AI Demand Outlook

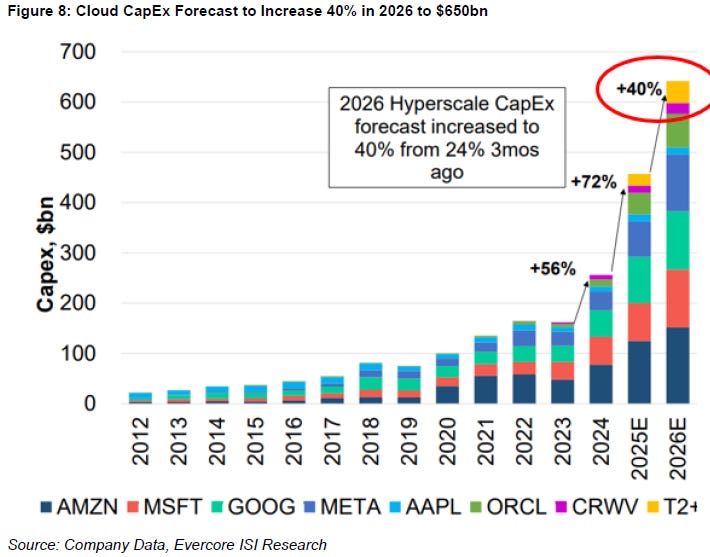

A key reason for the AI supply chain outperforming in ‘25 was token consumption coming in much stronger than expected, which resulted in cloud capex upgrades throughout the year. The chart below highlights how the bulk of capex is being driven by the hyperscalers and especially the major clouds, which is where enterprises run key infrastructure (alongside on-premise data centers).

Despite narratives of a bubble and circular financing, the bulk of investments is carried by hyperscalers who have some of the best balance sheets and cash flow generation in the world. While neoclouds are highly leveraged, these remain small in overall capex spend. However, most of their capex spend is backed by long term contracts and with high quality players such as hyperscalers. In addition, national governments are participating in building out dedicated AI infrastructure, while financing these by tax revenues and government bonds issuance. Again, these are not lower quality participants as they actually have the cash to participate.

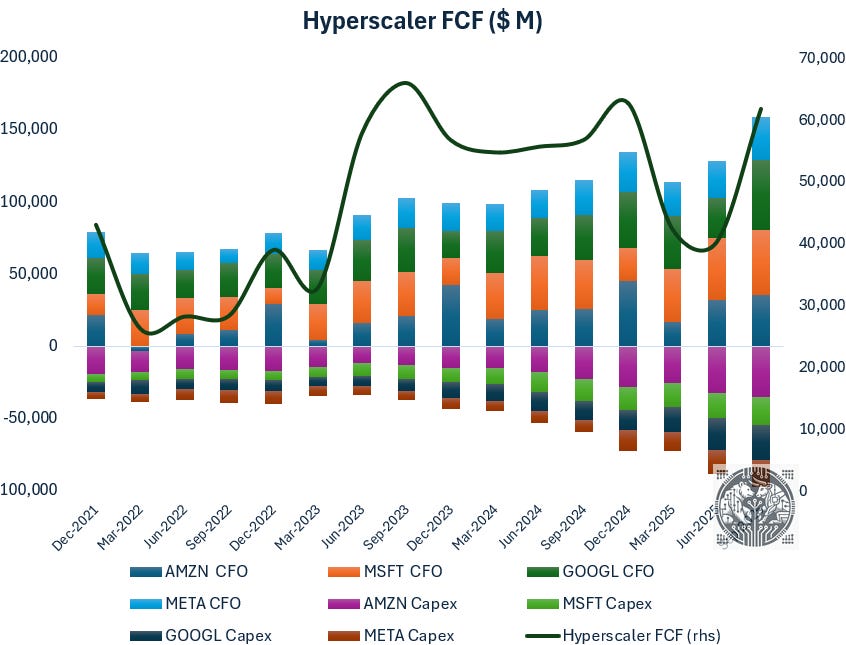

If we retrieve quarterly accounts, we can see that the four hyperscalers are actually close to peak FCFs again at $60+ billion per quarter (black line below, axis on the right). Despite elevated levels of capex, the returns on those investments are obviously already healthy. And all these installed AI servers will generate revenues for 6 years, so the real rewards in FCF still have to come as we’re still in the investment phase.

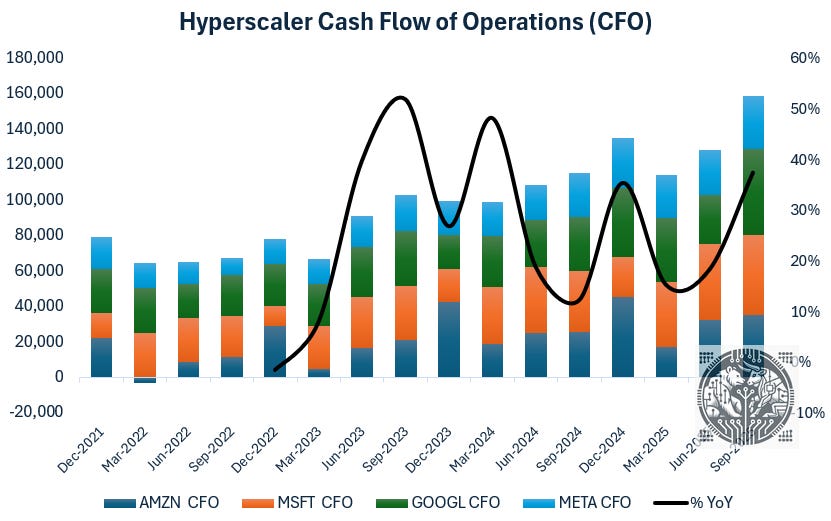

Hyperscaler cash flows of operations have been growing at attractive CAGRs since the start of this investment cycle:

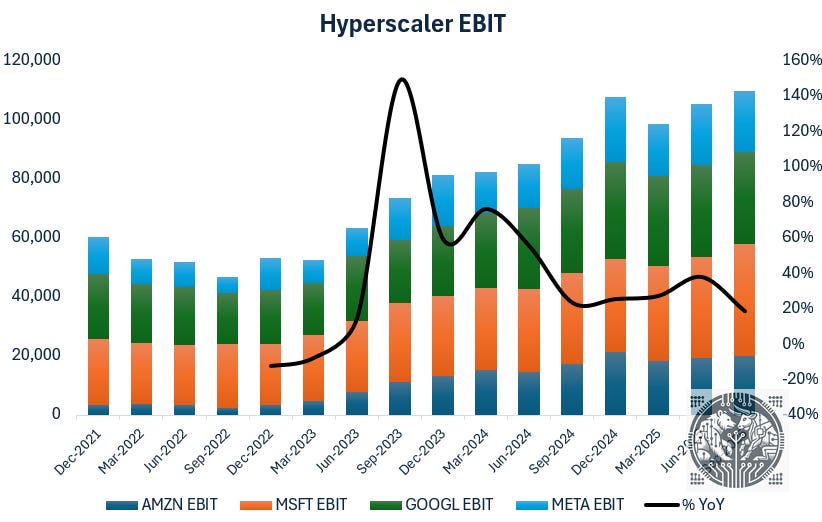

If we take into account rising capex via depreciation, EBIT has been growing at a 26% CAGR over the last five quarters:

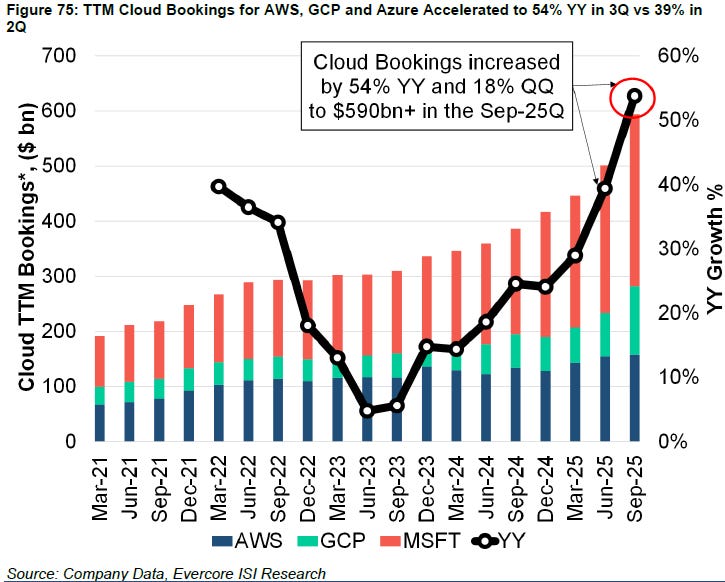

And the outlook continues to be extremely good. Cloud revenue growth has already been massively accelerating throughout 2025, while the key leading indicator of cloud bookings accelerated again to 54% YoY growth last quarter:

Concerns around large capex spend have been weighing on hyperscaler share prices, especially Meta. However, the financial returns are clearly there already, while we continue to be confident in the demand picture. We expect AI demand growth to remain strong as inference applications get increasingly inserted in the real economy and model reasoning capabilities continue to increase. The latter is becoming increasingly token intensive, with the ratio of the number of tokens generated in reasoning relative to the number of tokens in the final output being on an upwards curve. We’re moving away from an old world, where there was a 1:1 relationship, to a reasoning world where models consume huge amounts of internal tokens to solve complex problems such as in coding, science, etc. At the same time, advancements in AI agents mean that AI models can now work independently for longer periods on their own.

Overall, we see the hyperscalers as building out extremely valuable infrastructure, where enterprises are effectively locked in at the major clouds due to high switching costs in software services and data gravity effects.

Another fallacy we regularly encounter is the so called ‘circular financing’ narrative, i.e. that this capex cycle is being driven by circular deals. While there is some amount of circular financing, most notably in some Nvidia-neocloud deals or in the OpenAI-AMD deal, these remain a very low proportion of overall capex spend. Circular financing doesn’t even make 5% of Nvidia revenues on our estimates.

The main risk for the AI hardware names is that forecasts at some stage will start showing moderate growth and with the risk of a cyclical pullback. Going over the financials above, we think that the economics are very healthy for the AI bull cycle to continue. Even when capex growth rates start to moderate later this decade, for the major clouds, share prices can actually do extremely well as free cash flow growth accelerates (as we’re post the investment cycle). At the same time, more moderate capex growth still translates into revenue growth for the hyperscalers, albeit at a slower pace. Another factor is that pricing power for cloud software services remains strong, which will further boost margins at the major clouds.

AI hardware names on the contrary need ever more data center capacity being added to show attractive growth rates. A tailwind is that as AI data center equipment is becoming ever more advanced, ASPs will automatically increase. So, AI hardware names can still get growing revenues even by selling the same volumes of equipment, but at higher ASPs. Key cyclical indicators to watch out for in the coming years will be token consumption growth in the cloud, GPU rental pricing and availability, and capex guidance at the hyperscalers. We’ve seen quite a number of semi booms and busts over the last few decades, and so overcapacity at some stage later this decade is a key risk factor to watch out for. Once you’re in the overcapacity scenario, it will likely mean a multi-year downturn in AI equipment sales.

Another risk is that while AI demand should continue to come in strongly, we simply run into bottlenecks in the AI value chain somewhere, which reduces growth rates for the overall industry. To some extent this has already been happening since the start of this boom. First, in CoWoS, then in HBM, and now in Optics.

Overall, we see the environment as very healthy for AI. We expect token consumption to keep growing at high rates while the hyperscalers are reaping the rewards to pay for increasing investments. This brings us to where these investments will be allocated..

Next, we will dive into the entire semis space as well as key topics in AI. As a bonus, we’ll discuss our outlook for the quantum computing space, and we’ll also review a US-based, state-of-the-art fab trading on a sizeable discount to intrinsic value. Finally, we’ll discuss our top stock picks for 2026 across tech.