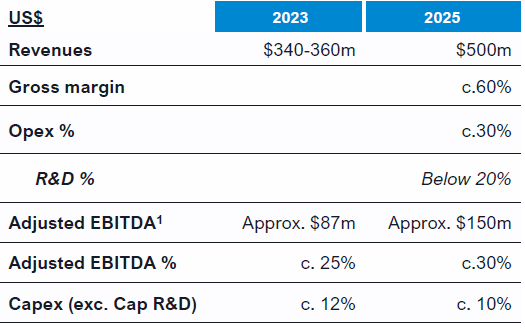

On the company’s guidance for this year, the EV is on 8.7x EBITDA:

More mature, fabless semi companies typically trade on 10 to 20x next twelve months’ EBITDA, for example Rambus (16x), Marvell (20x), Broadcom (12x), Microchip (12x) or Qualcomm (10x). If Alphawave keeps executing well and if it looks like they are going to hit their 2025 guidance, the shares could easily be valued then on a 15x next twelve months’ EBITDA multiple by the end of 2024. This would give an overall upside of 174% in the share price over the coming two years, resulting in an annualized return of 66%. As no dividends are paid out in the meanwhile, the IRR (internal rate of return) is the same.

US listed close peer Credo is trading on 48x next twelve months’ EBITDA. Both Credo and Alphawave are similarly exposed to high growth in the connectivity semiconductor space. Although Credo is also active in the cabling itself, more specifically in AECs (Active Electrical Cables). So they aren’t purely a semi play. At the Barclays tech conference, Credo’s CEO Bill Brennan mentioned their growth is being driven by AEC currently while this unit contributes more than half to their revenues already.

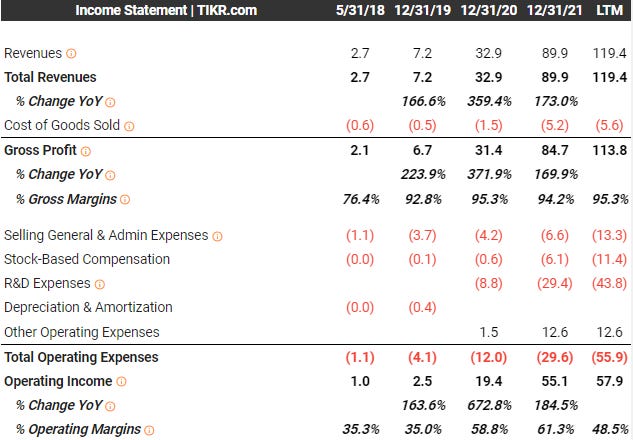

Summary historical income and cash flow statements (in USD) below – the company has exhibited strong growth. Due to the OpenFive acquisition in 2022, it’s hard to calculate a current organic growth rate. Taking this acquisition out, the overall business would have been expected to generate $225 million in ’23. This translates into an annualized growth rate of 58% as from 2021.

Sell side analysts are projecting $102 million in EBITDA for this year, making the current EV trade on 7.5x this number. The shares are thinly covered though, only two analysts’ estimates are in the system.

Overall two analysts rate the shares as ‘strong buy’ with another analyst rating it as a ‘buy’. The average price target for the coming twelve months is £2.51, giving an upside of 162%.

Insiders have continuously been adding to the shares over the last year:

The shares’ performance has been terrible over the last year. I can see four possible reasons. Firstly, if you look at annual bookings, business was actually somewhat down over the last year. However design wins, especially those with large hyperscalers, can be very lumpy (meaning bookings quarter to quarter can be volatile). Should the company make large design wins over the coming years, this should give good upside in the share price given the attractive valuation.

Secondly, the market didn’t take well the acquisitive nature of the company last year. Management is now guiding that they have acquired the necessary skills and thus going forward, acquisitions should normally be a thing of the past. Let’s see.

Thirdly, there was a negative Financial Times article on the company in ‘21. The article highlighted that their initial backlog had a high exposure to China and was likely obtained with the help of an initial Chinese private equity investor in Alphawave. However, these revenues were around $30 million last year so as from this year they will start to fade to under 10% of overall revenues. Also, clearly the company has been winning many new clients over the last two years – they have 40 customers in their IP business – so this issue should start to carry little concern going forward.

The share price cratered on the day of the negative Financial Times article:

Fourthly, the shares are under-covered with only three analysts on the stock, and with a relatively small market cap of £670m and an even smaller free float, this stock is below the radar.

A significant risk factor in the medium term would a hostile Chinese invasion of Taiwan. As most of TSMC’s manufacturing is based in Taiwan, this could disrupt manufacturing for a long period of time. Obviously this would be a disaster for many industries, ranging from smartphones to autos to datacenters, as it will be hard to obtain the necessary semiconductors. Naturally Alphawave’s revenues would be strongly impacted under such a scenario.

That said, China is unlikely to invade before summer 2024, given that in the coming 2024 Taiwanese presidential election, the more pro-Chinese KMT party is likely to come into power. And China will prefer a friendly transition of Taiwan into the People’s Republic as opposed to risking a difficult naval operation where they might to have to square off with the superior US supercarriers.

Bringing it all together, Alphawave is a stock with a higher risk profile due to the nascent nature of the business, the rapidly evolving tech and potential competitive pressures. That said, looking at it from a risk-reward perspective, the shares look attractive in my opinion. At a current valuation of 7.5x consensus EBITDA for this year, the shares are priced for growth to slow down dramatically. If you’re happy to take some risk, there should be good upside if the company executes well. I’ve purchased a position and will add to it should there be sell-off in the market later in the year with the high interest rate environment.

The stock’s primary listing is on the London Stock Exchange with ticker AWE, so here liquidity is best.

If you’ve enjoyed reading this, hit the like button below and subscribe. Also, please share a link to the research on social media with a positive comment, it will help the publication to grow.

You can find a complete overview of all research here.

Disclaimer - This article doesn’t constitute investment advice. While I’ve aimed to use accurate and reliable information in writing this, it can not be guaranteed that all information used is of such nature. The projected IRR is a subjective calculation based on what I estimate a likely and reasonable scenario for the shares to be, however, the shares’ future performance remains uncertain and a more negative scenario could play out. The views expressed in this article may change over time without giving notice. Please speak to a financial adviser who can take into account your personal risk profile before making any investment.

One of the directors, Sehat Sutardja (founder of Marvell Tech) has been buying millions of shares in the last couple months, and owns more than 13% of the company currently. Another director bought more shares last week as well.

The market was severely turned-off by the FT articles findings and largely lost trust in management.

How they calculate adjusted-EBITDA is indeed a bit dubious. But there absolutely is upside at this price and valuation, if those earnings do in fact materialize. Nice analysis.

Let’s connect!