Introduction

Over the years, Alphabet’s business mix has gradually shifted from its core bread-and-butter Google Search business to diversify into a wider variety of attractive assets:

Over the last decade, the company’s shares have been one of the lowest risk compounding stories. Which was driven largely by solid top line growth:

You can see on the chart above that as from 2022, Alphabet’s top line has been flatlining somewhat. However, the largest factor at play here has been the strong dollar, as around 53% of Alphabet’s revenues come from overseas. So when the dollar appreciates, your overseas revenues decline in dollar denominated terms.

If we adjust for these currency movements, Alphabet has kept churning out attractive, high-single digit top line growth rates:

This is especially impressive in light of the weak current macro environment, where a wide array of companies have been looking at cost cutting measures. And also taking into account that we’re coming out of the digital boom of the covid years, where Alphabet went back into hyper-growth mode:

Alphabet’s CEO discussed the macro situation on the Q1 call: “Search’s performance, notwithstanding the headwinds, reflects really Search's resilience. The ability of Search to deliver a measurable ROI in an uncertain environment. Many companies are very focused on shorter-term profitability amidst this uncertainty and some pulled back ads budgets as well. In network, really, it's a continuation of what we talked about last quarter. We saw the ongoing pullback in advertiser spend. And I would contrast that last quarter, we talked about both a pullback in YouTube and Network, and we were pleased that we saw the stabilization in ad spend on a sequential basis in YouTube. We still saw ongoing pullback in network, which tends to be a mix of businesses, as you know well.”

Below is an overview of how the Google Network business operates. So let’s say an advertiser like Nike wants to have its ad shown online to 1,000 young males living in the US and who happen to be interested in sports. Nike would set these criteria then on a demand side platform (DSP). After which this bid gets routed to an ad exchange. On the other side are publishers, e.g. the Wall Street Journal. These make advertising space available via a supply side platform (SSP). So if a Wall Street Journal reader then happens to be a twenty year old male living in New York who likes to read about basketball, he would be shown the relevant Nike ad. The Wall Street Journal then gets paid for having shown this ad and the DSP, ad exchange, and SSP all take a cut. An illustration from PubLift:

Alphabet has a global market share of 40% in the ad exchange market, 30% in DSPs, and 20% in SSPs. Competitors in these markets include Amazon, The Trade Desk, Meta, and Pubmatic.

Going back to Alphabet’s top line growth. Currently growth is especially being driven by their cloud service, the Google Cloud Platform (GCP), as well as the Google Other business unit. The latter includes Youtube Subscriptions, Google Play (Google’s Android app store), and the Pixel smartphones. Alphabet’s CFO on the Q2 call: “In our YouTube subscription products, the sustained, strong growth in revenues reflects significant subscriber growth, primarily from YouTube Music and YouTube TV. You may have seen that last week, we increased subscription prices for YouTube Music and Premium, which underscores the value of the products. Strong year-on-year growth in hardware revenues was due, in large part, to a timing change given the Pixel 7a was launched in the second quarter, whereas the Pixel 6a launch occurred in the third quarter last year. Finally, Play returned to positive growth in the second quarter.”

Pixel is Google’s hardware line meant to compete with Apple. However, their market share is still small at only around 1%. They don’t really want to displace the other strong smartphone player, Samsung, as this one is a major customer of Alphabet’s Android operating system. So Google has to execute here on somewhat of a difficult strategy of only trying to win market share from Apple.

The below chart shows Alphabet’s growth rates by division. But note that these aren’t adjusted for exchange rate movements, so they clearly show the impact from the strong dollar in 2022, eroding the value of overseas revenues.

GCP, the Google Cloud Platform

GCP is Alphabet’s most attractive growth story, with current year on year top line growth rates of around 30%. The chart below highlights well the upward revenue trend of this business, but also clearly shows the dollar and macro impacts as from the second half of 2022:

Personally I’ve used all three of Amazon’s AWS, Microsoft’s Azure, and Google’s GCP. Not Digital Ocean as their erroneous system claimed my debit card had been used for dubious activities, so I didn’t even manage to create an account. With AWS, what stood out was just the breadth of its offering, they really provide a service for everything. With Google I rated them best in terms of their ability to ease the workflow. With this I mean that I found their platform to be extremely user-friendly, with a very clear documentation and tons of examples how to get your needed services up and running. I also really liked the large variety of their data management options, with a mix of databases providing optimal solutions for particular needs. So there would be low-cost SQL and NoSQL databases, but also high-end databases such as Cloud Spanner providing you the best of both worlds, i.e. the querying flexibility of a SQL database combined with the horizontal scalability of a NoSQL database. Needless to say also Microsoft has a very comprehensive solution and as all three of these have kept building out their capabilities over the years, I suspect that currently it won’t matter much which one of the three you pick.

Google provides the below helpful schematic highlighting the variety of services you can connect together to set-up a workflow in the cloud. Imagine for a moment we’re architecting a web store aimed at competing with Amazon, I’ll walk through how we can set-up the needed apps..

First, we rent a variety of compute servers which will generate the needed web pages the customer interacts with and to process the customer’s queries and transactions. These servers are elastic, so more of them will switch on when demand is high, such as during the day. And servers will be scaled down when traffic is low so that we can save some costs. These transitions can happen within minutes. So if demand spikes, within a minute we can have more servers up and running, and we have the same flexibility to scale down when demand makes a sudden drop. So if suddenly Lebron James tweets out a link to our store, it won’t be any problem to handle all these requests to buy our shoes.

In front of the servers we put a series of load balancers, which distribute the received requests amongst the servers. This ensures that each one gets an equal workload. Behind the servers we use a couple of databases. We can use a cheap NoSQL database initially to scale the business up, or we could Spanner which would also allow for a large variety of querying power. We’ll also use a cache database where we store the results of common requests in its DRAM memory so that the main database won’t have to compute these each time. This will provide a faster user experience which should boost our revenues.

The images of all the products we sell will be stored in Google’s cheap cloud storage, from where we retrieve them as needed. Before a merchant uploads a new image, we’ll run it through GCP’s AI service to screen it for inappropriate content, as we don’t want any nudes on our website. Similarly, product descriptions and reviews have to be relevant as well so we’ll screen all text which gets inserted by users with the AI as well.

We’ll also make use of the Pub/ Sub workers to queue actions which can be handled with a slow delay, such as sending order confirmation emails to our customers. It’s fine if these arrive a few seconds later.

This is a brief example but it should give a glimpse of how you can architect a complete application in the cloud using the variety of services.

Alphabet’s CEO gave a few more examples of how customers are using GCP’s AI services on the Q2 call: “Our new anti-money laundering AI helps banks like HSBC identify financial crime risk. And our new AI-powered target and lead identification suite is being applied at Cerevel to help enable drug discovery. DuetAI is used by Instacart to improve customer service workflows.”

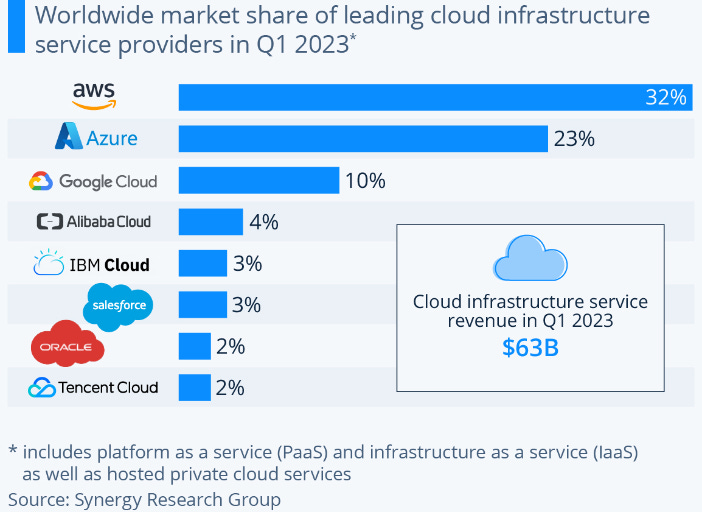

AWS and Azure are currently the two large cloud providers with Google being a solid third (chart from Statista):

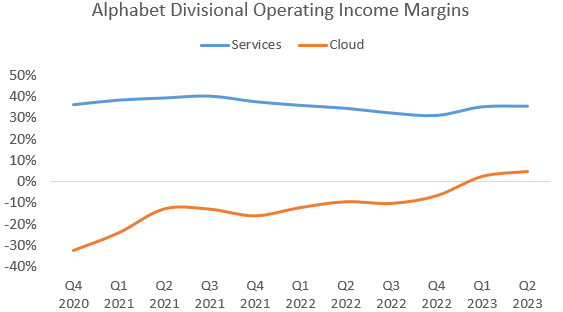

And as this cloud business has been gaining scale over time, its margins have kept moving upwards. Currently cloud operating income margins are around 5% and I suspect that over time they should be able to move north of 20%, i.e. closer to AWS’ operating income margins of 24%.

More recently on their quarterly calls, Alphabet has regularly been discussing how cloud customers are looking at ways to optimize spending. Something which Google has been helping them with. Amazon has been making similar comments on their part, although last week they mentioned that they’ve started to see a pick-up in AI related spending. I think it is probable that when macro headwinds blow over, growth in the cloud business has good potential to accelerate again.

Note that for financial reporting purposes also Google’s Workspace business is included in the cloud unit. This is essentially an enterprise version of Gmail, Google Sheets, Docs, etc. You can think of it as Google’s online version of Microsoft Office.

Other Alphabet growth drivers

At the recent Morgan Stanley conference, Alphabet’s CFO went through their opportunities in Youtube: “One is Shorts. We're super excited about the momentum in Shorts, up to 50 billion daily views at the end of last year, that's relative to 30 billion back in the spring and just continued ongoing really extraordinary strength. Monetization in Shorts is still early days. The other is Connected TV. Living room continues to be the fastest-growing screen. On the subscription side, we're now at 80 million subscribers for YouTube Music, more than 5 million for YouTube TV. Then there is the opportunity to offer a stand-alone premium channel subscription for the NFL Sunday Ticket, so distinct from a YouTube TV subscription. And there is the opportunity with our top YouTube creators to offer them exclusive NFL content. Longer term, we're looking at making YouTube more shoppable.”

Alphabet’s Chief Business Officer subsequently gave the following update during the Q1 call: “We're seeing watch time growth on Shorts. Monetization is also progressing nicely. People are engaging and converting on ads across Shorts at increasing rates. In one of our largest marketing mix modeling studies to date, YouTube ROI is 40% higher than linear TV and 34% higher than all other online video, according to a customer analysis from Nielsen across 16 countries. Regarding shopping on YouTube, it's still super early days. Last year, we brought shopping to more creators and brands by partnering with commerce platforms like Shopify. Now more than 100,000 creators, artists and brands have connected their own stores to their YouTube channels to sell their products. We're excited about the potential ahead.”

Unfortunately for consumers, longer ads will be coming to Youtube. But this will be another incentive to sign up for Premium. The Chief Business Officer discussing this topic during the Q2 call: “We announced two new ad offerings for streaming. First, thirty second unskippable ads are coming to YouTube Select, which is landing 70% plus of impressions on the TV screen. Thirty second ads are a TV industry staple, and now YouTube is bringing our unparalleled reach to the format. We're also exploring new pause experiences so brands can drive awareness or action when you hit pause.”

Google Lens is an interesting product that could become much bigger in the long term. This app allows you take pictures of objects you’d like to get more information on, such as ‘what kind of tree is this?’. But it also provides you with shopping options where possible. So if you’re seeing a couch or dress that you like, it will provide you with buying options. The product is getting around 12 billion queries per month and is growing strongly.

Waymo, Alphabet’s self-driving car effort, didn’t get any mention at the company’s recent investor events. However, they’re steadily expanding operations in US cities. A few days ago it was announced they’ll soon be launching a service in Austin, Texas.

AI, friend or foe?

Naturally the sudden emergence of large language models such as ChatGPT provides both threats as well as opportunities for Google. The main threat is that over time, there’s the potential that consumers start looking for information in completely different ways than the one provided by Google Search. It could be for example that people prefer interacting with a personal digital assistant, which knows you extremely well from your history of past interactions and therefore is able to make useful personalized suggestions. Maybe it will know your health status and can make suggestions with your food shopping. Or when you want to book a flight, it will know whether you want a budget one or a business seat at a more higher-end airline. Thinking about this concept, it does sound more useful than the 10-15 blue links and ads you get with a typical Google Search.

The opportunity for Google on the other hand is that they’ll be able to capture this new market, which should translate into higher revenues. Obviously Google released their AI chatbot Bard in March and from personal experience it has been getting a lot better month by month. They also provide an API for outside developers so that they can build other apps on top of Google’s large language models.

The big answer to ChatGPT however came with the launch of search generative experience (SGE) at Google’s IO event. SGE currently has limited availability as it is still in development, but the idea is to add more AI driven context to searches. So SGE might give you a few tips with your shopping and subsequently add below a number of links where you can buy the relevant product:

These same generative AI capabilities are being integrated into their Workspace products, to help you with your writing in Google Docs and Gmail, as well with worksheet building in Google Sheets. An example here is Duet AI, which helps a company’s employees collaborate in tasks such as coding, writing and data analysis. Competitor Microsoft is planning to price AI products like these separately so this provides an easy route to monetize these additional services. Similarly Alphabet is integrating AI into their products for advertisers. The goal here is to make it easier for them to set up advertising campaigns as well as to generate engaging content.

Another risk for Alphabet however is on the cost side. Both the training and running of AI models is vastly more expensive than a simple database lookup, which is what Google Search today mostly is. The company mentioned that they were working on reducing the costs to run these models, both on the software side by making the models more efficient, as well as on the hardware side by improving the design of their TPUs.

Needless to say, AI and more specifically large language models could result in one of the biggest shifts on the internet so far. Overall, AI is really a mixed picture for Google at this stage, with both risks as well as opportunities.

Financials - share price at time of analysis: $128, ticker: GOOGL (NASDAQ)

Alphabet last year announced they will start prioritizing margin growth, by making expenses grow slower than revenues. This is something the company historically hasn’t really been focused on, as the key goal was to drive top line growth. During the Q1 call, Alphabet’s CFO detailed their efforts here:

“I will now walk you through an update on our efforts to re-engineer our cost base, slowing the pace of operating expense growth while creating capacity for key investment areas, particularly in support of AI across the company. First, as discussed on the fourth quarter call, we have efforts underway in 3 broad categories. Number one, using AI and automation to improve productivity across Alphabet for operational tasks. Number two, managing our spend with suppliers and vendors more effectively. And number three, continuing to optimize how and where we work. As we've noted previously, all 3 work streams are ramping up this year, and we plan to build on these efforts in 2024 and in subsequent years. Second, we are meaningfully slowing the pace of hiring in 2023 while still investing in priority areas, particularly for top engineering talent. Finally, capex this year will include a meaningful increase in technical infrastructure versus a decline in office facilities. We expect the pace of investment in both datacenter construction and servers to step up in the second quarter and continue to increase throughout the year.”

Alphabet isn’t a particularly an expensive stock at 20x next year’s EPS, 11x EBITDA, and with a FCF yield of around 5%. If I put those estimated 2026 consensus EPS numbers on 18x PE NTM, I get to a 16% IRR from now till the end of 2025, taking into account share buybacks from the FCF generation.

Also compared to history, valuation is roughly in line. Albeit ten years ago, the company was generating top line growth rates of around 20%, whereas this has fallen back now to high single digits. Forecasts of annual revenue growth rates hover around 10%, as macro and currency headwinds get removed over time. Looking at it from this perspective, the shares have re-rated if you consider that the company’s growth has slowed. So you’re paying the same as ten years ago, however, for a currently lower growth company.

That said, Alphabet remains attractively priced compared to peers:

If you enjoy research like this, hit the like button and subscribe. Also, share a link to this post on social media or with colleagues with a positive comment, it will help the publication to grow.

I’m also regularly discussing technology investments on my Twitter.

Disclaimer - This article is not advice to buy or sell the mentioned securities, it is purely for informational purposes. While I’ve aimed to use accurate and reliable information in writing this, it cannot be guaranteed that all information used is of such nature. The views expressed in this article may change over time without giving notice. The mentioned securities’ future performances remain uncertain, with both upside as well as downside scenarios possible.

Great writing!