A Tour of Asian Tech

Semis, autonomous driving, robotaxis, batteries & travel tech

In this post, we’ll do a wider tour of Asian tech companies. There are a lot of good tech companies in Asia, but information on them is often limited due to a lack of earnings calls in English, as well as much more limited investor conference attendance. The goal of this article is to provide actionable insights on a list of Asian tech-related stocks. We’ll start with TSMC, one of the best tech companies in the world.

TSMC, at the Center of AI

We came across some interesting modelling from Needham on TSMC which concludes that 1) $90 billion in AI revenues for TSMC '29 looks conservative, and 2) strong semicap growth at TSMC in ‘27 will be needed (+47%). While we haven’t been able to look into the details of the model, the Needham analyst has a strong technical background, so it’s worth taking into consideration:

“Using TSMC's publicly stated AI revenue target (~$90B by 2029) and AI accelerator outlook (~50MM units by 2030), we developed our AI wafer demand model and found that TSMC doesn't need much unit volume growth (counted in package) to reach the target; significant silicon content growth from increasing number of compute dies in a package and the transition to custom HBM base dies should sustain the rapid AI revenue growth to ~$90B within four years.

We see potential deceleration of TSMC AI revenue into 2026, due to AI accelerator unit volume decel and the lack of silicon content growth in Nvidia Rubin. Still, we forecast TSMC's AI revenue will at least grow at a decent 20% YoY next year. Looking ahead, we see significant growth acceleration to nearly 40% YoY in '27 and 45% YoY in '28, as silicon content growth resumes with Rubin Ultra and Feynman. We believe the strong AI revenue growth should support TSMC's total revenue to reach $130B in '26 and $150B in '27.

We see Nvidia's AI GPUs alone should require a peak capacity of 60kWSPM on 5nm in 2026, 80kWSPM on 3nm in 2028, and 100kWSPM on 2nm in 2030. We see strong AI growth should fully digest TSMC's existing 5nm capacity by 2026, but TSMC may have to raise 3nm and 2nm capacity investment in 2027 to satisfy Nvidia demand. We forecast TSMC CapEx should grow from $40B in 2025 to $45B in 2026 and $50B in 2027. While CapEx growth looks moderate, we foresee a significant mix shift away from infrastructure and into equipment, which may lead to a record $29B WFE spending by TSMC in 2027. We see incremental CoWoS capacity (ex-OSAT) additions to decline in '26 and remain muted in '27, before 9.5x reticle CoWoS fully ramps up to support Rubin Ultra in '28. We forecast HBM packaging CapEx (ex-China), which is declining in '25, could be light in '26 and see a strong recovery in '27.”

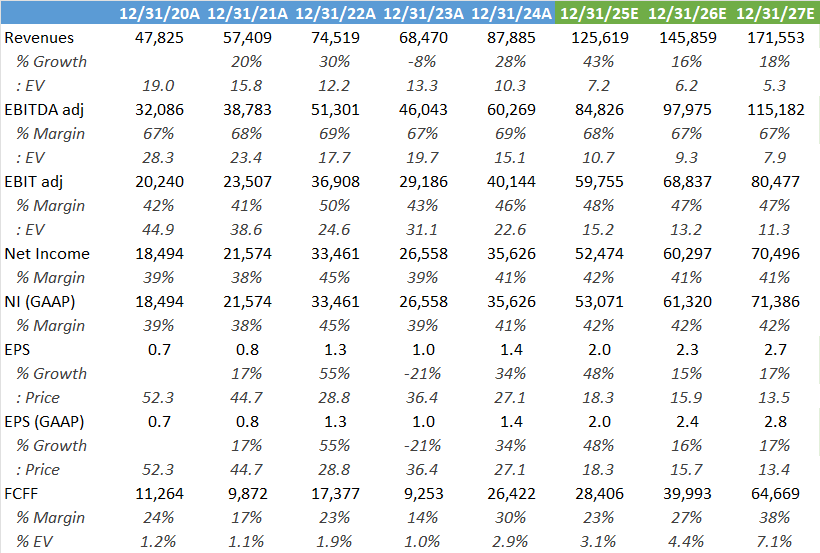

TSMC has been a strong performer over the last few years as it is really at the center of AI being the dominant foundry in leading edge semis. Valuation remains extremely attractive at 18 forward EPS, a multiple which can only be logically explained by the company’s state-of-the-art fabs being located in the geopolitical hotspot of Taiwan:

TSMC is expected to grow at double-digit top-line growth rates for the foreseeable future, which would make the company a FCF machine. And then on Needham’s modelling, the numbers which TSMC has been guiding for AI growth might well be conservative.

For premium subscribers, we’ll dive into more Asian tech companies, ranging from autonomous driving and robotaxis, to batteries and travel tech.